How I got into investing in cryptocurrencies

Welcome to the blog! For this introductory post I'm going to play catch up, and bring the blog up to speed to reflect my current situation. One purpose of the blog is to be a kind of running commentary on my activities and forays into cryptocurrency as an investor, specifically a newcomer to investing as a whole. You might find it interesting therefore to read how I came to this decision to invest in cryptocurrencies in the first place. The story so far...

PART 1 - Financial Intelligence

I suppose there are a handful of books we might read in a lifetime which are not merely influential but affect the very course of our lives; the act of reading the book being the start of a chain reaction of momentous decisions.

I will call Robert Kiyosaki's "Rich Dad Poor Dad" such a book. There are things I liked and things I didn't like about this book. But in the end, my intention is not to review or recommend this book to you, but simply to explain that it raised my consciousness to the concept of 'Financial Intelligence'. To summarise in my own words:

Financial IQ: Having good sense in financial matters. At a low level this translates to keeping a keen on eye on your incomings and outgoings, with the aim being to not be a spendthrift nor subject yourself to modern debt slavery by paying exorbitant interest rates from purchases made on credit. At a higher level, Financial IQ means having some understanding of financial instruments, economics, business, and laws, so as to be able to spot profitable opportunities and be ready to take advantage of them when they reveal themselves. The aim of this second, ultimate level of Financial Education being to free yourself from that other form of modern slavery: wage slavery.

The message hit home, and freedom sounds so very good. Next stop: the book shop.

PART 2 - Learning about Money

When I got back from that holiday where I'd read Rich Dad Poor Dad, I went straight into the newsagent at the airport and bought a handful of financial periodicals. It was the start of my financial education. And at the same time, something else caught my eye.

It was a book titled "How Money Works" - a reference book by DK publishing. And this book I have absolutely no qualms about recommending. Actually, DK reference books are fantastic in general. I've previously bought their encyclopedias on Natural History and Art History, and they're very well presented, as well as being exhaustive.

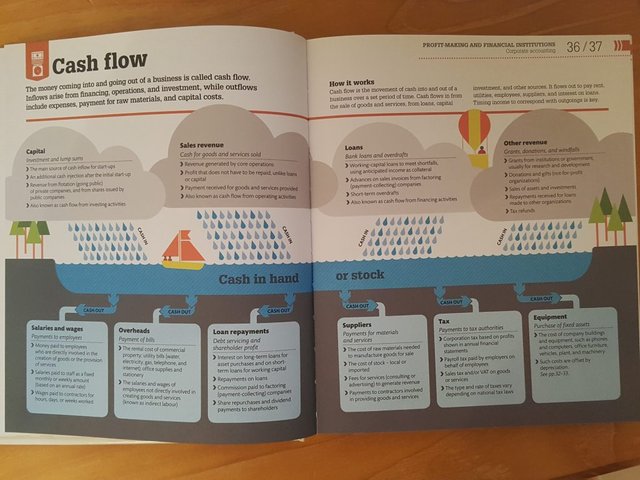

How Money Works is probably my favourite of all, covering all aspects of money, from the origin of barter and fiat currency, to how it's now traded in the form of financial securities. From lending and borrowing at the levels of the individual, corporate and state, to interest, inflation and central banks... I could go on and on. It's all presented with an appealing and clean graphic design which illustrates otherwise dry financial concepts by way of analogy to something intuitive. Just take a look at this beautifully laid out topic as an example:

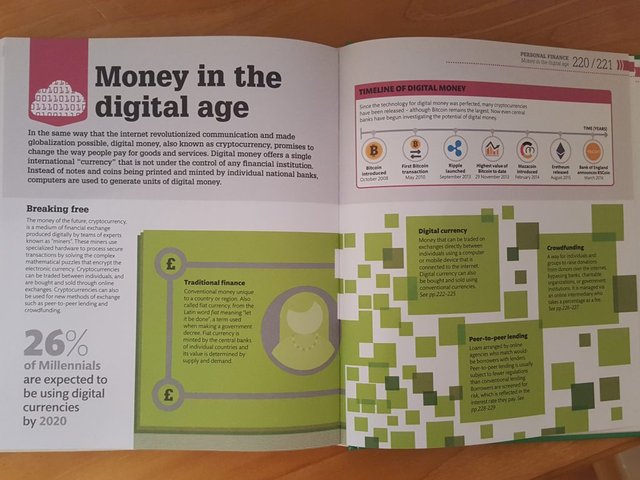

The key point about this book is it was published as recently as March 2017, so you know it's up to date with everything in the realm of money. You probably know where this is going now, but first a quick detour...

PART 3 - Investing

While I was reading How Money Works I was also dipping in and out of those financial magazines. Not all of them were aimed at beginners, but I felt that I was beginning to get to grips with the terminology and concepts of investing.

Mortgage-backed securities, subprime loans, tranches — it's pretty confusing, right? Does it make you feel bored? Or stupid? Well, it's supposed to. Wall Street loves to use confusing terms to make you think you can't do what they do. - The Big Short (2015)It's not just the terminology but the sheer plethora of choices the would-be investor is faced with when considering where to put their money. Then there are the various trading strategies and approaches to portfolio and risk management that one can adopt after the types of investment have been chosen. If I was to understand all this I would need something a little meatier to sink my teeth into than a few magazines, and so I opted for "Investing for Dummies" which seemed to have good feedback. Thus, from unassuming beginnings reading a single book about how one should approach the domain of money generally, I was now reading into all the forms that money and securities can take, combined with information on how to invest in those instruments. But that still left the question of just what was suitable for someone like me to put my money into as a first-time investor.

PART 4 - Bringing it all together

The book "How Money Works" begins with a chapter on barter, the system of exchange society used before money existed. It's fitting that a book opening with this prelude to the appearence of money ends on a chapter all about the latest step in its evolution: cryptocurrencies.As somewhat of a tech enthusiast, cryptocurrencies have always been on my radar. But I believe it was this new confluence of interests in personal financial awareness, investing, and systems of money which made me sit up and really take notice of what was happening. Yes, I'd heard of Bitcoin, as many people have by now. But Ethereum? Ripple? Blockchain technology? The fact that there were now over 700 cryptocurrencies and that the technology which underpins them was being lined up for many more uses far beyond simple stores of value was a revelation. The blockchain revolution is far bigger than any single currency. It can be as significant as the internet itself, so say some.

And so it was that I found the thing that excited me and which I truly believed in, in my head and heart. A deep and expansive subject that I was willing to research in depth and understand the fundamentals all the more because it was fascinating and aligned with my interests.

You might call it somewhat fortuitous that cryptocurrencies have appeared on the scene at roughly around the same time in my life that I became interested in investing and financial security and both have come together in apparent harmony. I'm excited, but also trying to keep my feet on the ground. Let's see what the future holds.

That's a nice guide to investing! I have done one here with monopoli game https://steemit.com/monopoly/@alketcecaj/learn-to-invest-by-playing-monopoly

Coins mentioned in post: