The Easiest Way to Earn Passive Income with Crypto

Cryptocurrency has transformed the way that we now think about money. It has opened an entirely new financial ecosystem where anyone with Internet connection can participate. It is still in the early days of the blockchain revolution, but the transfer and redistribution of wealth are well underway. A whole new world of sound digital money is here.

The question I am most often asked is “How do I earn passive income with crypto”?

There are so many different ways to earn passive income with cryptocurrency. The good news is if you are already holding some crypto, then you probably already are making passive income, you may just not know it. If you don’t, then you will want to buy some pretty quick or risk missing out.

I will explain the easiest way to earn passive income with cryptocurrency, but first, let me explain Passive Income.

Make Money While You Sleep

Passive income is money that flows in regularly without needing a substantial amount of effort to create it. Through an upfront investment of either time or money (usually both), after you get the ball rolling not much effort is required after that for money to flow in.

Traditionally rental income from real estate, lending, and dividend stocks are the primary sources of passive income. However, cryptocurrency has created new sources of passive income that previously weren’t possible. As an investor, the goal should be to eventually earn enough passive income to support them or at least pad their income.

Cryptocurrency Dividends

In traditional finance, a dividend is the distribution of reward from a portion of the company’s earnings paid to its shareholders. Dividends are distributed as cash payments, shares of stock, or by other means, but cash dividends are the most common. Although the IRS doesn’t define dividends as passive income, dividend stocks are by far the easiest way for investors to earn passive income.

Dividends are no longer restricted to stocks. I’m not aware of any cryptocurrency that actually promises investors dividends, but perhaps by mistake, this is precisely what many cryptocurrencies are doing. Every time a cryptocurrency hard forks, a snapshot of the blockchain is taken and everyone holding that cryptocurrency is also credited with the hard fork currency. If you are reading this, then you probably had already heard of the contentious hard fork of Bitcoin and Bitcoin Cash back in November 2017.

Roger Ver aka “Bitcoin Jesus” has accomplished many great things in his career and has been among the biggest supporters of Bitcoin. He opened the eyes of thousands of people to and even gave many of them their very first Bitcoin – hence his nickname Bitcoin Jesus. However, I would say that he should be called Bitcoin Jesus for his most remarkable miracle – creating free money out of thin air.

Unlock Passive Income Potential with Bitcoin

Just Hold Bitcoin…or Ethereum…or Litecoin…or any other cryptocurrency. Seriously.

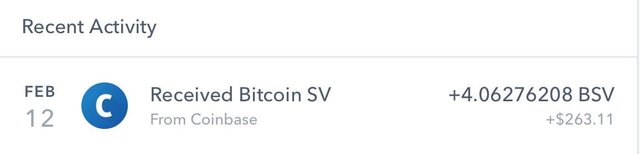

Take a look at the above picture. Without doing anything, my account on Coinbase was automatically credited with almost $300 of Bitcoin SV.

Did you know if you held Bitcoin in the past 2 years then you also hold:

• Bitcoin Cash (BCH) - $4,000 • Bitcoin Gold (BTG) - $475 • Bitcoin Diamond (BCD) - $85 • Super Bitcoin (SBTC) - $350 • Bitcoin Atom (BGA) - $1,300 • Bitcore (BTX) - $31 • Bitcoin God (GOD) - $110 • Bitcoin Private (BTCP) - $86 • And More! - $$$

For reference, I displayed their all-time high prices. These hard forks of Bitcoin aren’t currently even close to their all-time high, but I’m trying to make a point.What do I do when I receive these free hard fork “dividends”? I sell them immediately and buy more Bitcoin. The easiest way to earn passive income with cryptocurrency is… to do nothing! Just hold Bitcoin.

I may be oversimplifying how easy it is to earn passive income by holding Bitcoin. There are a couple of different factors to ensure that you actually credited with the various hard forks. Perhaps the most crucial element of receiving passive income with Bitcoin is to control your private keys.

What is a Private Key?

I cannot stress how important it is to hold your private keys, but I will try.“If you don’t own your private keys, then you don’t own your Bitcoin.”

Every Bitcoin address contains two digital keys: a public key and a private key. The public key is shared with everyone to communicate with others in the network. Imagine a public key is the same as your email address. On the flip side, a private key is used to access bitcoins in a wallet. Think of a private key the same as using a password to access your email account.

Every Bitcoin address has its own unique set of public and private keys. People can send bitcoin to a public key, but only the person with the private keys can access the bitcoin inside the wallet.

Now I know, I mentioned above that Coinbase credited my account. It is bad practice to hold Bitcoin or cryptocurrency on any exchange – even a trusted exchange like Coinbase. Not only is your crypto vulnerable to attacks from hackers targeting exchanges, but you also (usually) don’t get to participate in receiving Bitcoin “dividends.”

For example, there was a massive uproar in the community when Coinbase users didn’t receive the most well-known fork of Bitcoin called Bitcoin Cash. As the price of Bitcoin Cash was rising, users who held their Bitcoin on an exchange like Coinbase had to wait months and months before Coinbase granted them access. Additionally, other forks like Bitcoin Gold or even forks of Bitcoin Cash itself have never been given to individual wallets on Coinbase.

In Coinbase’s defense, it would be complicated for them to reward all of their users each and every fork of Bitcoin. That would require extensive development and testing before they made any digital currency available for trading on their platform.

Earn Passive Income With Other Crypto's

Not only are their hard forks of Bitcoin, but there are also hard forks of hard forks of Bitcoin! Recently there was a hard fork of Bitcoin Cash called Bitcoin SV – which is actually what Coinbase credited me with above. However, crypto dividends don’t stop with Bitcoin.

If you’re like me, then there is no way you just hold Bitcoin. You also hold Ethereum, Litecoin, Zcash, Monero, and many others. One of the more famous and widely accepted hard forks of Ethereum is Ethereum Classic, which got to as high as $50 last year (although you could argue Ethereum Classic is the original chain).

So what are you waiting for? If you’re holding ANY cryptocurrency on an exchange – get it off right now!

For the majority of my trading, I use Binance, which I highly recommend! Sign up through Binance to buy cryptocurrency and start earning passive income! Another alternative is Coinbase, but they have limited cryptocurrencies available on their platform.

Just make sure to transfer your cryptocurrency to your own private keys. For storing private keys, I recommend the Trezor Hardware Wallet.

If you have any questions on retrieving your crypto “dividends” let me know!