Cryptocurrency Spotlight – Envion (EVN)

Today we will look at the crypto mining sector

As promised in my post https://steemit.com/cryptocurrency/@bitbrain/crypto-shopping-cart-21-march a few days ago, I will be talking about Envion.

Envion is a crypto mining token that is currently listed on exchanges. I believe it to be a good investment. Here is why:

Cryptocurrency Spotlight – Envion

Envion Mobile Mining Containers from Envion on Vimeo.

Vital Statistics (at time of writing)

- TICKER: EVN

- MAX SUPPLY: 150 000 000 (whitepaper) / 127 425 494 (CMC)

- CURRENT SUPPLY: 107 439 884

- CURRENT PRICE: 0.000064 BTC / $0.54 USD

- VOLUME (24 hrs): 9.74 BTC / $82 327 USD

- COINMARKETCAP POSITION: 154

- DOES BIT BRAIN HOLD IT?: YES

- WILL BIT BRAIN BUY MORE?: YES

- BIT BRAIN RISK ASSESSMENT: MEDIUM-LOW RISK

- BIT BRAIN REWARD ASSESSMENT: MEDIUM-HIGH

Synopsis

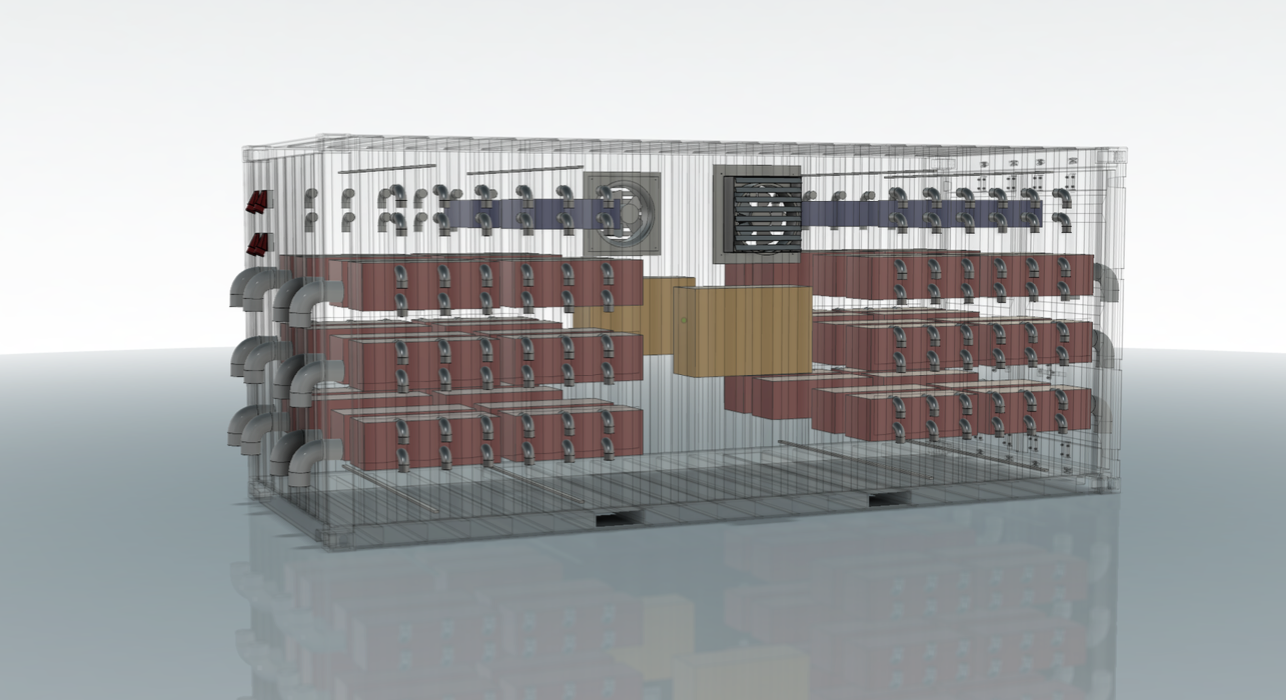

Envion is an Ethereum based token that will pay dividends for crypto mining. It is the token of Envion AG, a Swiss incorporated company. The idea of Envion is to build Mobile Mining Units (MMUs), ship them to cheap electricity sources around the world, and carry out crypto mining as close to the power sources as possible.

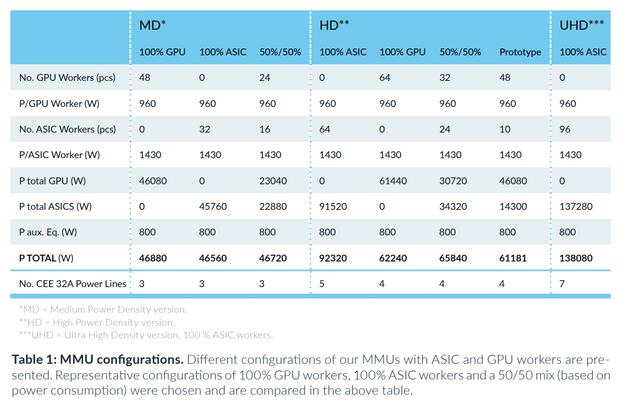

The MMUs are containerised systems filled with a mix of ASICS and GPUs, so a variety of different coins can be mined. While BTC and ETH will probably be the main coins mined (at least to start with), it is possible for this to be changed at short notice, Envion are ready to do this. The MMUs will be networked so that they can be monitored and operated remotely.

Envion are currently manufacturing MMUs in Germany and are trying to bring them online at the factory already, so that they can become profitable as soon as possible.

Once the KYC process has been concluded, the ICO funded MMUs have been produced, and the auditors (PWC) have finished their report, Envion should start paying dividends to EVN holders. These dividends will be paid weekly, provided that sufficient profit has been made. Depending on how many tokens an individual holds: if the transaction fees would eat up too much of his or her dividend that week, then their dividend will be carried over to the next week.

From https://coinmarketcap.com/currencies/envion/#charts

SEC compliance

Fortunately Envion are very forward thinking in their approach. They appear to place great value on doing things above board and the right way. They registered their token with the U.S. Securities and Exchange Commission (SEC) in December last year. If you know anything about recent developments wrt crypto regulation, then you will know just how significant that is.

(https://www.envion.org/en/legal/ and https://www.sec.gov/Archives/edgar/data/1726436/000121465917007529/0001214659-17-007529-index.htm)

This means that Envion has a considerable advantage over most other tokens or coins that could be considered to be “securities” by the US government.

Envion required strict KYC for ICO investors, but the tokens can now easily be purchased through the exchanges HitBTC, IDEX and Token Store).

What do I like about Envion?

They are honest and realistic: They are not some scam or MLM scheme who promise great returns that they can’t deliver on a sustainable basis. Their FAQ page shows ample evidence of this: https://www.envion.org/en/faq/. Generally, I don’t trust any coins that promise a return, but I make an exception for miner coins, because they know that they are going to be mining something, and therefore able to pay something.

According to the Envion website the expected annual ROI was 161% (https://www.envion.org/en/ico/). ICO price was $1 per EVN with discounts of between 10% - 30% during the initial investment rounds. This figure of 161% was later revised upwards (to 181%), but they kept the 161% on their website so as not to generate undue hype and make false promises. It should be noted that both figures were estimations and were never promises. For more details on the 181% figure, I suggest you read the Appendix to the whitepaper. It is found on pages 58 – 61 of the whitepaper and explains exactly how everything is estimated and calculated. That sort of transparency is rare in the crypto world and is a very positive sign. The CEO estimated returns of 50 – 150% per annum in this video: https://www.facebook.com/envion.org/videos/1896488834012453/ at time 2:27 – 2:37 in the video. The whole video is worth watching (it isn’t long). One way or another, I'm sure that you'll make decent money by investing in EVN. I consider all of the above figures to be conservative.

Speaking of the CEO; his name is Matthias Woestmann. He is CEO of an investment company called Quadrat Capital (http://www.quadrat-capital.com/) and used to be in journalism before that. He has a passion for investing in renewable energy, especially solar, and this is clearly carried through to Envion, who also seem geared mainly towards using excess solar energy. (https://www.envion.org/en/concept/) The insinuation here is obvious: the CEO wants to launch a company that buys solar energy, because he is invested in solar energy. Well I don’t care. The man has a wealth of solar energy knowledge. If anyone knows where to buy cheap solar energy, it is him. And so what if he makes a bit of money off his excess energy (and I'm not saying that he will) that would otherwise have gone to waste? As long as Envion is paying a good price for electricity, I'm happy.

Renewable energy? Correct. Envion specialise in using renewable energy. They are well aware of the massive amount of energy that goes into cryptocurrency mining and they are trying to change that. Envion uses green energy sources for its mining, so the crypto is still mined, but the environment isn’t harmed.

Because Envion focuses on using surplus green energy, they can get it at a very good price. That of course means greater ROI for EVN investors. They have already identified many suitable sites near green energy sources on which to place their MMU clusters.

Envion has 10 EU locations for Proprietary Operations MMUs offering power prices between $.04-$.06 per kw/h. We are currently determining which will get the first batch of MMUs from the factory, but with 50MW of capacity on the table, we expect over 600 MMUs will have a home among these first customers. - https://medium.com/@envion/investor-update-7c3e9c865374

The MMUs themselves are designed to be energy efficient. While there are limits to the energy efficiency of GPUs and ASICS, the MMU containers make use of a proprietary cooling system that does not use air conditioning. Envion make some very bold claims about the system, specifically that it is 40 times more efficient than that of traditional data centres. Now I’m no expert in data centre cooling, but that sounds incredibly high to me. More believable is the statement that Matthais made in the Facebook video referenced a few paragraphs up, about their cooling costing only 15% of what a traditional system would have cost to run. Looking at their design, I would say that that figure is believable. Whatever the case, their design is good enough to patent (they have filed a patent for the technology in Germany).

From https://www.envion.org/en/mobile-mining-unit/#tab-3

After deducting the costs of running Envion, and before paying dividends to EVN holders, envion deduct 25% of the profits to grow the company. This is good because it means that they are able to stay competitive and to grow in the world of cryptocurrency mining. With this money they can deploy new MMUs with the latest tech GPUS and ASICs. The Envion concept is to keep growing as long as cheap power is available and cryptocurrency mining remains viable.

25% of mining revenues will be reinvested in new mobile mining units, ensuring the solid growth of our container-fleet and token dividend pay-outs.

An intelligent reinvestment strategy allows us to grow the container fleet - as well as the dividend pay-outs - almost exponentially. This creates a maximum token value. No more tokens will be sold by Envion after the ICO. - https://www.envion.org/en/ico/

From the Envion whitepaper

I have been cloud mining for many months. The problem with cloud mining is that my investment doesn't grow. Nothing gets reinvested into my mines. As mining difficulty increases, so I slowly get left behind, especially when prices drop during a bear market. With a cloud mine you also don’t have a valuable token to trade. Your mine can’t be sold for profit, and it doesn't grow in value over time. The EVN token should itself increase in value (and can be sold), while at the same time producing dividends. With normal cloud mines I could have made far more money buy not investing in mines, but rather just buying a few good coins directly and letting them grow in value. The same is not true for EVN because EVN is a coin that will grow in value!

I have tried home mining too. Without a dedicated mining rig (or several rigs), it is just not viable to make money that way. A token based mine seems to me to be by far the best way to mine.

Envion are in communication with their community through various media channels. They often release investor updates, which are very informative. They have a Vimeo video channel where their community officer, Laurent Martin, gives updates and information. I will link to some more of their channels at the end of this post, so that you can see them for yourselves.

Envion Video Update February 27 from Envion on Vimeo.

Because the PWC report has not been released yet, we don’t know exactly how many tokens were sold during the ICO. We do know that Envion claim to have raised over $100 000 000 and that they are the top "#6 ICO of all time" - https://www.envion.org/en/ico/. After the report, there is the possibility of a token burn. This will obviously increase the value of existing tokens if it happens. (https://medium.com/@envion/envion-token-burn-process-after-kyc-ce7a48568a7a)

The whitepaper of Envion is something truly special. It’s good, really good. It is probably the most detailed and information rich whitepaper I have ever read, and I’ve read many. It’s so detailed that you can even skip the technical bits if you want to. But I think it’s nice that they have them in there for those who require more detail.

Envion is also one of the unfortunate coins that listed during a very bearish time for the market. Because of this the coin can be picked up for cheaper than the cheapest bonus ICO price in USD terms! I think that this is an incredible opportunity, possibly one of the best that you will ever see. It is mainly for this reason that I am writing this post today. Once the market turns bullish, I expect all these good, recent ICO coins that have never “Mooned” before to experience a large price increase. Note that there are no referral links in this post. The ICO is over, and I don’t stand to gain anything extra by writing this (because let’s be honest, I’m not nearly popular enough to create a price spike in a coin by using my social media influence alone! 😅).

Envion have not forgotten security, they are putting a lot of thought into securing both their physical hardware (the MMUs) and the crypto that they mine. If all else fails, they also have insurance. This is good news for investors as it gives them some peace of mind.

What don’t I like about Envion?

TL;DR answer: “not much”

Firstly it is not alone. There are competitors. Ice Rock Mining, Russian Miner Coin, HydroMiner, MinerOne and probably others that I have not yet heard of. I have looked at all of the competitors mentioned above and I can quite honestly say that I consider Envion to be the best of them by far. The others are either less honest, or they have complex token systems, or they are not as developed as Envion is yet, or their ROI (as estimated by myself) is lower etc. Put it this way, I evaluated them all, and I chose Envion. I am not invested in any other miner coins. (But of course, DYOR.) Okay, that wasn’t a very negative point, I’ll try harder in the next paragraphs.

The biggest stumbling block I see for Envion is logistics. I think that they may be underestimating the difficulty of shipping containers (the MMUs) full of delicate PC hardware around the world. Hardware like that doesn’t like being bashed around (as shipping containers tend to be sometimes, especially on ships). Those big ventilation holes are also going to be tricky when it comes to keeping salty sea-air and seawater out of the containers. I don’t know if they propose to move them in an empty state (I would advise this) which would slow down deployment once on site, or in a ready-to-mine state, which would be very risky for the hardware. Fair enough though, most containers will only have to be transported once, and thereafter they will only have to move if the power source becomes too expensive or can no longer provide supply. Of course containers destined for European locations would probably never have to travel by sea. The nice thing about this logistics system is that it is almost infinitely scalable. So in summary, it is a good system, but I think it is harder to use than what they envisage.

Many people are complaining about the bounty program. There was a referral program during the ICO. And those who referred others have not been paid. It’s a pity that these people feel wronged, because if they did their due diligence and researched why, they would soon find out that there are legitimate reasons. They will get paid, Envion is just attempting to rectify an exploitation of the system that occurred when bots started spamming referral links (or something like that – I’m not affected so I didn’t research the full details). But this does highlight the fact that, despite their many social media channels, Envion do not always keep their investors informed enough. Which brings me to my next point:

Envion does not keep its investors informed enough. Laurent Martin does a great job with his videos, he really does. But I would like to see more stats, more facts and figures (not necessarily in the videos, on their website would be best). How many MMUs have been completed? How many are being built right now? How many need to be built with the ICO funds? What are the projected figures for how many MMUs will be running by the end of each month? How far are PWC with their report? What happens with the few KYC customers that can’t be found, will they delay the whole dividend process indefinitely? What hardware configurations and densities are going into the MMUs? (The whitepaper gives various options, but no figures as to how many of each). When can we expect the next investor update? How much has been mined already? What happened to the miner dashboard and simulated dashboard? I'm not saying that Envion are doing a bad job of keeping investors informed, they certainly do a better job than most others, but there is definite room for improvement.

Envion is unproven. Nobody has received dividends yet. Being the crypto world, anything can happen, but I am 99% certain that dividends are coming. The niggling doubt is that 1% of "what if?", combined with “what if returns are really small?”, but I suppose that similar concerns exist for every crypto out there.

Conclusion

Envion is a cloud miner and a crypto token. It therefore has two ways of providing value. It has yet to start paying and it was released into a terrible market, so I expect huge returns on it. It is (in my not-at-all-humble opinion) the best of the miner coins available, and I like the way that the company does business. I’m invested in it and I would like just a little more if I can afford it. So go DYOR, but I strongly suggest that this is a token well worth putting money into.

LINKS:

- Vimeo https://vimeo.com/envion

- Medium https://medium.com/@envion

- Twitter https://twitter.com/Envion_org

- Some crypto related posts written by Matthias Woestmann – CEO of Envion:

Well that’s my latest spotlight coin. It's a long post, but I hope that you found the information useful and that it will help you decide whether this project is worth buying into or not.

Yours in crypto,

Bit Brain

DISCLAIMER:

I am not a financial advisor nor am I a professional trader/investor. This is not financial advice, investment advice or trading advice. Unless otherwise stated, all my posts are my opinion and nothing more. Crypto is highly volatile and you can easily lose everything in crypto. You invest at your own risk! Information I post may be erroneous or construed as being misleading. I will not be held responsible for anything which is incorrect, missing, out-of-date or fabricated. Any information you use is done so at your own risk. Always Do Your Own Research (DYOR) and realise that you and you alone are responsible for your crypto portfolio and whatever happens to it.

Envion Scam Update: Swiss Financial Regulator 'Finma' removed the CEO from the board and replaced the directors with a law firm. What does this mean for investors? Will they ever see their dividends? Watch the video and find out.

Thank you very much for your comment, much appreciated!

Good little video.

Coins mentioned in post:

great post man, thanks. Looks like a lot of work went into it, I hope people appreciate it.

Ha ha, I hope so too, all four people who have seen it so far! 😄

yeah I don't get much incentive to write stuff, when only a half dozen people read it and you get like 2 upvotes total. Good practise I suppose lol.

I want to add to "What I don't like about Envion".

1- They lock Envion tokens. Investors can not sell or send their tokens unless Envion unlock them.

2- They don't communicate with investors, they don't response to emails.

3- Envion is now tradable on HitBTC and Yobit. I think both exchange have lots of scam tokens. I hope Envion is not one of them.

The locked tokens only seem to be for credit card purchasers. The six month lock was made known to them before they purchased, a fact that many conveniently ignored. Other locked tokens are those to do with the bonus referral system. Those will become available after the PWC audit is completed. My ICO tokens were never locked.

The communication issue has been very bad as of March. they are well aware of it, but are obviously not prioritising it. It is really annoying me and is my only real Envion gripe at the moment. I speculated on it and the possible cause of it in this post: https://steemit.com/cryptocurrency/@bitbrain/crypto-shopping-cart-18-april

Hit BTC isn't great, I'm not clued up about Yobit. But Envion has a bit of a listing problem: it is seen as a security almost everywhere - it's designed to pay dividends more than anything else. This makes it complicated from a regulatory perspective, and exchanges shun it for that reason.

I trade Envion through IDEX. The volume isn't fantastic, but it's high enough not to be disadvantaged. IDEX is decentralised so you don't have to worry about it being dodgy. Envion itself is not a scam token. You can even look up it's German and American regulation applications with the SEC and it's German counterpart, or the company registration in Switzerland.

Thanks for the comments.

"The locked tokens only seem to be for credit card purchasers."

I don't want to complain them here. But believe me it is not correct.

My opinion for the decentralized exchanges is, they are so young, they have no volume. Because of that, mostly, you buy at higher price, you sell at lower price.

P.S. you did see that the post had a "What I don't like about Envion" section near the end, didn't you?

I have lots to say, but I don't want to bother you.

As long as the spread is very small it's fine too use exchanges like IDEX, I suggest giving it a try.

Please feel free to say whatever you like. This is a discussion platform: we learn from the thoughts and opinions of one another. I'm always eager to learn.

If you have personally experienced issues with Envion and locked tokens then I suggest you put in a ticket. If nothing happens then challenge them on all social media platforms, the links are on their homepage. Remember that busy blockchain companies CAN take quite a while to answer. I just got a reply from one last week (not Envion) for a ticket I submitted in AUGUST last year! I just kept on nagging until they answered.

I have already two tickets, and 27 emails, most of them includes "Please response". When I see a red flag on any project (actually there are more in this case), I just sell. But Envion doesn't allow me to sell my tokens by locking them. Do you know that:

1- How many MMU's are operating now ?

2- How and when will they take a snapshot of wallets to calculate the dividends?

3- Will they inform us before the snapshot, so we may send our tokens from exchanges to wallets?

4- When will they make announcements ? (They promised to make on mid-april).

5 - They won't send dividends if the token amount is very small because fee may exceed the dividend. And we still don't know their dividend strategy.

6- They promise us to give %161 ROI approximately. But I have already lost half of my initial investment.

7- They don't want to inform investors anymore, they intend to inform investors just once a year like other ordinary companies do.

I can count more and more.

That's very bad of them. I would name and shame, share your tickets and emails on social media. Let me see if I can help with any of your other questions: