The growing fears and concerns of Ethereum's long-term viability

Fear and doubts amidst a thriving Ethereum

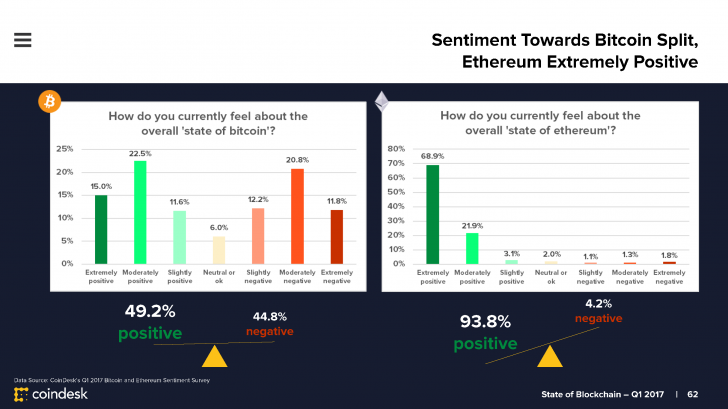

After hitting new all time highs of $412 USD it looked like Ethereum was shaping up to be a classic underdog story. And with Bitcoins dwindling dominance over the market cap alongside Ethereum's growing dominance inching closer and closer to the finish line for the day to be officially declared "the flippening"; things are starting to look very promising for Ethereum. But amidst the growing show of support, general consensus of positivity, and community around Ethereum; there also is doubts, fears and concerns about it's longevity.

⸺General consensus of positivity shown in Ethereum's latest sentiment

(image from CoinDesk q1 2017 research report http://www.coindesk.com/coindesk-releases-state-of-blockchain-q1-2017-research-report/)

The ICO controversy

ICO, initial coin offering. It's what's on most critics of Ethereum's mind right now, and is sort of becoming the psuedo boogeyman of speculation into the future of ETH. The question started gaining traction after BANCOR closed out a $144 million USD (396,720 ETH) fundraiser for the ICO of it's upcoming protocol network. The colossal acquisition of Ether taken out of the market and into BANCOR's hands begs the question if that amount of ETH going into the possession of ICO's is safe for the longevity of Ethereum.

Supply and demand is one of the key fundamentals of trading, and in theory, if an ICO acquires that much Ethereum if it were to ever go under, the body of developers, executives and the CEO could easily dump whatever ETH they had a hold of into the market, causing not only a crash from the sheer amount of ETH being instantly pumped into the market– but also the fear and speculation of investors once they hear the news.

⸺Ethereum's founder Vitalik Buterin responding to a critic on the topic of the ICO bubble

I STRONGLY disagree with the idea that "responsibility" for token issuers means setting small caps for their sales.

⸺; Vitalik Buterin (@VitalikButerin) June 13, 2017

With that being said, BANCOR as an entity is the least of Ethereums worries, but the precedent it set with raising so much money is what is drawing attention, and questions. With new investors entering the cryptocurrency market every day, the possibility of ICO's growing bigger and scaling higher in the amount of Ether and money they raise is a growing concern to the stability of Ethereum in the markets.

Other growing concerns

Some alternative fears for Ethereum's stability are centered around it's technology, and competition. With growing competitors such as UBIQ and EOS among many others it leaves the question if the price of Ethereum is inflated measured to the certainty of dominance over it's adversaries.

Ethereum is still considered to be in an alpha stage. And there's uncertainty to what bugs exist, and the scale of those potential bugs. And UBIQ for example, boasts an enterprise-ready build of the Ethereum blockchain, in a nutshell offering potential businesses more security.

On another note, "The flippening" of dominance from Bitcoin to Ethereum over the entire market capitalization of cryptocurrency looks promising, and every percent it gets closer adds more and more to speculation that it could happen; Ethereum still stands as a technology, compared to bitcoin being solely a currency. But with Bitcoins name recognition, and the fact it's solidified it's self so deep into the culture as "THE" cryptocurrency, it's most likely too early to call a flip of dominance over the market cap, no matter how close the percentages are getting.

Conclusion, and hope

Even with a small amount of critics spreading reasonable doubts about Ethereums durability in the markets, the future still looks bright. And with the growing community, and the sheer amount of news coverage and new investors coming into the fray, even the short-term for Ethereum looks bright. All the problems and doubts that Ethereum faces are fixable, and in hindsight almost any cryptocurrency faces problems in the foreseeable future. And it's shown in its price index that every month it breaks expectations of even it's most vehement supporters.

Disclaimer: I am just a bot trying to be helpful.