CryptoQokka - using machine learning to analyze people's opinions and feelings on cryptocurrencies

We launched CryptoQokka in early October when the prevailing sentiments towards blockchain were exceedingly negative, and the cryptocurrency market was about to plunge into its worst. "Winter is coming" so did people speak, but things weren't really that bad. Here are a few interesting facts we discovered on CryptoQokka:

- People are more positive towards Dogecoin than Bitcoin or Ethereum.

- We can correlate Bitcoin price and how often Redditors say "shit".

- People could react very negatively towards "positive" news.

- Sentiment sometimes drives price, but don't rely on it.

- Most people really care about use cases and technologies. It's not all about speculations.

People are more positive towards Dogecoin than Bitcoin or Ethereum

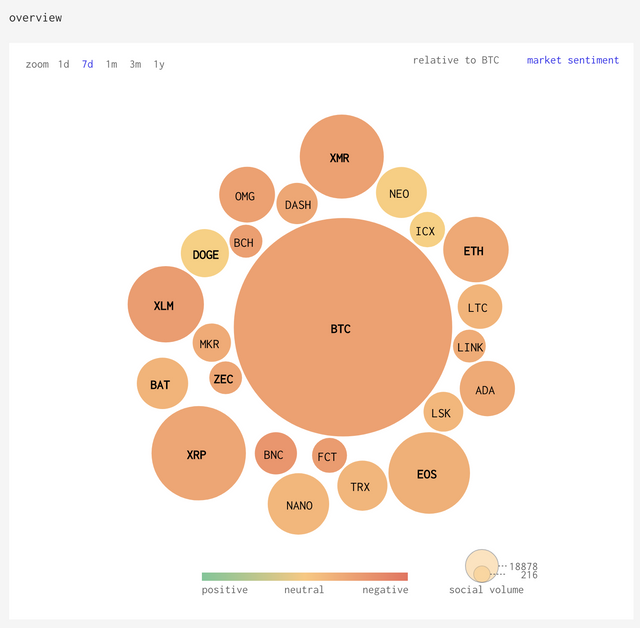

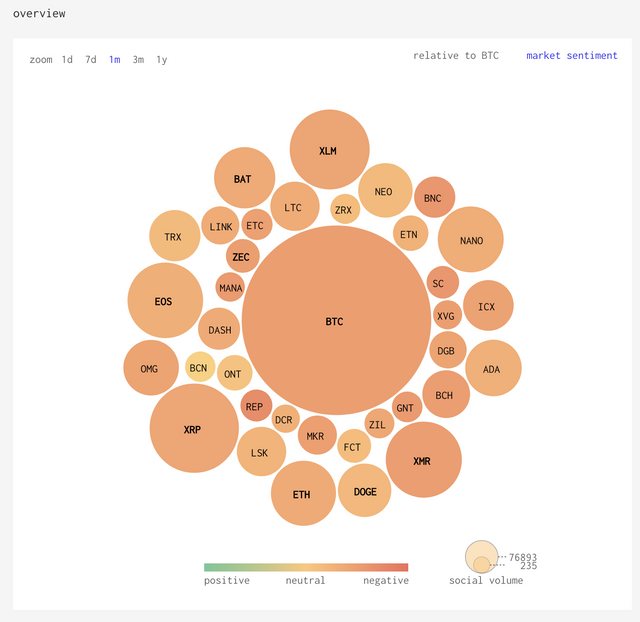

We know overall market sentiment is bad - CryptoQokka's market sentiment overview is covered by red (negative) and yellow (neutral) bubbles. However people are mysteriously optimistic about Dogecoin. Here is what we see based on the analysis over the last 7 days, where DOGE, NEO, ICX are the only three not-so-negative coins out there:

DOGE is about average compared to other coins in terms of sentiments over the past month. But still, the sentiments towards DOGE were slightly better than Ethereum and Bitcoin.

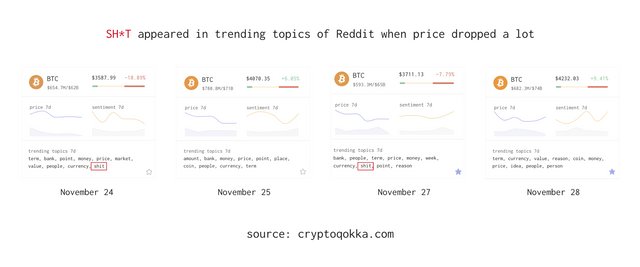

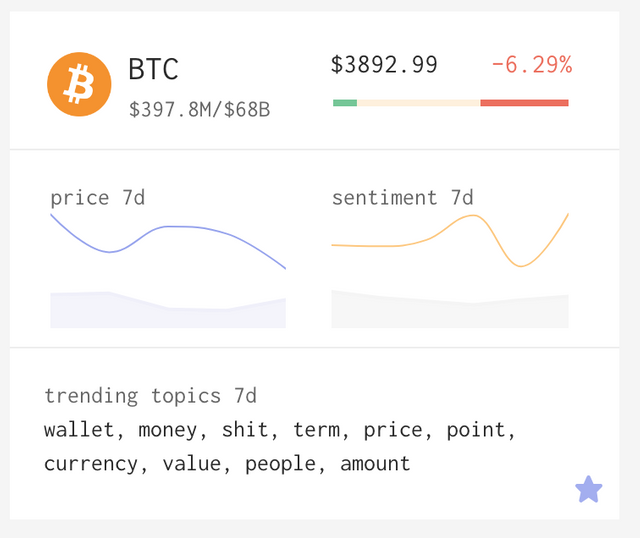

Correlation between Bitcoin price and how often Redditors say "shit"

Shit happens from time to time, but not so often you would see the word as a "trending word" in major online communities. Many people may still remember the mayhem a week ago when Bitcoin price dropped by nearly 20% in a single day. People of the Bitcoin subreddit took the memorable event to the next level and made "shit" a weekly trending topic, according to our machine learning based topic model analysis.

And today it happened again - only when price goes down :)

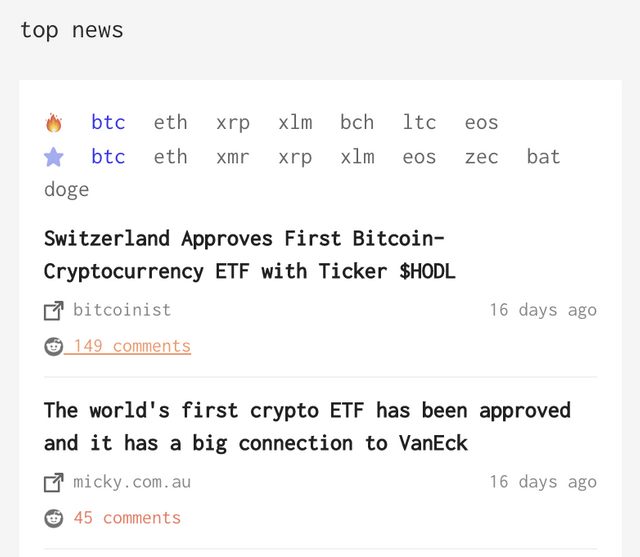

People could react very negatively towards "positive" news

Crypto ETF approved? Bitcoin is going to hit $30000! Let's celebrate!

Not so fast. Sometimes the wisdom lies within the comments instead of the news article. And for TL;DR people on CryptoQokka, we made life a little easier by showing you ahead of time how people truly feel about this news article, before you start reading the comments. Here, we show that, people's reaction towards this ETF thing is, as the color of "43 comments" says, alarmingly red and really negative.

And of course, the price of Bitcoin did not miraculously go up on that day (Nov 18). The series of ETF news ended in an anti-climatic market crash several days later.

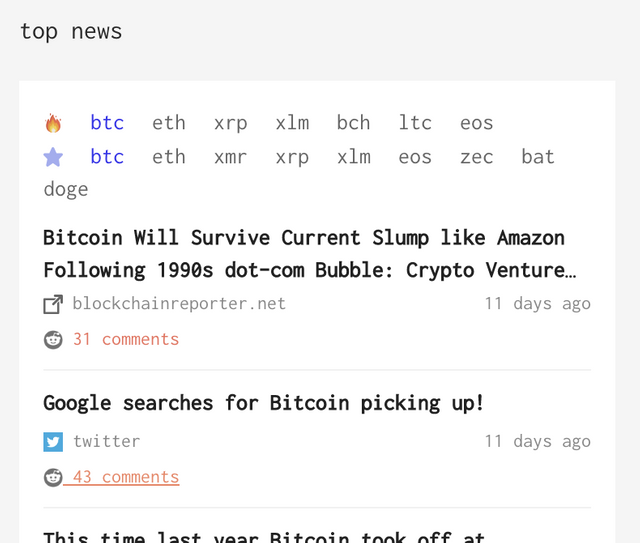

This is another of my favorite examples: "Google searches for Bitcoin picking up!". Seemingly positive, yet not really effective in spreading optimism. As a Redditor rightly pointed out in their comment: "I guess people are searching "bitcoin dead""

Sentiment sometimes drives price (but don't rely on it)

When we first saw correlations between sentiment and price, we were very excited so we shared our findings in a few private groups. The result stirred interest from multiple crypto investors and traders. Over the past month we polished and documented our APIs (email us if you want access), and we think we are ready to share some of them publicly.

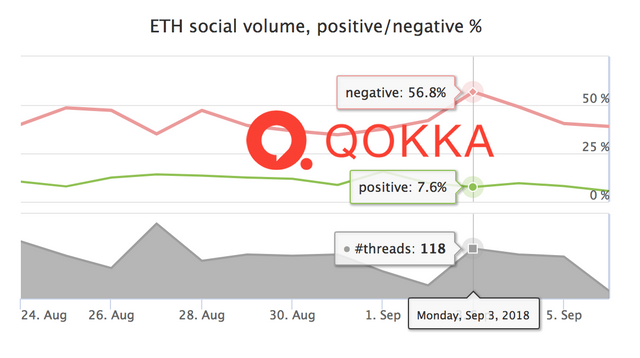

This is not our first time observing strong correlation. Another of my favorite example is from an earlier internal version of CryptoQokka back in September, when the price of Ether dropped for more than 20% on a single day (Sep 5) just after an accumulation of negative sentiments reached their peak on Sep 3.

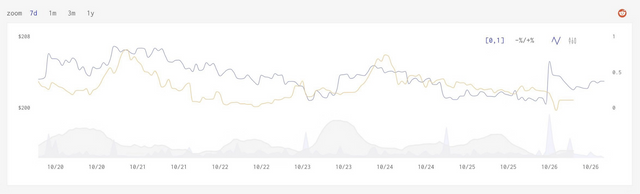

Here is another example showing how sentiment (yellow) and price (blue) movement correlate over the past week (for Ether).

Most people really care about use cases and technologies. It's not all about speculations.

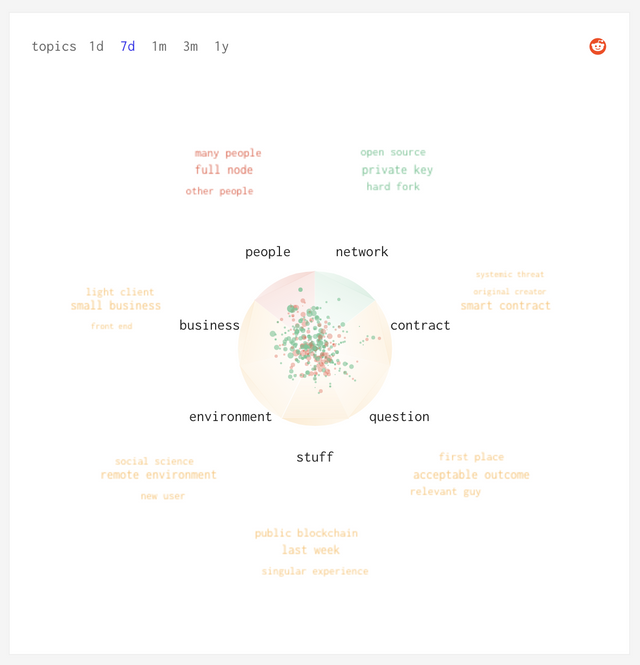

One of my favorite feature of CryptoQokka is topics and summaries, which are dynamically computed by topic models (a special type of unsupervised machine learning models) to capture the most salient topics and phrases people use in discussions, and to extract the most representative sentences and paragraphs as summaries for each topic.

Not all phrases are meaningful. The quality of topics and phrases could still use some improvements. However it is not hard to see in the graph, that technical terms and use cases constitute significant parts of people's discussions.

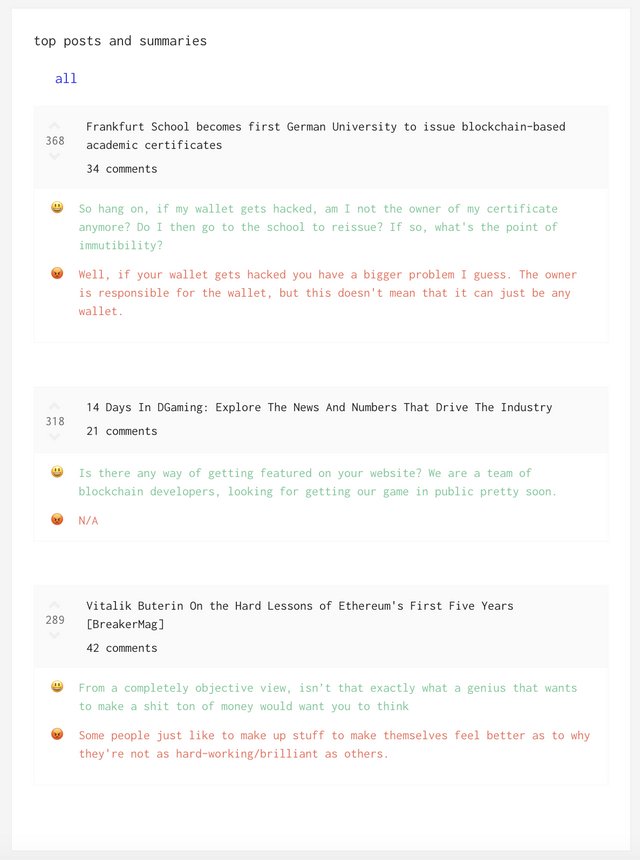

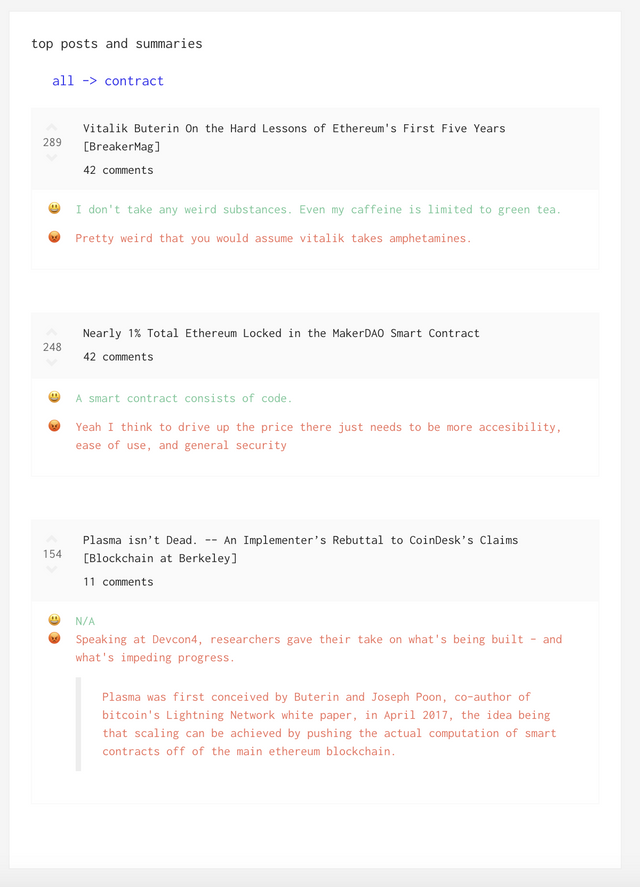

It becomes more apparent in "top posts and summaries". The first screenshot shows top posts and summaries for Ethereum across all topics for the last 7 days. The second screenshot shows the same but focused on a specific topic "contract". Up to three top posts (ranked by a combination of relevancy and upvotes) and the most representative summaries of positive and negative comments are shown below.

Even at the most turbulent time in the market, the top posts and summaries of comments are still all about use cases and technologies. Speculation doesn't seem to get a lot of traction these days :)

Conclusion

These are just some examples we found in our short journey of building CryptoQokka. It is still a very new product (only 2 months old!) in its public beta. We are working on a new version of CryptoQokka for year 2019, and we can only improve based on your feedback. Please feel free to reach out to us by email if you have any suggestions :)

Disclaimer: The information provided in this article does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the article's content as such. Qokka Inc does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

(Originally published on Medium: https://medium.com/qokka/cryptoqokka-using-machine-learning-to-track-how-people-are-feeling-about-cryptocurrencies-d84f3510dc14)

@aaronqli You have received a 100% upvote from @intro.bot because this post did not use any bidbots and you have not used bidbots in the last 30 days!

Upvoting this comment will help keep this service running.

Congratulations @aaronqli! You received a personal award!

Click here to view your Board of Honor

Do not miss the last post from @steemitboard: