Bitcoin can get to $100,000 if it keeps following one of tech's golden rules

Bitcoin is trading at record highs on Monday, but the cryptocurrency may still be far from hitting its ceiling.

It rallied 16.19% since July 31, despite last week's fork that split it in two. It's up 465% since last year.

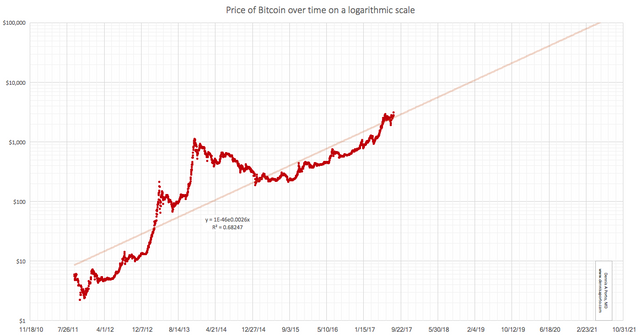

According to analysis by Dennis Porto, a bitcoin investor and Harvard academic, bitcoin's price could hit $100,000 per coin if it continues to follow one of tech's "golden rules" - Moore's law.

The rule, which was devised in 1965 by Intel cofounder Gordon Moore, describes the exponential improvements of digital technology.

"Moore's law specifically applied to the number of transistors on a circuit but can be applied to any digital technology, Any technology that is growing exponentially (i.e., 'following Moore's law') has a doubling time."

Typically, however, the rule applies to a technology's computing power or capabilities. This is the first time Porto has noticed a technology's price following Moore's law.

Since bitcoin's inception, according to Porto, its price has doubled every eight months.

"This poses a unique opportunity for investors: Whereas it was difficult to invest in circuits or internet speeds, it is easy to buy a bitcoin," Porto said.

Porto expects that this doubling trend could continue until bitcoin reaches mass adoption. Of course, another cryptocurrency could usurp bitcoin in the meantime.

By February 2021, Porto believes, it could be worth over $100,000. great news

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.businessinsider.com/bitcoin-price-and-moores-law-2017-8

yea i just want to post this news so you guy know it .

I have not bought any Bitcoin, but so far I have gathered some fraction amount by playing free games etc. I wish, it reach that level, so that my effort would be worth lakhs :)

great job sanjeevm .keep on going

Moore's law was a fun name for a trend observed in microprocessors

first of all - its not a rule set in stone as it ended for microprocessors as we began to reach the limit of how many transistors we can pack into silicon

secondly - I do not see how the microprocessor market correlates with the price bitcoin, the similarities presented in this article are pure hype buzzwords

the housing market also once grow exponentially, so what?