Why you need to use USDT substitutes?

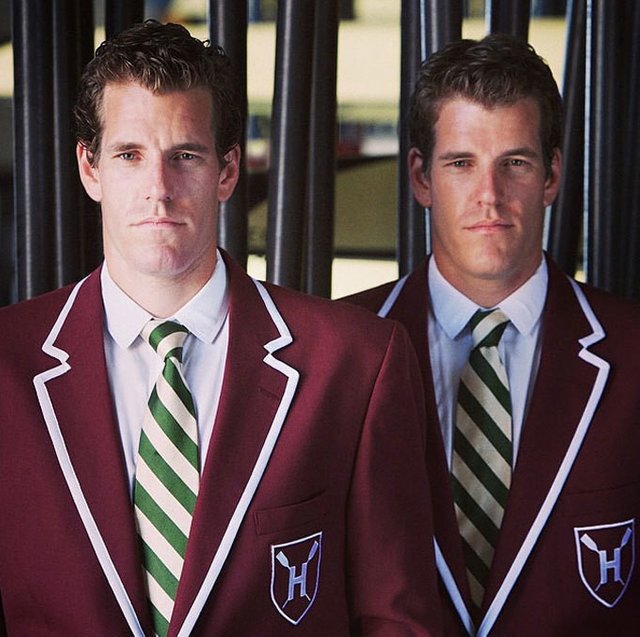

On September 10, 2018, a new stablecoin Gemini USD was released, which was created by the GeminiTrust company, owned by the Winklevoss billionaire brothers.

The main difference from other stablecoins is the complete legal regulation, since the appearance of this coin was approved by the New York State Department of Financial Services (NYDFS). In addition, to ensure transparency of operations with GUSD, an external audit company was involved, which will be verifying that the tokens are fully backed by the US dollar in a 1:1 ratio. The same company will be publishing monthly reports on the state of affairs regarding the Gemini USD.

This project is realized on the Ethereum network in the form of an ERC-20 token, however, in order to acquire a GUSD token, one must create a Gemini account which enables commercial transactions.

This token was released due to mistrust in the largest stablecoin - Tether, with a capitalization of $3 billion. It is believed that it is directly connected with the large exchange Bitfinex and is used for money laundering. Quite often there are news where it is stated that in reality the USDT is not backed by the US dollar in a 1:1 ratio. Doubts in this are arisen from the fact that the management of Tether Ltd. does not allow legitimate representatives of financial authorities to their monetary reserves. First signs of USDT not doing very well have already begun to emerge - it is being delisted from some exchanges and replaced by more transparent stablecoins, such as TrueUSD (TUSD).

It is worth noting that only last week along with GUSD 2 more stablecoins appeared - CarbonUSD (CUSD) and Paxos (PAX), and they are all legally approved by NYDFS.

The situation with stablecoins continues to complicate, with only those of them having a chance to remain in the market, which fully comply with legal and financial regulation.