MONEY - Understanding it and cryptocurrencies - Part 3: Cryptocurrencies

This series deals with what money is, where it comes from, who holds it and how it works.

More than that: it deals with the inherent BIG problems of fiat currencies and the solutions offered by crypto.

Part 1 and 2 dealt with fiat currencies. It is vital that you have a full understanding of fiat currencies before reading this post. If you do not, then please read at least Post 1 or Post 2 (preferably both). You can find them here:

https://steemit.com/cryptocurrency/@bitbrain/money-understanding-it-and-cryptocurrencies-part-1-how-fiat-works

Cryptocurrencies

To see what crypto can do that fiat money can't, let's list the problems of fiat money and then address them one by one. We'll see if crypto has the same problems, or if it can possibly solve those problems.

The problems with existing fiat money and if crypto can solve them

There is no supply limit / it's inflationary

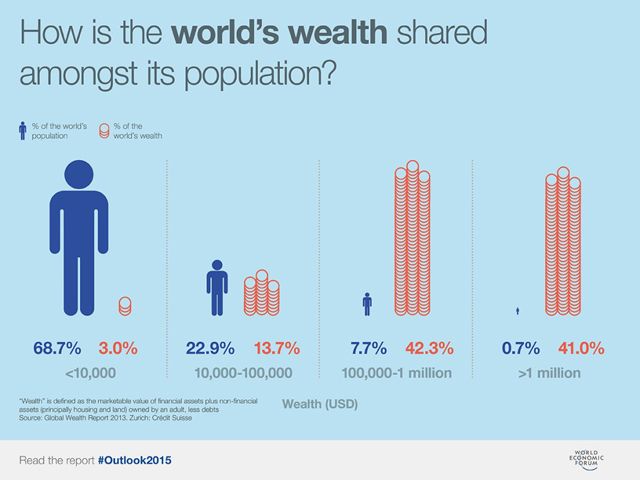

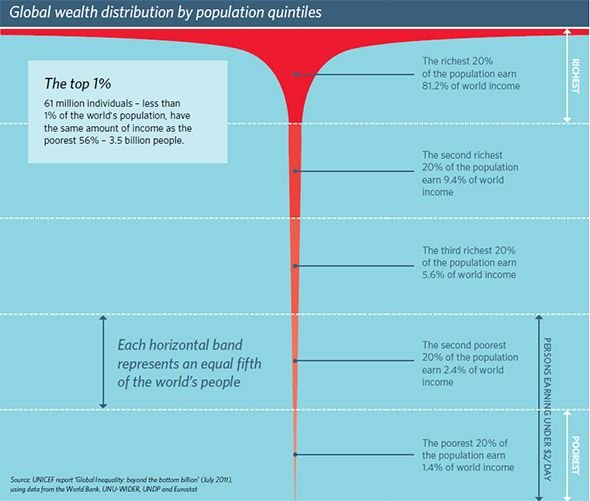

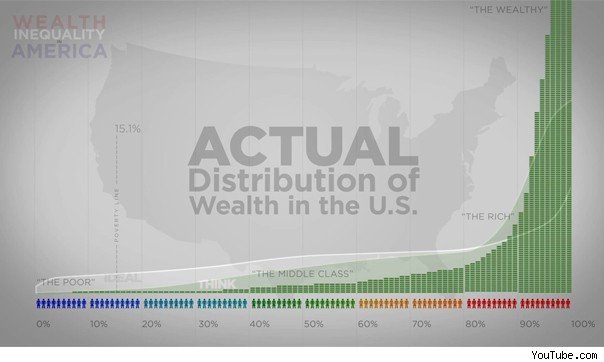

- Fiat can be printed for as long as governments/central banks want to print it. Because they always need money and they're always in debt, they always print more. Your fiat money becomes worth LESS over time. The rich own most of it and design it so that they keep getting more of it. You keep paying the rich interest on money you borrow from them. You can't win. Wealth creation is limited to the wealthy.

- Crypto differs from coin to coin. Most have a maximum supply. e.g. Bitcoin has a max supply of 21 000 000 coins. Crypto is deflationary - your crypto becomes worth MORE over time.

Both images from http://www.qcc.cuny.edu/SocialSciences/ppecorino/INTRO_TEXT/Chapter%2010%20Political%20Philosophy/Inequality.htm

Fiat money is centralised

- Only one place can issue fiat money. It is under their complete control. They control its value (or lack thereof). They control who get's it.

- Crypto is decentralised (in general). People can mint their own (PoW or PoS). Shutting it down in one place will not kill it. The information is copied and checked by multiple nodes around the world.

- There are some centralised cryptos. My advice is to stay away from them! Some cryptos are still in early stages and will decentralise more over time as more nodes come into operation (think NEO or VeChain - those ones are fine). Others are heavily centralised and are probably either scams (Like BitConnect) or crypto versions of existing fiat institutions (like Ripple - yes, I know it's a huge coin, but I strongly warn you against it. Do your research here. Dig deep. Dig into the team. Dig into the supply. I do NOT trust that coin at all!).

Fiat is slow

- Money takes days to send to someone in another country, or even in the same country

- Crypto Depending on which crypto and network traffic, it takes anything between instantaneously and a day or two. Normal speed is about 5-30 minutes.

Fiat is normally not used in cash form

- Fiat, while designed as paper money, is not used that way. Well over 90% of fiat transactions are electronic.

- Crypto is all openly electronic. It does not mess about with pretending to be cash.

Fiat is regulated

- The use of fiat is subject to laws and restrictions. How much you can move around, put offshore, invest in xyz.

- Crypto is not normally even recognised as "money" or "legal tender". While this may change, regulations can only exist at national level. There will never be global crypto laws, one or two nations will always oppose such laws. (Try to find me a real internationally respected law, go on, I challenge you.) Crypto "safe haven" countries may become very popular. Already you can become a virtual citizen of Estonia. You can operate an entire business out of Estonia - banking included - without ever having set foot in the country. https://e-resident.gov.ee

Fiat is not universally accepted

- While many countries accept the US dollar, there is no international currency. I can't walk into a Japanese car dealership and buy a car with Brazilian Real. I can't buy a beer in Mexico with Australian Dollars. Even with US dollars, I will probably still have to exchange them to a local currency in order to use them in a foreign country. Some sort of exchange will come into play somewhere along the line with such a transaction, even an electronic one.

- Crypto is universally accepted. David's Bitcoin in England is the same as John's Bitcoin in the USA which is the same as Sergei's Bitcoin in Russia and Juan's in Argentina. They can all exchange funds easily and spend them again just as easily.

Fiat is just a substitute for something of value that is now taken out of the hands of the people (not strictly true)

- Fiat used to be backed by the likes of gold (the gold standard). The gold was held by the reserves while you got to keep their devaluing paper IOUs instead. But by definition, that is not fiat money. Fiat money is the same IOUs without the gold. (The rich have long ago run off with the gold, and it is no longer tied to paper money, so they never have to give it back to you.)

- Crypto does not profess to be anything that it isn't. Crypto derives value from YOU, the user. It is valuable because we know that it ISN'T a government controlled fiat currency. We can use it anywhere and across borders without regulations. Limited supply makes it DEFLATIONARY. We know all this, and that is why we are willing to pay so much for it (of our inflationary fiat paper money that is on a one way trip to disaster).

Fiat uses credit cards and tries to lure you into debt

- Banks try to extend credit to you. They advertise products designed to get you into debt.

- Crypto does not do that. Lending platforms do exist, and may do so in future, but the decentralised nature of crypto means that no central authority gains when you are in debt. Worst case scenario: you end up being in debt to a decentralised network of regular people. So your interest will be paid to the poor instead of the super rich. (This is an oversimplification - the interest will go to whomever holds that crypto asset that you are borrowing from e.g. the SALT token.)

Fiat is susceptible to lies, cheating and theft

- Banks can, and do, try to obscure the truth and charge you for everything they can. It does not matter if this is legal or not, most of the time they have the connections to make things legal (probably already done decades ago), the point is: they still take your money. It comes down to trust. You have to trust your bank to be fair and honest with your money. Nobody can even enter the Fed - why is that? You have to trust banks not to alter contracts too much (e.g. change interest rates) Realistically, no large bank is going to openly defraud you (they would rather just take little bits and pieces, enough to annoy you, but not alarm you), people would lose faith in them and they would go out of business. But it's what you don't see and don't know about that is the problem.

- Crypto runs on smart contracts. They can't defrauds you. You don't have to take any leap of faith. All transactions are visible on the blockchains.

NOTE: Trust is important. See my post https://steemit.com/cryptocurrency/@bitbrain/who-do-you-trust for more about Trust in crypto.

Fiat that does not exist can be lent

- Fiat can be lent when it doesn't even exist. Incredibly this is often seen as good, it increases money supply. Of course this just leads to inflation. A downward trend in market sentiment can then lead to a market crash.

Crypto can not be lent if it does not exist. Every decimal of every coin or token is tracked on the blockchain. maximum supply can't be exceeded. Crypto value can also crash when investors lose confidence. But I believe that as people become more educated about crypto, this will become less and less of an issue.

Put it this way: I know a thing or two about crypto. Not nearly everything, but enough (see my "Bitcoin price predictions" series from last week). That knowledge was enough to keep me smiling right through the current market dip. We're down to $250B total market cap from over $800B. I'm still smiling.

Fiat is owned mainly by very few, extraordinarily rich people and families.

- Fiat belongs to the rich. They get richer. I've said this before.

- Crypto can be owned by any of us. As we will see in the next post in this series, the rich can buy crypto too, but it isn't so easy for them to dominate the market. Average Joe stands a fighting chance in the crypto market, especially if he thinks ahead.

Fiat is used to manipulate markets.

- Forex and stocks are susceptible to market manipulation. The whales can abuse these systems. Regulations exist to try to make them lay fair, but like casinos, they always win in the end.

- Crypto loses this one to fiat. Crypto markets are even more prone to manipulation than fiat markets are. This is why a crypto investor must always remain on his or her toes and must never panic and overreact. It's why the popular "HODL" strategy, while certainly not giving optimised short or medium term returns, is actually a very sound long-term investment strategy (provide that it is done correctly of course). In practise, not many self-professed "hodlers" seem to hold their investments for very long or through rough patches. A six month hold is not a hold.

Fiat is traceable

- Fiat transactions can be traced back to the originator. Criminals must go to great lengths to launder money if they want anonymity.

- Crypto is not all anonymous, but many "privacy coins" (ZCash, Verge, PIVX etc) do allow anonymous transactions. But even the traceable transactions e.g. Bitcoin ones, only give you a long coded wallet address (series of numbers and letters) at the end of the day. But your address could be linked to your bank account if you use it to cash out/buy crypto or it could be linked to e.g. your address and name if you use it to purchase products online. There are a lot of variables at play here, it is certainly quite possible to remain entirely anonymous.

- This is good from a privacy point of view. Why should the rich and powerful know what you are doing with your money anyway. What gives them that right? they do, they give it to themselves. It may be legal, but it sure isn't right!

- On the other hand this does make law enforcement tricky. I'm not talking about laws with regard to money etc. I mean the big ones. Anonymous transactions open the doorway to things like easily being able to: hire a hitman, acquire morally wrong forms of pornography, launder dirty money, buy military weapons and other illegal substances. That is not good news, and we as a crypto community need to stand up against the use of crypto for such things and attempt to find away around that without infringing on our own rights.

Fiat is not secure

- Banks can be hacked. Banking interfaces (e.g your phone or PC) can be hacked. Fiat can be stolen by hackers.

- Crypto can also be stolen. But here is the kicker: it can only be stolen if you fail to be cautious! The more cautious you are, the less the chance that your crypto can be compromised. This is not a post about crypto security, but it is worth researching that for yourself if you feel that your crypto may be hackable.

Summary

Crypto is not perfect, but it is almost infinitely better than fiat is! It addresses most of the concerns that we have with fiat. I can not see how we will not end up replacing fiat money with crypto money. Of course this will not be easy, the fiat rich will not want to give up their advantage, but that is a topic for the next post in this series.

What is certain is that the current situation is unsustainable. With the top 0.00001% of the 1% holding most of the wealth (and acquiring more), it is only a matter of time before something gives. Whether that takes the form of a market crash, a collapse of the entire fiat system, a revolution, a war or something else is irrelevant; it will come. Ironically: crypto may be able to save the super rich from such a disaster by offering them a fair way out, IF they are willing to share.

But if I know the rich, this will not happen, and even with crypto, such a disaster will happen. The huge advantage to holding crypto is that a disaster of such a nature will benefit crypto (as a stateless, safe, decentralised, universally accepted store of wealth), whereas is may obliterate, or at least greatly affect, some fiat currencies.

Look at some countries and their fiat. It is bad enough that the US dollar devalues due to inflation, but how would you feel if you lived in e.g. Argentina or Zimbabwe and you were trying to save money to create a better life for your family? Your saved funds devalue faster than you can save them!

Three down, one to go. The last post of the series "Weapons of the crypto war" is not one to be missed. By now you should know all the basics of money and how crypto relates to fiat money. I hope that this series has been enlightening so far. If I come across as strongly opposed to banks and fiat, it's because I am. WITHOUT getting all conspircay theorist weird about it, I invite you to research that topic until you are blue in the face. If anything, I have understated the problem. This problem is very real. Ask Jefferson. Ask Jackson.

Good evening to you all. As always feel free to leave a comment, question, quibble, query or quote.

Yours in crypto,

Bit Brain

Interesting links:

- https://www.theguardian.com/business/2018/apr/07/global-inequality-tipping-point-2030

- https://www.washingtonpost.com/news/wonk/wp/2014/01/22/10-startling-facts-about-global-wealth-inequality/?utm_term=.d218761cf601

DISCLAIMER:

I am neither a financial advisor nor a professional trader/investor. This is not financial advice, investment advice or trading advice. Unless otherwise stated, all my posts are my opinion and nothing more. Crypto is highly volatile and you can easily lose everything in crypto. You invest at your own risk! Information I post may be erroneous or construed as being misleading. I will not be held responsible for anything which is incorrect, missing, out-of-date or fabricated. Any information you use is done so at your own risk. Always Do Your Own Research (DYOR) and realise that you and you alone are responsible for your crypto portfolio and whatever happens to it.

Footnote: Here is a great little youtube clip on wealth inequality. Only 3m50s long.

man, this is like enough material for 10 decent quality posts ! I'd suggest you edit it down and release one a day or something, seriously :-)

really great info, am enjoying the series, resteemed.

Thanks. Yeah. I just don't have an off button once I start. Let me just finish this series, then I PROMISE I'll try to break them up more!

The last one should be short. Should be. I hope.

just don't shoot your bolt too early, that's something I worry about for me (apart from not having a bolt to shoot with...)

I can't write about trading forever, and I'm damn determined not to get into the 'prediction' thing and just post charts every day like the scam whales, so what can I write about in the future ?

I'll need to have a think about it. I might just do like a diary or something at that point, just a list of trades I've done that day and why I took them etc. It's a bit like doxing myself to the taxman though...

Assuming the taxman knows who you really are...

What I do is jot down every idea that I have. I make a note on my phone if I'm at work and then a store them on a consolidated list on my PC in the evenings. My list is growing faster than I can empty it. I have a few topics I can always talk about like my daily or weekly trades or any one of hundreds of crypto coins. The latest breaking news is always good too - your take on it of course, adding value is so much better than copy and paste. A weekly market recap and short term prediction is always good, (though difficult in crypto!) And if you don't want to make your own predictions, then just pull those of other people apart! I think you have a talent for that. You can slate "death crosses" and other mumbo jumbo until the cows come home!

I also wouldn't worry too much about repeating yourself. As you get new followers, so that won't matter as much. Especially if you put a new spin on old info.