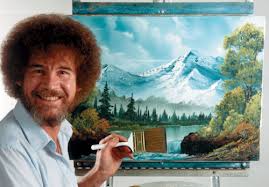

Happy trees (or my crypto mistakes): Noob mistake #4

Noob mistake #4: FOMO part 1 -- Doing all of my investing at one time

I set aside an amount to invest in blockchain projects each year. While I’ve never fallen prey to the greatest noob mistake of all, spending more than I can afford to lose, that doesn’t mean I shouldn’t try to be smart about my investing.

It’s easy to fall prey to the classic FOMO idea that you’d better buy now or you’ll miss out. That fear-driven mindset has been around forever. It drove crazy investments in 1999 (pets.com anyone?) and 2006 (better buy that $600,000 teardown with an interest only 3/1 ARM or get priced out forever) and even in 1637 (tulips anyone?).

Well crypto is no different as November 2017 – Janauary 2018 has reminded us. Despite always trying to have a level head and to follow the plan I lay out, I fell for this one. I invested my 2017 funds according to plan, using 1/12 of my funds each month to buy my preferred altcoins (dollar cost averaging). So far, so good. But then I got caught in the hype in December right as I made my 2018 plan.

Long story short, I convinced myself to front load my 2018 funds and I spent half of my annual plan in January. It seemed crazy not to do it at the time. Afterall, the market was going to the moon, right? We all know what happened next. And it was a great reminder for me that you need to make a plan and then stick to that plan to avoid falling prey to the psychology of FOMO.

So what do I do most of the time? And what should I have done in December/January? I have a set amount that I invest each month and I do just that. I don’t worry if the market seems to be up or down. I just invest in projects I believe in and trust that the overall trajectory will be up. After all I believe blockchain is poised to change the world. So why worry about any temporary booms or busts…I’m in it for the long haul. Meanwhile in the booms, I can claim some of my gains (and save them to reinvest at the next bust – see noob mistake #3), and in the busts I can rest assured that my next purchases will be at a discount. With a long view, the ups and downs don’t mean much.

What have you done right or wrong that we can all learn from?

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.