Why Everyone Missed the Most Mind-Blowing Feature of Cryptocurrency

There’s one incredible feature of cryptocurrencies that almost everyone seems to have missed, including Satoshi himself.

But it’s there, hidden away, steadily gathering power like a hurricane far out to sea that’s sweeping towards the shore.

It’s a stealth feature, one that hasn’t activated yet.

But when it does it will ripple across the entire world, remaking every aspect of society.

To understand why, you just have to understand a little about the history of money.

The Ascent of Money

Money is power.

Nobody knew this better than the kings of the ancient world. That’s why they gave themselves an absolute monopoly on minting moolah.

They turned shiny metal into coins, paid their soldiers and their soldiers bought things at local stores. The king then sent their soldiers to the merchants with a simple message:

“Pay your taxes in this coin or we’ll kill you.”

That’s almost the entire history of money in one paragraph. Coercion and control of the supply with violence, aka the “violence hack.” The one hack to rule them all.

When power passed from monarchs to nation-states, distributing power from one strongman to a small group of strongmen, the power to print money passed to the state. Anyone who tried to create their own money got crushed.

The reason is simple:

Centralized enemies are easy to destroy with a “decapitation attack.” Cut off the head of the snake and that’s the end of anyone who would dare challenge the power of the state and its divine right to create coins.

That’s what happened to e-gold in 2008, one of the first attempts to create an alternative currency. Launched in 1996, by 2004 it had over a million accounts and at its peak in 2008 it was processing over $2 billion dollars worth of transactions.

The US government attacked the four leaders of the system, bringing charges against them for money laundering and running an “unlicensed money transmitting” business in the case “UNITED STATES of America v. E-GOLD, LTD, et al.” It destroyed the company by bankrupting the founders. Even with light sentences for the ring leaders, it was game over. Although the government didn’t technically shut down e-gold, practically it was finished. “Unlicensed” is the key word in their attack.

The power to grant a license is monopoly power.

E-gold was free to apply for interstate money transmitting licenses.

It’s just they were never going to get them.

And of course that put them out of business. It’s a living, breathing Catch-22. And it works every time.

Kings and nation states know the real golden rule:

Control the money and you control the world.

And so it’s gone for thousands and thousands of years. The very first emperor of China, Qin Shi Huang (260–210 BC), abolished all other forms of local currency and introduced a uniform copper coin. That’s been the blueprint ever since. Eradicate alternative coins, create one coin to rule them all and use brutality and blood to keep that power at all costs.

In the end, every system is vulnerable to violence.

Well, almost every one.

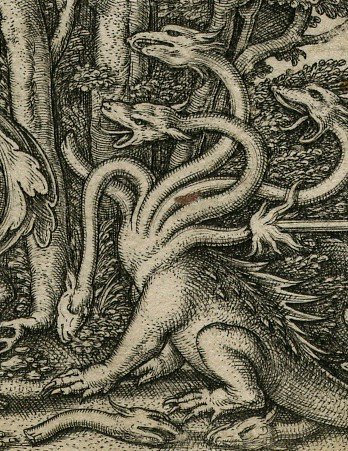

The Hydra----------------------

In decentralized systems, there is no head of the snake. Decentralized systems are a hydra. Cut off one head and two more pop-in to take its place.

In 2008, an anonymous programmer, working in secret, figured out the solution to the violence hack once and for all when he wrote: “Governments are good at cutting off the heads of centrally controlled networks like Napster, but pure P2P networks like Gnutella and Tor seem to be holding their own.”

And the first decentralized system of money was born:

Bitcoin.

It was explicitly designed to resist coercion and control by centralized powers.

Satoshi wisely remained anonymous for that very reason. He knew they would come after him because he was the symbolic head of Bitcoin.

That’s what’s happened every time someone has come forward claiming to be Satoshi or when someone has been “outed” by the news media as Bitcoin’s mysterious creator. When fake Satoshi Craig Wright came out, Australian authorities immediately raided his house. The official reason is always spurious. The real reason is to cut off the head of the snake.

As Bitcoin rises in value, the hunt for Satoshi will only intensify. He controls at least a million coins that have never moved from his original wallets. If VC Chris Dixon is right and Bitcoin rocket to $100,000 a coin, those million coins will shoot up to $100 billion. If it goes even higher, say a $1 million a coin, that would make him the world’s first trillionaire. And that will only bring the hammer down harder and faster on him. You can be 100% sure that black ops units would be gunning for him around the clock.

Wherever he is, my advice to Satoshi is this:

Stay anonymous until your death bed.

But resistance to censorship and violence are only one of a number of incredible features of Bitcoin. Many of those key components are already at work in a number of other cryptocurrencies and decentralized app projects, most notably blockchains.

Blockchains are distributed ledgers, the third entry in the world’s first triple-entry accounting system. And breakthroughs in accounting have always presaged a massive uptick in human complexity and economic growth, as I laid out in my article Why Everyone Missed the Most Important Invention in the Last 500 Years.

But even triple-entry accounting, decentralization and resistance to the violence hack are not the true power of cryptocurrencies. Those are merely the mechanisms of the system, the way it survives and thrives, bringing new capabilities to the human race.

The ultimate feature is one that Bitcoin and current cryptocurrencies have only hinted at so far, a latent feature.

The true power of cryptocurrencies is the power to print and distribute money without a central power.

Maybe that seems obvious, but I assure you, it’s not. Especially the second part.

That power has always rested with the divine right of kings and nation-states.

Until now.

Now that right returns to its rightful owners: The people.

And that will blow open the doors of world commerce, sowing the seeds for Star Trek like abundance economics, leaving the Old World Order of pure scarcity economics in the pages of history books.

There’s just one problem.

Nobody has created the cryptocurrency we actually need just yet.

You see, Satoshi understood the first part of the maxim, the power to print money. What he missed was the power to distribute that money.

The second part is actually the most crucial part of the puzzle. Missing it created a critical flaw in the Bitcoin ecosystem. Instead of distributing the money far and wide, it traded central bankers for an un-elected group of miners.

These miners play havoc with the system, holding back much needed software upgrades like SegWit for years and threatening pointless hard forks in order to drive down the price with FUD and scoop up more coins at a depressed price.

But what if there was a different way?

What if you could design a system that would completely alter the economic landscape of the world forever?

The key is how you distribute the money at the moment of creation.

And the first group to recognize this opportunity and put it into action will change the world.

To understand why you have to look at how money is created and pushed out into the system today.

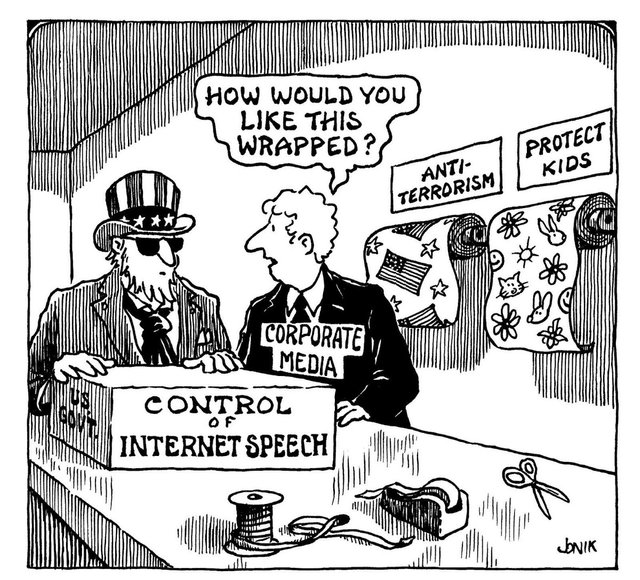

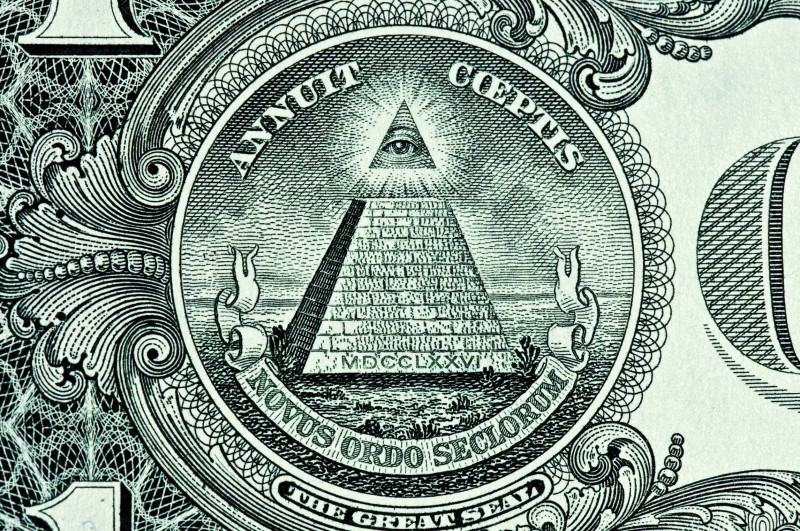

The Great Pyramid

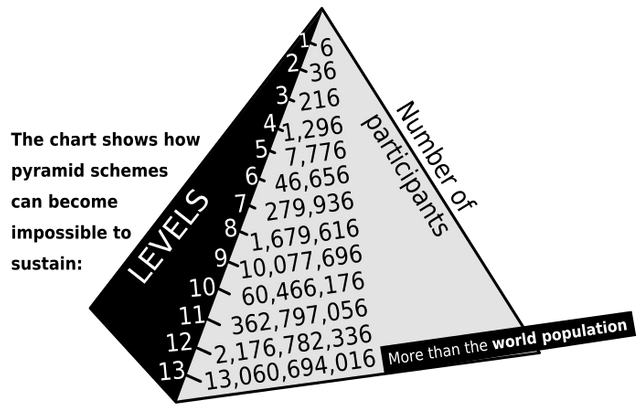

Today, money starts at the top and flows down to everyone else. Think of it as a pyramid.

In fact, we have a famous pyramid, with a third eye, on the dollar itself.

One of the most cliched arguments against Bitcoin is that it’s a Ponzi or “pyramid” scheme. A pyramid scheme rests on the original creators of the system roping in as many suckers as possible, paying them for enrolling people in the system rather than by offering goods and services. Eventually you run out of people to bring in and the whole things collapses like a house of cards. A Ponzi scheme is basically the same, in that you dupe the original investors with fake returns on their initial investment, a la Bernie Madoff, and then get them to rope in more suckers because they’re so elated by the huge returns.

The irony of course is that fiat currency, i.e. government printed money like the Yen or US dollar, is closer to a pyramid scheme than Bitcoin. Why? Because fiat money is minted at the top of the pyramid by central banks and then “trickled down” to everyone else.

The only problem is, it doesn’t trickle down all that well.

It moves out to a few big banks, who either lend it to people or give it to people for their labor. In fact, having a job or getting a loan are the primary methods that people at the bottom of the pyramid get any of the money. In other words, they trade their current time (with a job) or their future time (with a loan) for that money. It’s just that their time is a limited resource and they can only trade so much of it before it runs out.

Think of economics as a game. Everyone in the system is a player, looking to maximize their advantage and the advantage of their team (a company, their family and friends, etc.) to get more of the money. But to start the game you need to initially distribute the money or nobody can play. Distributing money sets the playing field.

Now if you were in charge of the money, how would you distribute it to the network? You’d want to keep as much of it for yourself as possible, so you’d set the rules to maximize your own personal advantage. Of course you would! That’s what anyone in their right mind would do, maximize their own power to keep it for as long as possible.

That’s precisely what the kings and queens of the ancient world did, and that’s what nation states do today. As Naval Ravikant said in his epic series of tweets on blockchain, today’s networks are run by “kings, corporations, aristocracies, and mobs.” “And the Rulers of these networks [are] the most powerful people in society.”

That’s why every single system in the history of the world has distributed the money in one way:

From the top down.

Because it maximizes the advantage of the kings and mobs at the top.

Unfortunately, that means most of the money never really leaves the top. It stays right there, as wasted and frozen potential that’s never realized. There is little to no incentive for the money to move. Since money is power, hoarding it is literally hoarding more power and nobody would willingly give up that power.

In other words, the game is rigged.

What we need is a way to reset the game.

Up until now, our prospects looked very dim.

For example, we could pass a law, like a Universal Basic Income (UBI). That would give everyone a stream of money, pushing it out across the entire playing field and giving more people a chance to participate in the system. If more people can participate, we unlock all kinds of hidden and untapped value.

How many great inventors never managed to create their next breakthrough because they were stuck driving a bus seven days a week to feed their family, with no hope of free time or any clear path to digging themselves out of debt? How many great writers went to their graves never having written their great novel? How many budding scientists never discovered the cure to cancer or heart disease?

The problem with all of the plans before now, from UBI to socialism (high taxes on the rich to spread the wealth across the game) is that to redistribute the money after it’s already been distributed is nearly impossible. The people with that money rightfully resist its redistribution. And as Margret Thatcher said “The trouble with Socialism is that eventually you run out of other people’s money.”

But what if the money is NOT already distributed?

What if we don’t have to take it from anyone at all?

That’s the missed opportunity of all of today’s cryptocurrencies. Cryptocurrencies are creating new money. And unlike credit markets, which only pretend to expand the money supply, by lending it out 10x with fractional reserve lending, cryptocurrencies are literally printing money. And they aren’t loaning it to people, they’re giving it to them for their service to the network.

It’s like microloans, without the loans!!

MONEY IS A GAME..!!! EMBRACE IT

All governments despise freedom in every form. They want us to believe that if we are free, we are absconding with the government's property, us. The only way for humanity to be free is to eradicate government from the Earth. It seems this might be done by using a currency they can't control, and starving it until government atrophies away to nothing. The tyrants will resist however, and I suspect that those addicted to government would see every human dead, than not under their control.

I think that mutually assured destruction is the only way out.

Life, liberty, and property for all, or existence for none.

Great article, you copy and pasted it three times though and overlapped a lot of the same stuff. Great ideas though!!! DONT LET THEM RAID YOUR HOUSE BRO!

Brilliant post!

Edit:

Read a little further to find out you copied and pasted. Still a good article to read so I bookmarked.

Of course i am not the author of this article

But I found it very informative so shared it

You should make it clear that it's not your article and preferably have a link to the original. Otherwise, people might start flagging you for not being upfront.

sure thanks for the advice

am new to this place..will keep that in mind

Congratulations @achalm! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @achalm! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!