Bitcoin Market Update: All Eyes on AML Regulations Coming in October.

Hi traders, let's have a look at the market.

Bitcoin.

Apologies for missing yesterday's market update, passions were high and it didn't seem like a good time to do some objective analysis on the market.

EDIT:

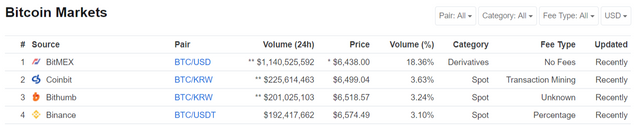

I realized that I did all my TA on a USDT chart, since Tether isn't pegged 1:1 to the dollar anymore just keep in mind that the "real" price is lower. USDT/BTC market still moves the spot market in volume though.

So, let's jump into this.

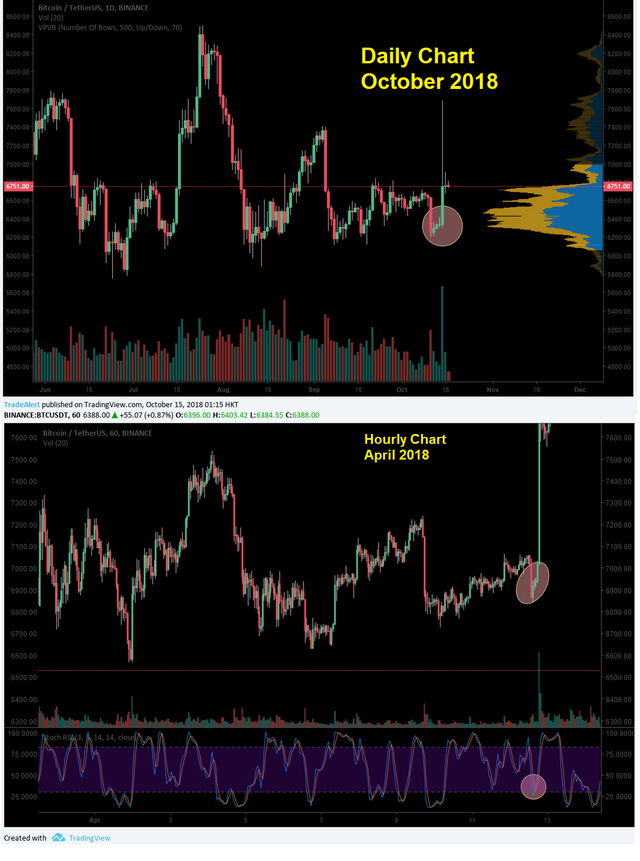

This week's beginning is firing on all cylinders, as we predicted Bitcoin spiked in impressive fashion after completing a fractal pattern from back in April 2018.

Wrecking the shorts in the process.

Despite the fact that this spike was certainly not organic but a combination of short squeeze and market manipulation, it's nonetheless established $6000 as a strong level of support in Bitcoin and has reinforced our thesis of a Bitcoin bottom which we formulated about a month ago.

You'll notice that the "Short Squeeze Danger Zone" established in the chart above is the reflection in the inverse of the $6000-ish level of support.

.png)

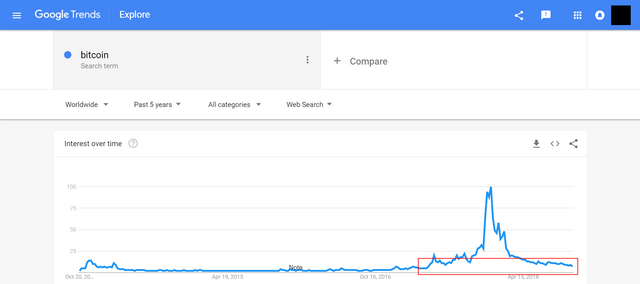

Now, we've yet to see a follow-up on the spike, the market remains extremely cautious and has been stripped of most "dumb money" with overall interest as low as back in April 2017.

A quick volume profile analysis shows Bitcoin hitting against resistance around $6800 due to low market auction beyond that price.

.png)

What this means is that it'll certainly take another pump to move this market another leg up.

Strategy.

- From a technical point of view, I believe that Bitcoin has bottomed at $6000 and now is the time of maximum financial opportunity for a long term Bitcoin swing trade.

- I don't recommend trading those chops, especially with leverage, stick to buying on spot and accumulating for the next market cycle.

- From a fundamental point of view, pay very close attention to any news coming from the Financial Action Task Force this October, related to cryptocurrencies and AML provisions. A real tightening of regulations around crypto currencies could represent another bearish catalyst event.

Until then,

FØx.

This content is for informational purposes only and does not constitute financial advice.

If you liked this article, make sure to show some love by up-voting or following the blog. You can also follow us on Twitter at F0xSociety.

Buy Digital Assets: Coinbase

Buy Digital Assets: Coinbase

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Keep your Crypto Safe in a Hardware Wallet: LEDGER NANO S

Published on

by FØx

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by FØx from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.