Advanced Breakout Strategies with Volume Profile and VWAP

Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Advanced Breakout Strategies with Volume Profile and VWAP. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

.png)

Question 1: Explain the Concepts of Volume Profile and VWAP

Define Volume Profile and VWAP and discuss how each tool provides unique insights into market dynamics. Explain their role in identifying potential breakouts.

Volume profile and VWAP both are the important trading tools. They provide information about the market dynamics. Here is a detailed information about both the tools:

Volume Profile

Volume Profile is one of the most versatile technical analysis tools for visualizing trading volume distribution at various price levels within a particular time frame. Traditionally, volume indicators monitor the flow of volume versus time, but Volume Profile arranges data to provide a clear indication of where the main activity occurred at specific price points. This is fundamentally useful in determining market sentiment and market levels that impact the price change.

Key Components

Here are the key components of the volume profile trading tool:

Point of Control (POC): The price level with the highest trading volume for the considered period. The POC is often seen as a "magnet" for price because it represents a level of maximum agreement among market participants.

Value Area (VA): The range of price levels where about 70% of total trading volume has been traded.

- Value Area High (VAH): The top side of the range where resistance often occurs.

- Value Area Low (VAL): The bottom side of the range where support often occurs.

- High and Low Volume Nodes:

- High Volume Nodes (HVNs): These are the areas where price has traded in high volume, often exhibiting stability or consolidation. Such areas are very likely to be strong support or resistance.

- Low Volume Nodes (LVNs): These are the areas of very low trading activity where the price has made a turn. Such areas are subject to price action and are likely to break out.

Volume Profile Insight

As we have discussed earlier that this is an important trading tool which helps to identify the concentration of the volume and we can take decisions based on this concentration. Here are some insights for the volume profile trading tool:

- Support and Resistance: It allows the traders to identify the areas where the price may get stuck or reverse. We know that support is the zone from where the price often reverses in the upward direction and similarly resistance is the area from where the price turns backward or takes correction. This tool helps us to identify the support and resistance levels.

- Market Structure: It helps us to identify the balanced markets from unbalanced markets. Here the term balanced market is used for the consolidation market and similarly the term unbalanced has been used for the trending market. We know that consolidation market has low volatility and similarly trending market has higher volatility.

- Price Acceptance and Rejection: It helps us to identifies areas where the market accepts price means the high volume versus rejects it means the low volume.

Using Volume Profile to Identify Breakouts

Volume Profile shines for breakout traders in highlighting areas of interest:

Breakouts above VAH or below VAL: They are breaks out of the value area into imbalance zones. They indicate the continuation of the trend. If the trend is in bearish zone then it will continue and similarly for the bullish pattern.

Low Volume Nodes: Upon reaching a LVN the absence of resistance often leads to sharp and fast price movements with lucrative breakout opportunities.

Volume Weighted Average Price (VWAP)

The Volume Weighted Average Price is a dynamic indicator. It computes the average price of security weighted by its trading volume. It is mainly the benchmark in intraday trading. It provides insight on market sentiment and institutional activity. VWAP facilitates the transition of the traders to determine the condition between fair value and overbought or oversold.

Formula: VWAP = ∑ (Price × Volume)/∑Volume

- ∑ (Price × Volume): The sum of the price multiplied by the volume of each trade.

- ∑Volume: The total volume of shares traded during the period being analyzed.

VWAP Insights

This dynamic trading tool has different insights for the market. These insights are given below:

Dynamic Support and Resistance

- Price above VWAP indicates bullish sentiment and often acts as a support level.

- Price below VWAP indicates bearish sentiment and often acts as resistance.

Institutional Trading Benchmark

- Institutional traders usually use VWAP as a benchmark for trade execution. They want to buy below VWAP or sell above VWAP.

Trend Confirmation

- Persistent trading above VWAP signifies strong upward momentum.

- Persistent trading below VWAP indicates downward momentum.

Role in Identifying Breakouts

VWAP is a critical tool for assessing the strength of breakouts:

Breakout Above VWAP: Indicates that buying pressure is strong enough to overcome the average price. This is a sign of bullish momentum.

Breakout Below VWAP: The break out below VWAP is a signal to increase selling pressure. This indicates the bearish sentiment.

VWAP also acts as a mean reversion level in false breakouts. If the price gets away but returns to VWAP quickly then it is a sign of a lack of conviction in the breakout.

Volume Profile vs. VWAP

| Feature | Volume Profile | VWAP |

|---|---|---|

| Focus | Historical trading activity across price levels | Intraday average price weighted by volume |

| Nature | Static (over a set period) | Dynamic (real-time updates) |

| Insights | Support/resistance zones, market structure | Intraday trend, fair value, market sentiment |

| Timeframe | Works across all timeframes but excels in higher timeframes | Primarily an intraday tool |

| Use Case | Find important price levels for strategic trading | Real-time assessment of momentum and breaks |

Combining Volume Profile and VWAP for Breakouts

We can use the combination of volume profile and VWAP to get a comprehensive overview of the market. We can asses the break out momentum and can analyze the historical context.

Volume Profile for Key Levels:

- We can identify important price levels such as POC, VAH, and VAL to understand where price is most likely to face resistance or support.

- We can use low volume nodes as a breakout zone as there is minimal trading friction.

VWAP for Trend Confirmation:

- We can verify breakouts above or below key levels by checking the price action around VWAP.

- A break out above a high volume node combined with price staying above VWAP is a strong indication of bullish momentum moving forward.

- Conversely a breakdown below a value area with the price staying below VWAP is a strong signal of bearishness.

Tracking Reversal Areas:

- If the price returns to VWAP following the testing of breakout levels then it means that such a breakout has failed or the market is consolidating.

- Combine VWAP with Volume Profile to determine whether the breakout will be sustained or reversed.

Example Workflow:

Step 1: We can use the Volume Profile to identify significant levels such as POC, VAH, and LVNs.

Step 2: Then we can observe price relative to VWAP for the confirmation of the breakout.

Step 3: Then we should monitor the volume surges as price breaks through key levels for validation of strength in the breakout.

Volume Profile provides a detailed history of market activity showing the principal price levels that serve as support, resistance zones and breakout areas.

VWAP provides real time insight into what is happening on the market in terms of sentiment and momentum. It is the benchmark for a fair value price.

All of this will enable the traders to make informed decisions, simply combining static price volume relationships with dynamic price action. These trading tools provide a multi dimensional view of market dynamics. They increase the accuracy of breakout identification as well as the trade execution itself.

Question 2: Identifying Breakout Zones with Volume Profile

Use historical charts of Steem/USDT to show how Volume Profile identifies areas of strong support/resistance and low-volume zones where breakouts are likely to occur.

Volume Profile is a robust tool for pinpointing breakout zones by analyzing historical price action and volume distribution. The resistance and support both zones are very critical for the traders. If the traders can determine the exact resistance and support zone then they can make the good decisions to drive the market according to the market sentiments and trend. The volume is directly linked with the trading decisions. The low volume and high volume indicates the amount of trading of the specific asset. Volume Profile indicator helps us to determine the resistance and support levels as well as low volume zones from where the breakouts can occur.

If we talk about the STEEM/USDT trading pair we can examine Steem/USDT historical data to identify the areas of significant support and resistance as well as to locate low volume zones where breakouts are likely to occur.

Below is a step by step guide to using Volume Profile for this analysis enriched with practical insights:

Step 1: Setting Up the Chart

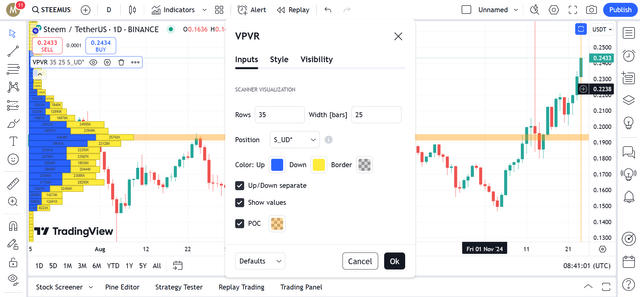

First of all we need to setup the chart to apply Volume Profile indicator to determine the resistance, support and low volume zones. I will use TradingView platform because it supports Volume Profile trading tool.

The chart is ready and now we can apply the Volume profile indicator here to determine the strong support or resistance levels and the low volume zones.

Here I have changed the settings of teh oindicator and before changing the settings everything was overlapping with each other and it was hard to identify the bars. Now there are total of 35 rows and every row is clearly visible. Each row has a value on its own which is representing the volume. And the size of the bars is 25% of the whole screen.

Here in the above chart we can see a longest bar. This longest bar represents the high volume area. This zone represents that this area is the strongest zone for the traders. It is the critical zone for the traders even the traders are selling or buying.

At the POC level the price consolidates and then it breaks out below or above this POC level. And at this point it serves as a support or resistance level.

POC as Support: If the price is moving in the upward direction then it serves as a support level. In the bullish market it acts as a support level. And the traders consider it as a buying zone in the bullish market. When the price comes down and touch the POC level they consider it as a support level and take advantage of the buying opportunity. Because it is possible that the price will move in the upward direction after touching this POC level as a support zone.

POC as Resistance: If the market is in the bearish trend or the prioce moving downward then this POC level acts as a strong resistance level. The traders consider it as a strong selling zone because of its behave as a resistance zone. And when the price reaches this POC level it is possible that the price will break out below or above this level. If the selling pressure is high then the price will reverse from this zone and if the buying pressure increases then the resistance will be break out in the upward trend.

In the above chart we can see the two critical points in the chart with the help of the Volume Profile indicator. These two important levels are Value Area High (VAH) and Value Area Low (VAL) .

VAH: The value area high is the upper boundary of the value area in the chart. It often acts as resistance. This is the point from which the price often returns backward. It can be considered as a exit zone.

VAL: The value area low is the lower boundary of the value area. This acts as a support level. The traders can take long entry at this area because it is possible that the price will break out above this zone.

Here by moving next I have identified the Low Volume Nodes(LVNs). These are the nodes where the activity of the trading is low. These are the zones from where the price is rejected. You can see that from these points the price has rejected each time and after the rejection it is moving in the upward direction. These are the zones from where the price moves swiftly in the upward direction. I have highlighted the swift movements in the price by the black lines. In this the volume is 8222k.

Volume Profile also helps us to identify the High Volume Nodes (HVNs). This is the zone where the price looks that that it is stabilizing. I have highlighted the zone with the help of the rectangle. We can see that the price is in the consolidation zone before the next movement. Actually in this zone the trading volume is huge and the price is not moving in the upward direction but it is moving in the fixed box. But still the volume is increasing at this point. It suggests that the volume is increasing because the traders are selling their assets. Due to this selling pressure the market tried to stabilize but could not and it led to the downward movement. These levels often act as a support or resisitance level. But in the above example it is acting as a resistance level because the price was rejected from this level.

In the above chart the highest recorded volume with the help of the Volume Profile indicator is 31441k and the lowest recorded volume is 8222k.

Question 3: Validating Breakouts with VWAP

Discuss how VWAP is used to confirm breakout strength by analyzing its interaction with price movements. Provide examples of price-action behavior near VWAP during Steem’s bull run.

The Volume Weighted Average Price (VWAP) is a vital tool for assessing breakout strength. It uses both price and volume for the assessment of the breakout. It offers a dynamic benchmark that reflects the average price a security has traded at throughout the day. In breakout scenarios VWAP serves as a key reference for institutional traders and retail participants alike.

How VWAP Validates Breakouts

Price Interaction with VWAP:

- Above VWAP: When the price is consistently trading above the VWAP then it signals bullish momentum. It means the buyers are dominating the market. And the asset is trading at a higher price as compared to its average price.

- Below VWAP: When the price remains below VWAP then it indicates bearish sentiment with sellers exerting control.

Breakout Confirmation:

- A breakout accompanied by strong volume and sustained price movement above or below VWAP is more likely to be legitimate.

- Failure to hold above VWAP after a breakout suggests a potential fakeout or reversal.

Dynamic Support and Resistance:

- VWAP often acts as a support or resistance. In a bull market pullbacks to VWAP may provide opportunities for re entry while a failure to hold VWAP could signal weakness.

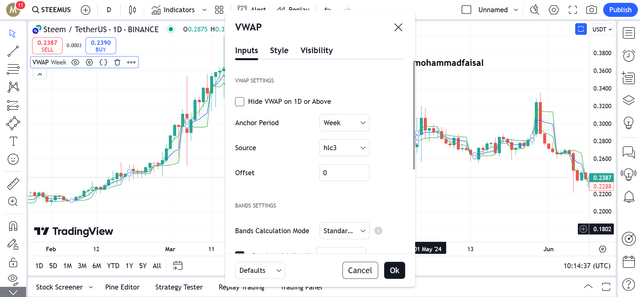

So first of all in order to use this trading tool we need to add it on the chart. As I am using TradingView so I have added it on the chart from the extensive list of the indicators. You can see the chart I have added VWAP indicator on the chart.

Then If we move to the settings we can see different features. There is the option to set the period, source and offset. I have changed the anchor period from session to week.

VWAP Price-Action Behavior During Steem’s Bull Run

I will explain the price behaviour with two cases where the STEEM done a successful breakout and where the breakout did not happen successfully and the price reversed.

Case 1: Bullish Breakout and VWAP Interaction

As we know that every bull run is after the consolidation phase. In the consolidation phase the price moves in the fixed zone and it absorbs the selling pressure here. You can see in the above chart that the market was in the consolidation phase. This consolidation phase started in the November, 2023. And this consolidation phase continued until 2024. And in this consolidation phase the price moved in highlighted area in the rectangle.

After this consolidation phase the price dip below this key area. It was actually a retesting before the start of the next bull run.

After the consolidation phase the price started breakout from the consolidation phase. The breakout started from $0.2091 and it continued towards the $0.24. Because the price crossed above the VWAP. The blue line is representing the VWAP and the other bands are representing the volatility of the market. And as soon as it reached this level it re-tested the price. During this retest the price reached around $0.1990. When after the breakout the price retests itself then starts moving in the upward direction it confirms the trend and it means that the price will strongly move in the upward direction.

Here you can see that the breakout was confirmed by the re-test in the price. And this drove the price to move in the upward direction. It touch the significant high level. The price touch $0.40. So in the bull run after the consolidation phase the price broken out successfully and VWAP helped us to confirm the successful breakout.

Here I have calculated the outcome of this breakout. This breakout led to a significant increase in the price of more than 100%. So in this way we can use VWAP to confirm the breakout. This is also important that the breakout followed by a retest during the bull run strongly confirms the trend.

Case 2: Fakeout Below VWAP

Here in order to identify the false breakout I have scrolled to the historical bull run and then the consolidation phase. As we know that after the consolidation phase where the price moves sideways the price reverses. So here the consolidation phase is going on between 3 May to 23 May.

Here we can see that the price broke above the VWAP which means that the price will move in the upward direction while leading the bull run after the consolidation phase. This is a daily timeframe chart for the long term scenarios. Here the price broke out from $0.2613 and this broke out pushed the price in the upward direction up to $0.33350.

But here you can see that right after the breakout in this daily chart the price reverses the trend. It did not remain a sustain upward trend. The price crossed below the VWAP line and it started moving in the downward direction. It confirmed the downtrend and the price moved significantly in the downward direction.

It proved to be a correct breakout in the downward direction. This breakout led to move the price from $0.335 to $0.17. It was a significant downtrend after the breakout. This consolidation phase led to the downtrend. The VWAP indicator suggested the correct breakout of the price in the downward direction.

At first the breakout happened above the VWAP but the breakout above VWAP indicated the weakness. It actually suggested that the traders should wait for the further confirmation before entering the long position.

Practical Analysis Techniques for Steem Breakouts Using VWAP

Intraday Breakout Validation:

- We can monitor price movements relative to intraday VWAP during breakout attempts.

- We can look for volume confirmation when the price sustains above or below VWAP.

Retest Strategies:

- During the bullish breakout we should observe whether the price pulls back to VWAP and rebounds.

- A rebound with high buying volume suggests institutional support validating the breakout.

Multiple Timeframes:

- We should use VWAP on higher timeframes such as daily or weekly for macro trends and shorter timeframes such as 1H, 4H for intraday breakouts.

- Alignment across timeframes strengthens breakout conviction.

VWAP is an essential tool for validating breakout strength in Steem/USDT. By analyzing how price interacts with VWAP the traders can determine the sustainability of a breakout. They can adjust their strategies accordingly. During Steem’s bull runs VWAP often acts as a reliable dynamic support/resistance level. It provides actionable insights for both intraday and swing trading strategies.

Question 4: Developing a Breakout Strategy

Create a step-by-step breakout trading strategy for the Steem/USDT pair. Integrate Volume Profile and VWAP to define entry points, stop-loss levels, and profit targets.

We can develop a breakout trading strategy for the STEEM/USDT pair by integrating Volume Profile and VWAP trading indicators.

Here is a step by step breakout trading strategy for the STEEM/USDT pair:

Here in this chart you can see that I have implemented Volume Profile indicator. I have used this to identify the key levels which will be helpful to develop a good breakout trading strategy.

Here in the above chart you can see that I have identified High volume node and low volume. We have already discussed that high volume node is the area where the activity of the traders is greater than other areas. At these areas the trading volume is higher than other areas. And similarly for the low volume node it is the zone where the trading volume is very low. Low volume areas represents the inefficiency in the price movement. But the breakout in the low volume node is often rapid because there is no significant resistance or support.

At the chart I have considered the high volume node as the resistance zone for the current chart. Because if we see historically it is the point from where the price reversing backward. So I will use this as the resistance zone. It is also the POC level because the trading volume is the biggest bar than others. The HVN is at the price level of $0.1940.

And in the above chart I have considered low volume node as the support level. I have determine it as the strong support level because the price is always returning back in the upward direction after touching this support level. The LVN is at the price level of $0.15.

By using Volume Profile I have determine the key support and resistance levels by using the high volume node and low volume node. But now we need to monitor the confirmation of the trends. And for the confirmation of the trend I have added VWAP indicator. You can see in the above chart. In the settings I have chosen the period of week and I have enabled the bands as well which will help us to identify the volatility in the market as well. If I say it is similar to the bollinger bands then it will not be wrong.

We know that when the price crosses above the VWAP then it indicates the bullish momentum. And similarly when the price crosses below the VWAP then it indicates the bearish momentum.

Here I have considered the support zone as the entry level. But for the confirmation of the trend I have watched VWAP carefully. We can see that the price has crossed above the VWAP's blue line. It confirms the upward trend. Moreover for the confirmation of the entry I have noticed the Volume Profile indicator as well. We can see that the volume is also increasing with the increase in the price from the VWAP level. It suggests that the price will move in the upward direction. I am developing a bullish trading strategy so I have considered this point as a long entry.

Then again if we want to take second entry then we can consider taking entry after the retest of the market. So I have highlighted the second entry zone as well. We can see that after the second entry the volume is increasing rapidly at high speed. We can also call this entry as a pull back entry.

Now risk management is the key factor while developing a trading strategy. So now in order to set the stop loss level I am considering the support level. If the price turned back after the breakout and it crosses below the support level then it means that the price will further go downward and in order to manage the risk I have implemented this area below the support as a stop loss level to avoid big loss. The key stop loss level is $0.14 because it is the area from where the price is moving downward from the VWAP. The price is crossing the below the lower band and in future after the entry if the price do the same thing then we will be safe from the huge loss.

Moreover we can use trailing stops to dynamically manage the risk and to avoid the fake swings of the market. Trailing stops are really helpful to trade in the dynamic and volatile market. They support in the trending market such as in the bullish market.

For the determination of the profit targets I have used the combination of Volume profile and the price action. I have identified the foremost local resistance where the price is not moving but staying for a while and the volume is continuously increasing. It means the users are selling their assets. So we can set this zone as the first target zone. This is the short term target.

For the second target which is significantly big target and full of profit I have used the high volume node as the second target for this trading strategy. Because this zone is acting as a strong resistance in this chart. And there is the high probability that the price will move downward from this resistance zone. So this is the second target from where we can take our money out of the entry. And then we can prepare ourselves for the next entry and again we can follow all these steps for taking entry in the market.

Here we can also use the VWAP bands for the determination of the profit targets. These move dynamically and in the volatile market conditions we can use it for the dynamic profit targets.

This trading strategy is combining Volume Profile and VWAP. It provides a systematic approach to breakout trading while managing risk and maximizing the returns.

Question 5: Avoiding False Breakouts

Highlight common risks in breakout trading, such as false breaks, and explain how Volume Profile and VWAP can mitigate these risks. Provide practical tips for enhancing breakout reliability.

False breakouts can be one of the most frustrating challenges in trading, leading to losses and eroding trader confidence. A false breakout occurs when the price temporarily moves beyond a key level (support or resistance) but fails to sustain momentum, quickly reversing and trapping traders. Tools like Volume Profile and VWAP offer valuable insights to mitigate these risks by analyzing market participation, trend strength, and volume dynamics.

Common Risks in Breakout Trading

Low Volume Breakouts:

- Breakouts unsupported by high trading volume often indicate weak interest and lack the momentum required for continuation.

- Example: Price moves above $0.80 but on declining volume, signaling a higher risk of reversal.

Fakeouts:

- The price temporarily breaches a critical level but lacks follow-through, reversing sharply to trap breakout traders.

- Example: Steem/USDT briefly rises above $0.85 but closes below, indicating a failed breakout.

Overextension (Late Entries):

- Entering after the price has already moved significantly increases the likelihood of buying into overbought conditions.

- Traders often enter just before a pullback, leading to premature losses.

Sideways or Low-Volatility Markets:

- Breakouts occurring in choppy, sideways markets are often unreliable and lack the trend strength needed for continuation.

News-Driven Moves:

- Sudden price movements caused by news or events may lead to false breakouts, especially if the underlying volume is inconsistent or market sentiment changes rapidly.

How Volume Profile Mitigates False Breakouts

Volume Profile provides a visual representation of trading activity at different price levels, helping traders identify key areas of support, resistance, and inefficiency.

Key Features of Volume Profile in Avoiding Fakeouts

High-Volume Nodes (HVNs):

- What They Indicate:

HVNs are zones of significant trading activity, acting as strong support or resistance. - Breakout Analysis:

A breakout above an HVN is more reliable if the price sustains above the node, indicating that buyers or sellers have accepted the new price level. - Practical Tip:

Wait for the price to consolidate above the HVN after a breakout to confirm strength before entering.

Example:

- Resistance at $0.80 (HVN). Price breaks above but holds with increased volume. This suggests the breakout is valid.

- What They Indicate:

Low-Volume Nodes (LVNs):

- What They Indicate:

LVNs represent price zones with little trading activity, often resulting in rapid price movement when entered. - Breakout Analysis:

If a breakout leads into an LVN but fails to sustain momentum, it often reverses, signaling a potential fakeout. - Practical Tip:

Use LVNs to assess whether the breakout has sufficient room to move or risks stalling due to low market interest.

- What They Indicate:

How VWAP Helps Validate Breakouts

VWAP (Volume-Weighted Average Price) acts as a dynamic benchmark for price trends, offering insights into the balance between buyers and sellers.

Key Features of VWAP in Avoiding Fakeouts

Trend Confirmation:

- What It Indicates:

Breakouts above VWAP often indicate bullish momentum, while breakdowns below VWAP signal bearish trends. - Breakout Analysis:

If the price holds above VWAP after breaking resistance, it confirms buyer strength. Conversely, failure to stay above VWAP post-breakout indicates a weak or false breakout. - Practical Tip:

Avoid entering long positions if the price reverses below VWAP after a breakout.

- What It Indicates:

Volume Validation:

- What It Indicates:

Rising volume near VWAP during a breakout confirms market participation and supports breakout reliability. - Breakout Analysis:

Low volume or decreasing volume near VWAP during a breakout suggests weak buyer interest, increasing the likelihood of a fakeout. - Practical Tip:

Monitor volume closely; only trade breakouts accompanied by higher-than-average volume.

- What It Indicates:

Practical Tips for Enhancing Breakout Reliability

Wait for Confirmation:

- Enter only after the price closes firmly above a resistance level or below a support level.

Combine Multiple Tools:

- Use Volume Profile and VWAP alongside candlestick patterns or oscillators (e.g., RSI or MACD) to confirm breakouts.

Check Volume Trends:

- Rising volume during a breakout increases reliability, while declining volume suggests hesitation.

Watch for Retests:

- Valid breakouts often retest the broken level (now acting as support/resistance) before continuing. Enter on the retest to improve reliability.

Adjust Stop-Loss Levels:

- Place stop-losses slightly below breakout levels or VWAP to avoid being caught in a reversal.

Avoid Trading Near News Events:

- News-driven volatility can cause erratic price behavior, increasing the risk of false breakouts.

Monitor Market Context:

- Breakouts during trending markets are more reliable than those in low-volatility or sideways markets.

Conclusion

False breakouts are a significant risk in trading, but Volume Profile and VWAP provide reliable ways to validate breakouts by analyzing market participation and momentum. By focusing on volume trends, price interaction with VWAP, and the structural insights from Volume Profile, traders can improve the reliability of their breakout strategies and avoid common pitfalls.

Hi, @mohammadfaisal,

Your post has been manually curated!