CryptoAssets Book Review - Can Bitcoin Increase Returns & Lower Risk?

Below is a detailed and thoughtful CryptoAssets book review. Enjoy!

If you are confused by the world of Bitcoin and Blockchain Technology and wish you knew more – pick up this book immediately.

If you consider yourself a veteran and have been familiar with the crypto for a while – still - pick up this book immediately.

The book CryptoAssets: The Innovative Investor’s Guide to Bitcoin and Beyond by Chris Burniske and Jack Tatar is a treasure chest full of information for both the beginner and experienced reader. Mainstream portfolios increasingly include cryptoassets as an alternative asset as an entirely new asset class appears right before our eyes. With thousands of cryptoassets available on the market, it is essential to have tools in your toolbox to analyze and evaluate them before investing.

Bitcoin has paved the way for its digital siblings to enjoy similar success. At one point in 2017, the total market cap of all cryptoassets soared over $813 billion. Cryptoassets trade 24/7/365 and the market can transform in the blink of an eye. For the innovative investor, CryptoAssets is a must read to arm yourself with a working framework to evaluate these revolutionary assets.

CryptoAssets promises to provide the following:

- An actionable framework for investing and valuing cryptoassets

- Portfolio management techniques to maximize returns while managing risk

- Historical context and tips to navigate inevitable bubbles and manias

- Practical guides to exchanges, wallets, capital market vehicles, and ICOs

- Predictions on how blockchain technology may disrupt current portfolios

Introducing CryptoAssets

CryptoAssets begins by painting a picture of the economy during the Financial Crisis of 2008. Burniske and Tatar briefly explain what led to the economic collapse and subsequently, the genesis of Bitcoin by an unknown person under the pseudonym Satoshi Nakamoto. The authors explain blockchain technology and quickly bring the reader up to speed on Bitcoin, Ethereum, Litecoin, and various other cryptoassets in an easy to understand, digestible manner.

I feel like this is the classic, obligatory introduction to every book on Bitcoin. I loved how they didn’t spend too much time introducing Bitcoin and altcoins because that was not what I desired from the book. Instead, I wished the topics to be focused more on how to evaluate cryptoassets.

Modern Portfolio Theory

If you’re like me and work in Finance, you are probably most interested in how Bitcoin and cryptocurrencies fit into Modern Portfolio Theory. CryptoAssets explains MPT concepts such as standard deviation, Sharpe ratio, absolute returns, and volatility clearly.

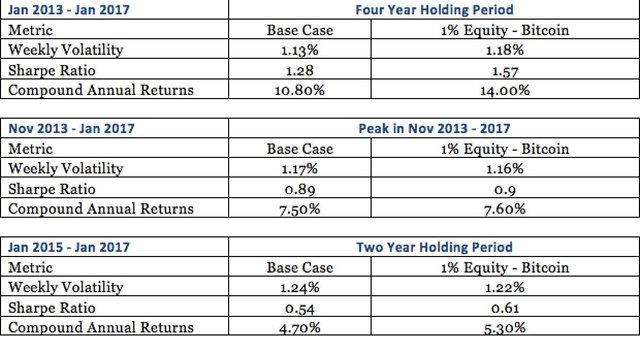

The authors built a model to simulate how a 70 percent equities– 30 percent bonds portfolio behaved in comparison to a 1 percent bitcoin–69 percent equities-30 percent bonds portfolio.

Hint: A Portfolio with 1 percent bitcoin experienced the joy of a golden asset that both decreased volatility and increased returns. I recreated the charts in Excel for reference.

Interestingly, if an investor purchased Bitcoin at the peak in November 2013 and held through January 2017, absolute returns remained about the same while volatility decreased.

Using Fundamental Analysis for CryptoAssets

By far my biggest takeaway and the part I enjoyed most was the framework for evaluating a cryptoasset. The authors examine the following to determine the intrinsic value of a project:

- Whitepaper

- Decentralization Edge

- Valuation

- Community & Developers

- Relation to Digital Siblings

- Issuance Model

Operating Health of CryptoAssets

After providing a Fundamental Analysis and a Valuation Framework, the authors then take the analysis one step further by examining the operating health of a cryptoasset. The innovative investor can examine consider the health of a cryptoasset by reviewing the following:- Miners

- Hash Rates as Sign of Security

- Geographic Distribution of Miners

- Software Developers

- Company Support

- User Adoption

More factors to consider are mentioned in CryptoAssets as well, but these stood out the most to me. The authors make it clear the most important thing an innovative investor can do is to Do Your Own Research (DYOR)!

However, this wouldn’t be a complete CryptoAssets book review if I failed to mention the negatives.

What I Didn’t Like

Honestly, there isn’t much I didn’t like while reading CryptoAssets.

When performing Modern Portfolio Theory analysis, it's difficult to say anything meaningful from 5 years of data. However, with crypto we don't have a ton of historical data to work with, so you have to work with what you got. I would be interested in seeing a more in-depth analysis, possibly with correlations with various asset classes and sectors. It would be cool to see cryptoasset's correlation with multiple commodities. I suspect cryptoasset's are most correlated with precious metals and mining companies.

Playing around with different allocations would be interesting as well, maybe a 5% Bitcoin allocation rather than just 1%? They only scratch the surface in their analysis.

Published in October 2017, the world of cryptocurrency has changed drastically. I can only imagine how difficult it was for the authors to determine which information will still be relevant years from now, but somehow they managed to accomplish this feat. My only complaint is: Why isn’t there a 2ndedition available yet!

I went the extra mile here and checked Amazon Reviews to see how on earth anyone had anything wrong to say about this book. Check out this comment from focusreader:

This guy is upset he wasted $5 on this book, but I’m sure he lost far more than that investing in failed cryptoassets.

CryptoAssets Book Review Summary

This book is perfect for both beginners and seasoned veterans interested in becoming a smarter investor in cryptocurrencies. I wasn’t interested in a book on how Bitcoin or Blockchain Technology worked but instead focused on learning how to evaluate cryptocurrencies better. This book delivered big time.

CryptoAssets earns a 5-star rating. Check out CryptoAssets today on Amazon!

I would love to hear your thoughts. Please leave a comment below!

For more content, feel free to check out my website Walk the Wire

The book will become a crypto classic in the future! We would like to invite you to post on our decentralized blog platform, CBNT. By posting on the CBNT platform you can mine additional tokens. We are currently selecting a small group of individuals for the Beta test. We would like to invite you to our try our website at web.cbnt.io

Congratulations @willwalker! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPNice! Keep it coming!