Thought Evolution on Cryptocurrencies in the Government

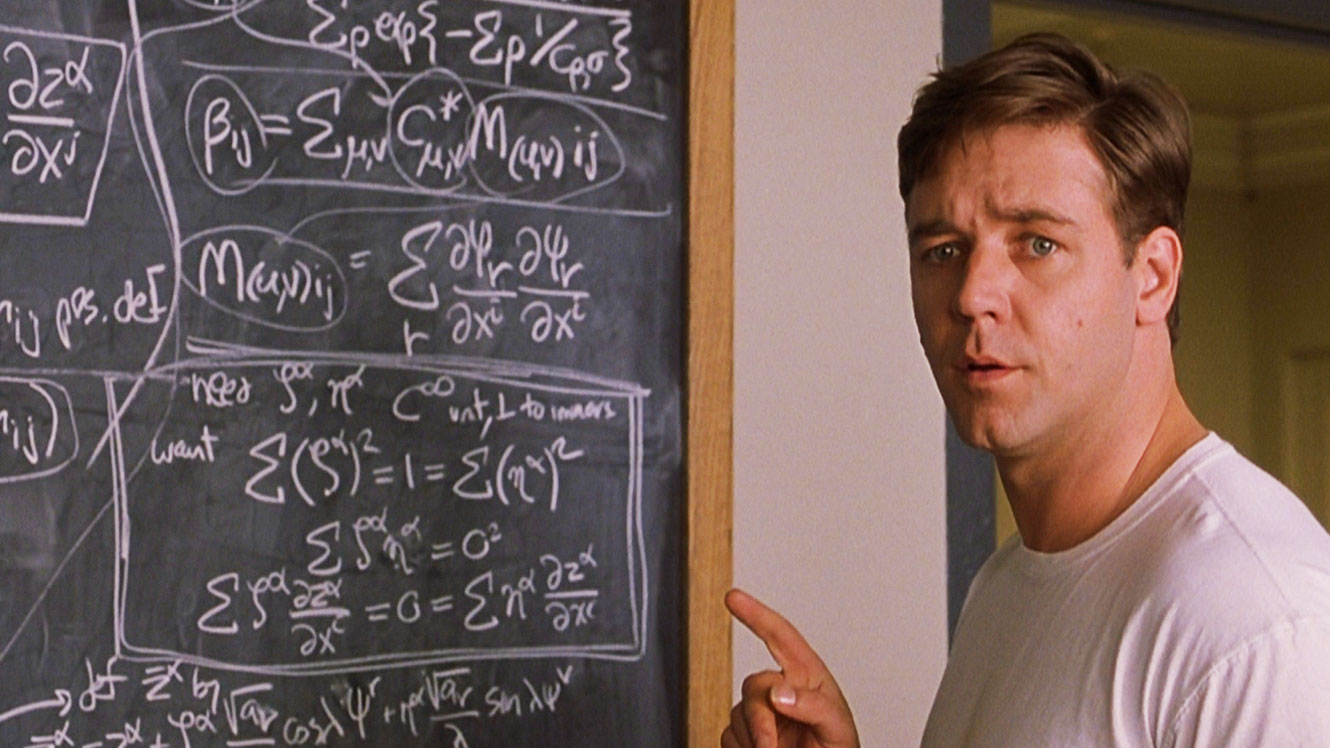

When you start to question all the things the U.S. government is up to, you begin to sound a little crazed like you're in that scene from Beautiful Mind trying to connect all the pieces. Still, there does appear to be something brewing in the U.S. government in regards to blockchain, and it makes me wonder what's up.

There has been a lot of talk about government getting involved in Bitcoin and blockchain and the regulations coming in. Which in the long run is suitable for a significant and emerging technology but some of it seems strange too. So first off, there was a large group of people that got into Bitcoin to avoid the government and big banks. Crypto has been around for several years, but still, a tiny portion of U.S. citizens are involved in the crypto marketplace. So why is the United States government so far out ahead on something like this? Very rarely have we seen the United States government plan ahead, they typically react to what has already happened. When a major crisis or public outcry occurs over some threat or new technology, only then does the government intervene. And when they respond, very often it is to ban it, until they can make a plan for what sort of regulation should be in place. Similar to what we're witnessing in China over cryptocurrency at the moment.

So what's happening?

The most significant news to garner peoples interest was some of the comments during the Senate Banking Committee hearing this month on virtual currencies. Overall, the talks steered to consumer protection without a heavy-handed ban on development of cryptocurrencies.

Commodity Futures Trading Commission (CFTC) Chairman J. Christopher Giancarlo won the hearts of the Bitcoin community with comments like "if there were no Bitcoin, there would be no blockchain" and “we owe it to this new generation, to respect their interest in this new technology with a thoughtful regulatory approach."

Where was this sort of respect for the new generation in 1985 when Tipper Gore wasted time getting the RIAA and the music industry to develop guidelines and a rating system?

In all honesty, that SEC hearing was pretty hopeful news, especially after the price correction we saw over the last 60 days. And it wasn't all just price prediction hype; it was a substantial step to move things forward.

At the state level, there has been some more crypto news. Recently, the Arizona Senate passed a bill that would allow residents to pay their income taxes using Bitcoin or other cryptocurrencies “recognized” by the state’s revenue authorities. The term "other" is the big take away here. This term leaves it open for a state currency, or a government-backed digital currency to be an option. Now, this bill still needs to pass the Arizona house, but these types of measures often signal a positive sign for mass adoption. Arizona needs to decide how they are going to store the currency and do they keep it as Bitcoin or turn it into the US Dollar? Something they are likely working with someone on a federal level to determine.

We also have Tennessee looking to legitimize cryptocurrency purchases by making them legal on paper. You don't see many businesses in the United States accepting cryptocurrency for purchases just because most companies don't know how to deal with it and most people don't know how to use them. Then there is Wyoming throwing its hat into the ring, with four blockchain pieces of legislation up for consideration.

Arizona? Tennessee? Wyoming? Wouldn't you think San Francisco, the tech capital or even the state of California would be taking measures before these smaller states? Or New York? There does seem as though something is brewing out there; someone is out there lobbying these states to do this, it doesn't come out of thin air. Somebody is working towards something, and you need to realize this is big.

You may be saying, but Bitcoin is already huge, so of course, the government needs to take notice?

Not true, the cryptocurrency market cap is around 500 Billion dollars, and Bitcoin sits at approximately 200 Billion of that. And that's global. Sure, it's starting to pick up a bit, and the reason that most governments would want to start rolling out regulations is to get a piece of that pie. It's still a relatively small pie in comparison to the biggies out there. Apple has a market cap of 849 Billion, Amazon is 702 Billion and Microsoft 700 Billion; those businesses get away with plenty and because they are large businesses they have lobbyists working with them to influence the government. The 500 Billion market cap of cryptocurrency isn't being used to lobby for regulations. Perhaps there is someone within the NYSE, taking notice, the $18.5 trillion NYSE market cap is enormous compared to the cryptocurrency space. Maybe some people there are concerned that they aren't ready for what's coming.

Money is what this is going to come down to and why this isn't going to go away. The United States government and people around the world see a new marketplace that was created by the people and the idea that someone is getting rich outside of their system doesn't tend to sit well.

The government is working towards allowing cryptocurrency to exist alongside the US Dollars and that's something we haven't seen in our lifetime. Pay attention to the infrastructure that they are building for this. Being an early adopter is going to be huge.

It never hurts to bet on technology! It just depends on how fast and what form these changes will come.

TL;DR The U.S. Government is up to something, pay attention!