Will Bitcoin's price triple this cycle?

Hello crypto enthusiasts!

Let's dive into some crucial topics today, including the latest updates on the WazirX hack, a significant dispute between Liminal and WazirX, exciting news about Ethereum ETFs, and an analysis of Bitcoin's current trends and future possibilities.

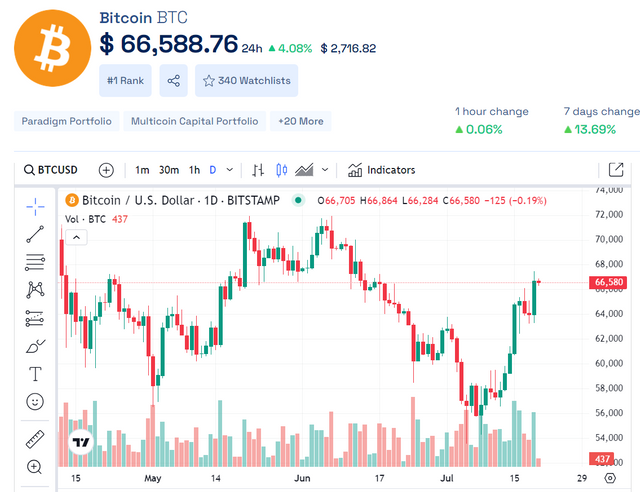

Bitcoin is riding high with a Fear & Greed Index at 74 (Greed) and a current price of $66,553. Key metrics show BTC dominance at 54.198%, up by 0.234%, a total market cap of $2.42T, increasing by 3.459%, and a total volume of $74.86B, up by 5.914%. Bullish vibes are soaring! 📈💪

Liminal vs. WazirX: The Ongoing Dispute

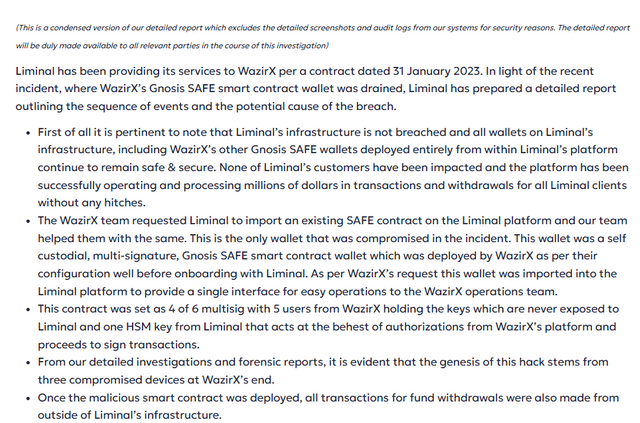

The recent hack has led to a heated dispute between Liminal and WazirX. Here's a breakdown of their stances:

Liminal’s Stance: The attack began when a compromised WazirX device initiated a legitimate-looking transaction on Liminal’s servers. Liminal asserts their infrastructure wasn’t hacked.

WazirX’s Claim: WazirX blames Liminal, suggesting discrepancies between the transaction data received by Liminal and the actual transaction details led to the hack.

Blame Game and Lessons Learned

Both parties are pointing fingers, but the real victims are the users whose funds were affected. This situation underscores the importance of diversifying investments across different platforms, including decentralized and hardware wallets, to minimize risks.

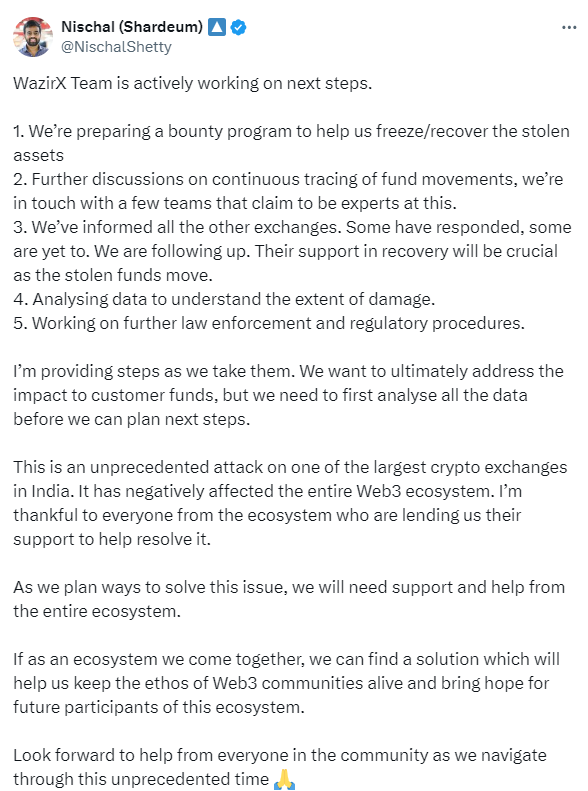

WazirX's Response

According to Shetty from WazirX, the team is preparing a bounty program to incentivize individuals and entities to help freeze or recover the stolen assets. This program is part of their strategy to enhance efforts in tracing the stolen funds.

Steps Taken by WazirX:

Preparing a bounty program to help freeze/recover the stolen assets.

Continuous tracing of fund movements, collaborating with expert teams.

Informing other exchanges for support in recovery efforts.

Analyzing data to understand the extent of the damage.

Working on further law enforcement and regulatory procedures.

This attack has negatively impacted the entire Web3 ecosystem.

Ethereum ETF Update

Anticipated Approval

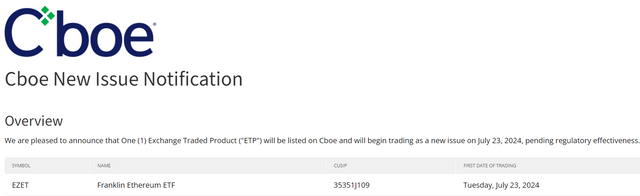

On July 23, five spot Ethereum ETFs might be approved by the CBOE Exchange. These involve institutions like Invesco, Fidelity, 21Shares, and Franklin.

Market Impact

Before Approval: Potential price spike for Ethereum.

After Approval: Possible pullback similar to Bitcoin’s pattern, with some growth leading up to the approval, followed by a possible retest, and then a new high.

Bitcoin Analysis

Bitcoin is currently priced around $66,600. Here's what you need to know:

Continuous Uptrend: Bitcoin has been on an upward trend with minor pullbacks.

Retest Expected: A significant retest is due, potentially filling the CME gap.

Entry Point: Anticipated price pullback offering a new entry point for investors.

Future Rally: Likely bounce back after filling the CME gap, continuing its rally and potentially reaching new highs.

Expert Predictions

Notable investors like Hugh Drie predict Bitcoin could triple its current price in this bull cycle.

Final Thoughts

There are significant opportunities ahead for both Bitcoin and Ethereum. Keep an eye on these developments and remember to secure your investments wisely.