The Performance of Gold During Times of Crisis

We currently find ourselves in a time of a global epidemic. Panic and fear are everywhere. The economy is in turmoil. But history often repeats itself. Now is the time to revisit the history books for guidance. Let us discuss some of the biggest pandemics that have plagued our society in the last 30-40 years to see how gold has performed during that period.

HIV/AIDS

The HIV/AIDS pandemic dates back to the 1920s, but the big outbreak began much later – during the 1980s – 2000. At the turn of the millennium, more than 3 million people were infected with HIV/AIDS.

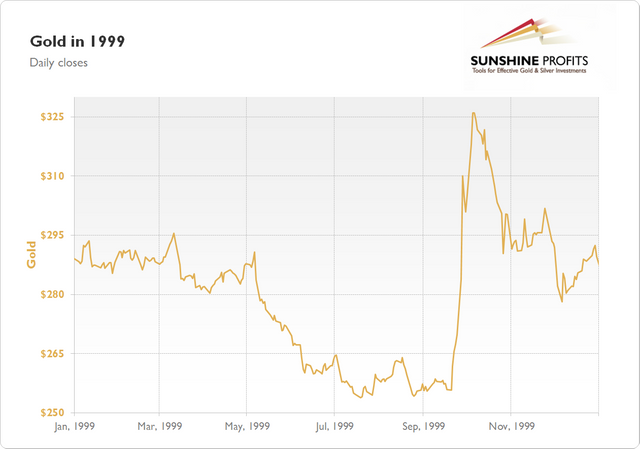

Let us take a look at the charts and see what happened with gold from 1999-2000.

What we immediately notice is the big upward trend in September and October when gold went above the $325 mark before bouncing back down towards the $300 area. 1999 was a year where gold started and ended the year around the same value. Overall, the HIV/AIDS pandemic didn’t have an immense effect on the gold market.

There are various theories as to why that is. The virus has already been around for decades. It is nothing new and it is not frightening; it is common knowledge of how it is transmitted. Furthermore, the HIV/AIDS pandemic is relatively under control in the west, unlike the situation in Africa. The precious metals market responds only when big economic centers are under threat.

The year 2000, shows a different picture.

What started as a healthy rise in the first two months of 2000, ended in a downturn for the rest of the year. Ultimately, gold ended the financial year with a 5.5% loss in value. It is not negligible but it is still much better compared to the steep falls we have seen in recent weeks on the stock market.

SARS

Did you know that COVID-19 has almost the same genetic code as SARS?! This is another type of virus that belongs to the Coronavirus family. Its origins were traced back to bats. The pandemic began in China and lasted from November 2002 until March 2003.

Take a look at the gold chart for 2002 below.

It looks pretty healthy, doesn’t it? That’s because it is. During most of 2002, the SARS epidemic had no major impact on the prices of gold. Between June and November, there weren’t any noteworthy movements. In December we notice another solid gain in value. Gold closed the year with a 24.80% leap.

At the beginning of 2003, gold continued where it left off in the previous year with two very positive months. March and April weren’t as good but in May we notice a positive increase in momentum. During the 2nd part of 2003, gold was bullish reaching the yearly high of $417 at the end of December.

By looking at the previous chart we can conclude that gold has gained a lot of value during the SARS pandemic. We can also observe a hefty loss of value between February and May 2003, but overall gold performed extremely well by gaining 19.5% during the year. The February-May losses don’t necessarily have to be linked to SARS but could be the result of the burst of the dot-com bubble and the US invasion of Iraq.

Swine Flu

The Swine Flu pandemic stroke the world at the beginning of 2009 and lasted until August 2010. It was a new strain of influenza pandemics.

The gold market in 2009 reacted with an early decline until mid-January before pushing upwards until March.

Just like in the previous years, gold performed particularly well in the last quarter. We notice a regular upward trajectory on the charts. The yearly high occurred on 3 December at $1,218. The gold market closed the year with gains of almost 24%.

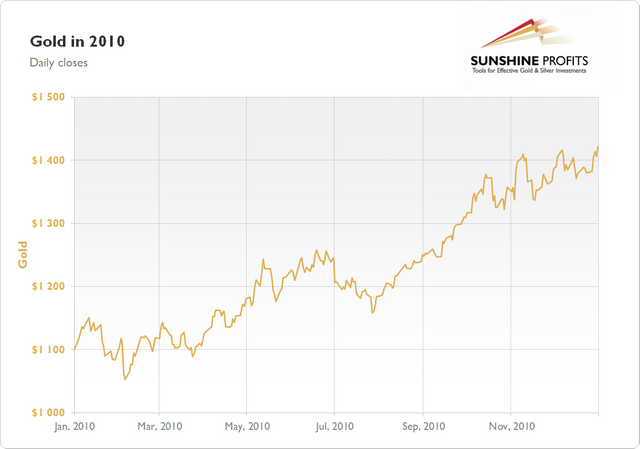

What happened in 2010?

After an initial period of consolidation from January-March, gold had a relatively bullish year. Another retracement period took place in July and August followed by a recurring event where gold reaches its all-time-highs at the end of the year. In 2010 that number was $1,421 on December 31. The year ended with totals gains of 29.67% for 2010.

Another global pandemic that overall did not affect the gold market. As the charts for 2009 and 2010 show, gold recorded remarkable gains during a world crisis.

Zika Virus

The Zika pandemic lasted between 2015 and 2016 before the WHO announced that it had officially ended in November 2016. Zika crippled almost 80 countries throughout the world and resulted in 1.5 million infections.

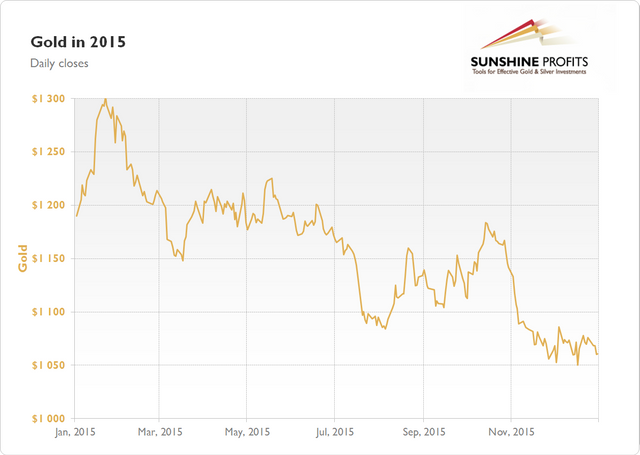

Here is the performance of gold in 2015.

After a great initial start to the year where the price of gold increased from $1,200 to the $1,300 region in January, gold had a relatively tough year. 2015 shows a falling trend with a yearly low at $1,050 in December. The year ended with a loss of 10%.

“What goes up must come down.” - Isaac Newton

The year 2016 is a great example of that.

The losses that were made during 2015 were recovered in the first 6-7 months of 2016. The bullish run lasted until July, followed by a short negative spell. The yearly high was on 2 August accompanied by a period of consolidation in the 4th quarter of 2016. At the end of the year, the charts show a gain of 8.6%.

Most of the losses that gold experienced in 2015 were reclaimed in 2016. If we add up those two years, we discover that gold lost ‘only’ 1.4% of its value during one of the worst pandemics in human history.

COVID-19

The COVID-19 pandemic started in December 2019 in Wuhan, China. From there it spread to almost all corners of the world and it has proven to have a significant impact on the whole world economy.

The virus is very similar to SARS and one might ask: Are we going to experience the same market impact as during the SARS outbreak? Let us take a look at the charts for December 2019 when the pandemic began.

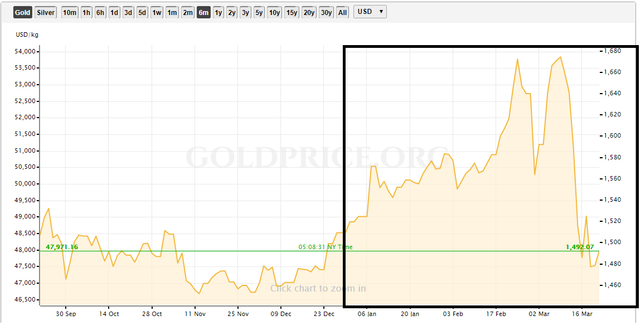

It is important to highlight that just before the pandemic begun the gold market was going through a bullish run from June till September. This bull run was then followed by a downtrend from September to November. During the entire month of December gold was gaining value, almost reaching its yearly high from 4 September at $1,560.

Now we are going to take a look at the performance of gold during the first 3 months of 2020.

A relatively positive January was followed by an even better February performance. We then experienced a drop in value during the last week of February before gold reached $1,674 on March 9. As the reports started coming in that COVID-19 was being identified in more and more countries throughout the world, all financial markets reacted negatively. The results of this can be observed in the above chart where gold is now trading around the $1,500 area.

Why the Negative Performance of Gold During the COVID-19 outbreak?

COVID-19 is a similar type of virus as SARS. So why didn’t the market react in a relatable fashion as during the SARS pandemic? If you remember the charts above, gold was gaining +20% during the SARS outbreak. What was different this time?

COVID-19 is not as deadly as SARS but it spreads much quicker and is much more contagious. China is now a key player in the global economy and has a much bigger influence on global trade than it had during the SARS pandemic. The decline of the Chinese economy has therefore had such a tremendous impact on the global economy, including the precious metals market.

But there are other reasons why we have such an impact on the economy, including the gold market. One of those is the supply chain disruption. A recent report points out that over 5 million companies from all over the world have one or more suppliers in Wuhan, the epicenter of the COVID-19 outbreak. The supply chain for the IT industry, pharmaceutics, car manufacturing, and many others, is partly or completely interrupted due to this recent pandemic.

The Wuhan area was in a state of isolation and complete lockdown. This means: reduced or no production and shipping of goods to the rest of the world. What happened in Wuhan is now evident in most parts of the word. Isolations, curfews, fear, and disease. We didn’t experience such measures during past pandemics. This is new and it is scary. There is no demand for nonessentials. In a state of confusion, consumer demand has gone down. Gold is at this point a non-essential asset.

Usually, when we are in a state of fear and economic unpredictability, gold is supposed to act as a hedge. It didn’t do that this time. US investor George Gammon has an interesting theory as to why that is. In his YouTube video, he created a connection between failed Repo agreements and the price of gold. A Repo is a Repurchase Agreement. In a Repo, government securities are sold to investors for a short term and bought back the next day for a higher price. Repos are a method to raise short-term capital. A failed Repo happens when one of the parties violates the agreement and decides not to go through with the transaction. A comprehensive guide on this topic is available here.

The correlation between failed Repo Agreements and the Prices of Gold

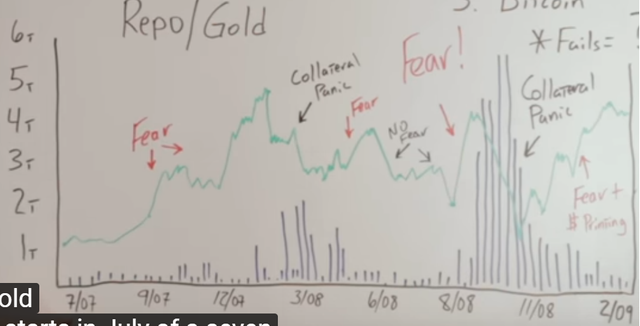

George Gammon produced a chart that shows the price of gold alongside the number of failed Repos during the same period. The chart shows crucial economic events that took place between 2007-2009.

source

The bars at the bottom of the chart point to the number of failed Repos.

As we can see from the chart, the prices of gold were increasing until we arrived at the beginning of 2008 when the Bear Stearns trading company collapsed. The number of failed Repos suddenly increases resulting in a lack of collateral. This triggers a sell-off of gold that ultimately drives down the price. Then the US government steps in. They change some rules, the Repo agreements go back to normal, and the price of gold takes off again.

We notice the same scenario at the end of 2008. Gold was going through a nice bull run until September 2008 when the Lehman Brothers investment firm failed. This triggered terrible issues with collateral and again failed Repo agreements went through the roof. Gold prices went into a free fall from the $1,000 mark to the $600 mark. The government steps back in and starts printing more money. The prices of gold move right back up to the $1,000 area.

History repeated itself in March 2020. More failed Repos bringing down not just the price of gold, but also silver, Bitcoin, and the entire cryptocurrency market. What we should do now is to wait for the Federal Reserve to print more money that will result in a ricochet of gold to new highs.

While we wait for the COVID-19 pandemic to fade we can start planning in terms of future investments. As has been demonstrated and explained above, we are waiting for new injections of fresh money onto the market that has in the past resulted in a positive course for gold.

Due to interruptions in the supply chain, delays in shipping, and various complications with investments in physical gold, there is now an easy and safe method to purchase and store gold.

Digital Gold

Digital Gold (https://gold.storage/en/home) is an Ethereum-based cryptocurrency platform offering a simple way to store, trade, and transfer gold in a digital format. The native currency is called GOLD Token. These tokens are safely stored on the blockchain, un-hackable, immutable, and anonymous. They are much more practical and user-friendly, compared to conventional methods of storing and transacting with gold because they are protected by cryptographic signatures and first-grade smart contract functionality, and accessible only to the owners of the private keys securing the assets. The blockchain has for the first time in history made it possible to use gold as a sound means of payment.

Each GOLD token equals the market price of 1 gram of 99% pure gold. The Digital Gold company can guarantee that the tokens are traded at current market rates because they are also a liquidity provider. GOLD tokens are backed by verifiable physical gold bullions that are stored in protected company vaults. Every user is welcome to verify if the company owns the gold bullions they claim to own at any time.

A quick check reveals that Digital Gold has stored 17,200 grams of gold in a secure vault. The advisory board has recently notified the public that they are planning to triple the storage to a total of over 60kg of gold bullions throughout 2020.

What Are the Benefits of Investing in GOLD Tokens?

GOLD Tokens are a hedge against volatility. GOLD is a stablecoin, tied to the spot price of gold. It acts independently compared to the rest of the crypto market that usually follows the movements of Bitcoin. Most crypto assets are highly volatile and encounter problems maintaining their price. Gold has increased in value throughout its history. During turbulent times GOLD Tokens are an excellent way to diversify your portfolio.

Become an investor in gold within minutes. All sales and purchases of GOLD Tokens are quick and affordable. The Digital Gold Marketplace doesn’t charge its customers transaction fees and doesn’t set any account limits. You can transfer any amount anywhere in the world. The Marketplace is available on-demand and round the clock. Users only pay the standard Ethereum gas fees. In terms of value, there is no difference between keeping physical gold and owning GOLD Tokens, because the tokens are pegged to the spot price of gold.

No more inconveniences trading on traditional gold markets. The purchase of physical gold involves finding a trustworthy merchant, complying with market rules and regulations, undergoing KYC/AML verification, and securing the gold. The market cap of gold-related funds and shares is in the tens of billions of dollars, meaning that investors like the opportunity of not having to deal with physical gold. Digital Gold is tokenized and represents the simplest entry-point to the gold market. No middlemen, no brokers, no obstructions or verifications. Safe and anonymous, and available to anyone who uses a smartphone or computer.

GOLD utilizes the benefits of the Ethereum blockchain. Gold is an ERC-20 compatible token that can be stored in Ethereum wallets supporting the ERC-20 standard. Fast transactions, security, immutability, provable transaction records, and smart contract functionality. Ethereum is a trustless decentralized platform that protects digital value.

Future Expectations

The economy is currently in a state of deflation and all asset classes aren’t looking so bright at the moment. But that will pass and it creates great buy opportunities and that is where the smart money goes. As the market stabilizes and the government gets involved, we are potentially looking at new all-time-highs for gold. It has happened before, during the big financial crisis of 2008 the gold market was hit with the same severity and it bounced back. At the moment, gold is not a good short-term investment asset. We can’t be sure if the price will not continue to fall. Look at gold in the long-run because the profits will potentially be made in the next two years.

Digital Gold has opened the doors and simplified the investment process for new investors. With a few clicks of a button on the Digital Gold Marketplace, you become an owner of GOLD tokens, an asset that is backed by physical gold. It is not a question if it will, but when will gold rise again. When it happens, we want to have the easiest route possible to gain access to the gold market. Digital Gold provides investors with everything that is needed.

Website: https://gold.storage/en/home

My Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2437930

Resources: