Earn Passive Income Through Crypto Staking.

Hello steemians, I want to share with you some of the best staking coins with good staking rewards. I also believe that these projects will be growing and taking advantage of the undeniable expansion in blockchain usage and investment in the future. I will explain the key aspects you need to know about each coin, including the potential rewards, how to stake them, and also the potential pitfalls you need to be aware of.

The first staking coin Solana. It has risen steadily over the past few months, to become one of the top cryptocurrencies by market cap and currently at number 13. Solana is known for two things and that is a speedy blockchain, and also a low-cost blockchain. Transactions can be completed in just a few seconds at a fraction of the cost of something like ethereum right now and Solana is a version of a proof of stake network meaning we can stake Solana tokens.

image source

Visit a website called Solanabeach.io and see what exactly is happening in the network. You can also look at the validators in the network to see some of the validators that you can choose if you are delegating but it's extremely hard to run your own node on the network. Currently, there are 614 validators. These are people that will validate blocks in the blockchain and be rewarded with new Solana tokens, as their staking rewards on this website. You can see the effective staking APY which is a yearly figure at the most 7.5%. You can delegate your stakes to these validators and participate in the rewards that they receive. You can check out the validators and how much stake they have in the system in terms of the points, and the percentage of the network that they have, and choose your validator accordingly. If you check out a website like stakingrewards.com, it will actually show it as slightly higher around 10%, depending on the validator that you choose.

This figure could change so be sure to choose the validators with the highest amount but you can work out how many extra slots and tokens, you will get each year by using a simple calculator, showing how many in US dollars, you would have. Solana does have a rate of inflation for right now, as the total possible supply isn't actually circulating, therefore you can see on the staking rewards.com the actual reward is actually reduced as an adjusted reward because there is an amount of inflation right now. Even though it is technically correct that your rewards are reduced by the current inflation rate on Solana, practically the Solana tokens have done extremely well over the past six months to a year. If you want to stake Solana, you can use supported wallets like Exodus wallet, ledger hardware wallets, Atomic wallet, and trust wallet, which are well-known wallets that you can use to go and stake your solana in a decentralized way. You can also set up an account on binance.com and buy some Solana from the exchange and stake your coins on the exchange for a 30 day period for a rate of 10%, and that actually goes up, the longer that you stake.

The next blockchain that you might want to stake coins on is Polygon which is also known as Matic. Polygon is getting a lot of hype right now, because they've done something that everyone wanted, and that is creating low fees while using ethereum based tokens. As we know ethereum is moving over to ethereum 2.0 but for right now, it's still a proof of work blockchain and transaction fees are extremely high anywhere up to $100 or more depending on how fast you want your transaction to go through and how many people are using the network. Polygon is a layer two solution for ethereum which means that it allows you to use ethereum based tokens, and also ethereum based applications, like all of the best and biggest brands in DeFi, but you're actually using the Polygon blockchain to do so and polygon fees are almost non-existent. It does take a bit of work to get your tokens over to the polygon blockchain, even if you don't want to do that, and you want some matic tokens, you can stake them on the polygon blockchain fairly easily. Visit the polygon Network website and go to the rewards calculator, it will show you exactly what the rewards are for staking your tokens at the time. Polygon is a proof of stake blockchain, and you should be aware about something called slashing. Slashing is when a network takes away tokens and rewards from a bad validator.

According to the Matic blog, a validator is liable for partial slashing if it misbehaves, and this also applies to bonded delegations as well.

What that means is that if someone delegates coins, stake them and give them to a validator. If the validators' tokens are slashed, your tokens will also be slashed. It's really important that when you stake your coins that you have chosen first make a good analysis.

image source

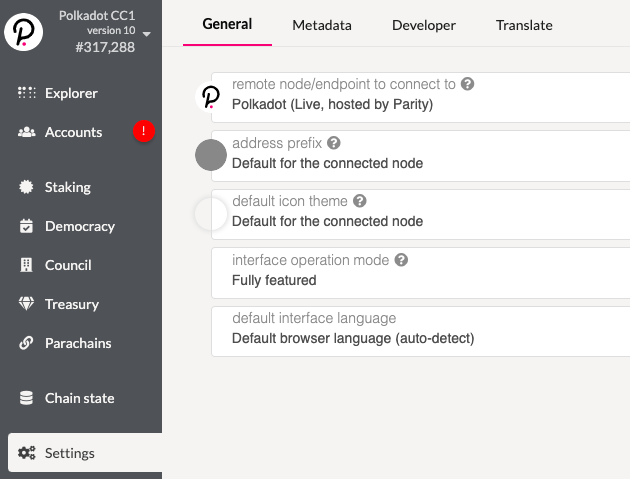

The next blockchain to stake coins on is Polkadot. Polkadot doesn't really get a lot of love compared to other blockchains which get way more hype. Polkadot is rolling out its infrastructure and it's quickly becoming the internet of blockchains with a structure that allows other blockchains to be built on top. Polkadot is well within the top 10 coins by market cap currently sitting at number nine. There is a lot going on with Polkadot right now, and also their secondary chain called Kusama.

Polkadot runs a proof of stake system called nominated proof of stake. There are validators in the system, and once more it's going to be extremely difficult for you to become a validator on the network. It requires a huge stake of coins and it also requires us to run nodes in the network. In Polkadot the system encourages Dot holders to participate as nominators and nominators may back up to 16 validators as trusted validated candidates which are so different from other blockchains like Solana and Matic where you actually just choose one validator. Rewards on Polkadot are also paid out slightly differently. According to the Polkadot docs;

The general rule for rewards across validator pools is that two validator pools get paid out essentially the same amount of tokens for equal work, and not paid in proportion to the stakes in each pool.

image source

What that actually means is that if two things are doing the same amount of work in terms of validating the blocks in the blockchain, they will be paid the same amount of tokens, even if one of the pools’ lot sizes is smaller than the other. Of course, if one pool is smaller, and has the same amount of tokens, then it will have a higher reward or a higher yield than the same amount of tokens split over more users. This is how Polkadot aims to keep the system of staking and the system of decentralization, as fair as possible.

Rewards for Polkadot staking are actually extremely high as of right now, around 13%. There is a rate of inflation however, if the price of Polkadot continues to accumulate and rise as it has done over the last 12 months, then it will be a net positive for both the price and the yield that you get. You can use the polkadot{.js} Chrome extension as your Polkadot wallet to nominate validators. You can also buy the tokens directly from Binance and also stake them directly on the exchange with a yield of around 12%, 15%, or even 18% depending on the timescale.

This is not financial advice and you can also make your own research about staking coins to earn more passive income from the crypto space.

Keep steeming,

@brayan256

You have been curated by @yohan2on, a country representative (Uganda). We are curating using the steemcurator04 curator account to support steemians in Africa.

Keep creating good content on Steemit.

Always follow @ steemitblog for updates on steemit