Predicting Bitcoin's future price at a future date

also read the article here at CoinClarity!

Bitcoin

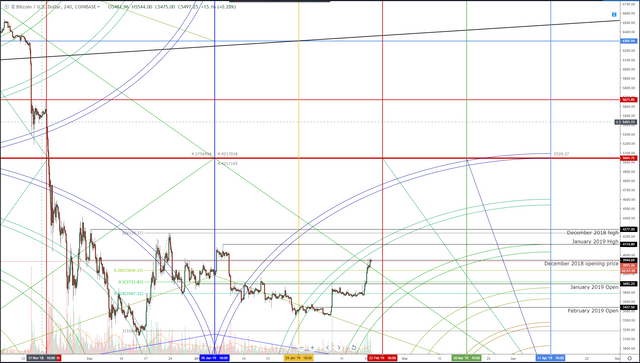

When looking a the chart above, we can see that Bitcion has twice been halted against the 0.618 Fibonacci arc. This is a very normal and predictable process and an example of price action that is often misunderstood. The arcs act as a sort of ‘shield’ or a ‘bumper’ for price. It’s not exactly like a horizontal level of resistance, but it more represents a ‘Yield’ sign – consolidate before moving higher. What is so very important on Bitcoin’s chart is the labeled dates on the right-hand side of the chart. Bitcoin is trading above the February open, the January open and is just barely trading above and below the December 2018 open. These dates are important for two reasons. First, Bitcoin has not had a monthly candlestick where the close was greater than the open for 7 months. Additionally, if Bitcoin’s chart closed above the open of December 2018, we’d fully engulf the prior two trading months – a very bullish sign.

Inside the current geometry, we can predict a certain level of cautious bullish bias ahead. Bitcoin has traded above the 45-degree angle (green diagonal line nearest the current candlestick) and has continued to hold that level since the close of yesterday’s close. There is also an extremely important time pivot that occurs on February 22nd, 2019. This time pivot is one of the most important during the entirety of the current Law of Vibration cycle because it triggers a move that lasts until the 4/8th time pivot on April 11th, 2019. Given the nature and bearish sentiment that has weighed down on Bitcoin’s price – we can safely predict a bullish response from this zone – but expect some pullback prior to any significant break towards the 4000 value area.

Predicting and forecasting future price at a certain date

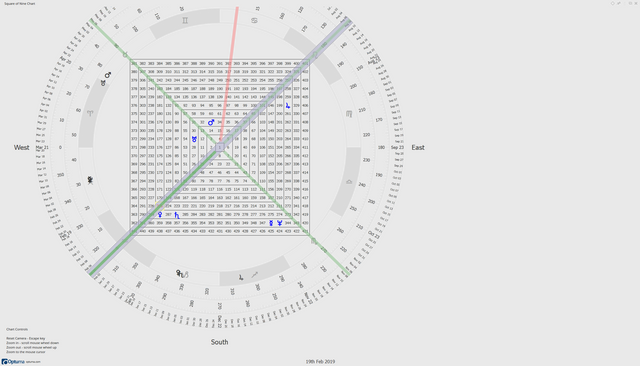

Gann was formidable at being able to predict specific price and time targets, something few have been able to replicate. That is one skill I continue to develop, myself. However, utilizing the same predictive tools in Gann’s trading toolbox, we can get an idea of when and where the next turn in the market may occur. This can be achieved using Gann’s Square of 9 tool. If we begin the Square of 9 tool at the 2018 December low of 3130, then we can forecast where time and price are squared.

The low of 3130 was found on December 14th, 2018. Starting with that date and price, we can see an interesting confluence zone within the Square of 9. First, the yellow highlighted line represents the angle of 120-degrees (also 120-days). April 11th and April 12th are 120-degrees from the bear market low – that coincides with the current Law of Vibration 4/8th time-harmonic on April 12th. Predicting a price target requires a little more finesse, personally, I don’t worry about the price, I just want to know when something will happen. But let’s try to predict and pinpoint some targets.

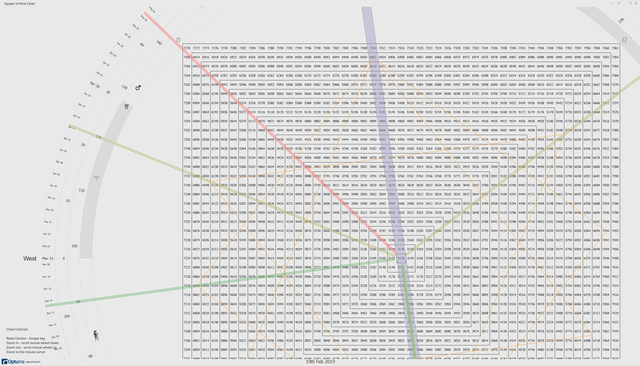

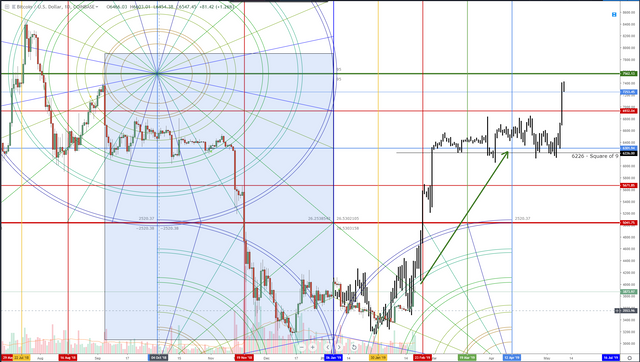

Mirrored Foldbacks, Squares of Price and Time

The blue highlighted box represents the price area that I copied and then ‘flipped’ or ‘mirrored’ onto the end of the blue box – creating the dark bars you see on the chart. This is what’s called a ‘Mirrored Foldback’ pattern. They’re everywhere in every market on every time frame and are extremely useful in forecasting and predicting future price swings. When looking over the Square of 9 for the December 2018 low at 3130, we can see that a square time and price value of 6226 is found. That price level is very, very close to the 4/8th inner harmonic of 6301.94 that falls right on April 12th, 2019. We have a confluence zone of two different square of price and time in the same area.

While predicting a future time and price location is extremely difficult – it is very difficult to not isolate the 6301-value area being the price target zone around the April 12th, 2019 date. Now, certainly, the prediction could be way off and a lower price level within the Square of 9 could be found, but give then nature of these shared dates, the predicated price level of 6301.94 is a very conservative and reachable target.

I would anticipate a move towards the 4400-value area sometime after February 23rd but before March 9th with another strong push towards the 2/8th Major Harmonic at 5041.75 at the beginning of March. February 23rd should be a strong catalyst for price action given that it is 99-days from capitulation move from November 14th, 2018. Also, consider that there was NO retest of the 2/8th Major Harmonic level at 5041.75 – which is odd. But Major Harmonic price levels should be observed from a weekly and monthly standpoint, so Bitcoin moving to test this line before Mid-March would be very much in line with normal price action behavior. March 19th is very close to the Gann Seasonal date of March 21st, which I would predict sees Bitcoin reacting to that time cycle and moving swiftly toward the 6301.94 value area.

Thanks, captain for proving such wonderful information as we know the future is unpredictable and we don't know about it, Raising the Bitcoin price or decreasing the bitcoin is depending on various condition like ETOP, market, and government role. As I share the link for further information about Predicting Bitcoin's future price at a future date, please click below:-

https://www.investopedia.com/articles/forex/042015/why-governments-are-afraid-bitcoin.asp

Excellent stats you got there. It would be nice if it goes the way you showed it. However, I also saw a couple of posts implying that around May we will be around 2500$, based on some old trend lines. But I don't know, it looks like the bulls are slowly returning and people are losing their patience.

If everything goes good, we might as well see this Adam and Eve pattern fulfilling:

The image is from my Bitcoin Update post, you can check it here if interested.

Carry on!

Nice!

Great Analysis! And Yes, Gann remains a mystery but his concepts are def worth using

wow thanks for share. hi

All this is a big world divorce, which began in 2014. First they gave everyone a lot of satosh - and then ...)))) --- supposedly everything was blown up by a cyber attack - in fact they gave it themselves - they took it - that's all. As always, only the top rose, and the rest - "in the ass" as they were - remained.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

thanks, but now i have more than less sorry

I learned my lesson. I bought too much, HOLD and now I'm stuck waiting for BTC to recover. What I am doing now is trading small sizes and doing it quickly. That's more profitable for now.

por fin te creas tu cuenta en esta plataforma

🎁 Dear @rickdevorne,

SteemBet Seed round SPT sale is about to start in 2 days!

When our started the development of SteemBet Dice game, we couldn’t imagine that our game would go so viral and that SteemBet would become one of the pioneers in this field.

In order to give back to our beloved community, we’ll distribute 4000 STEEM to SPT holders immediately after Seed sale. Plus, investors in this earliest round will be given 60% more tokens as reward and overall Return on Investment is estimated at 300%!

Join the whitelist on SteemBet webiste now and start investing! Feel free to ask us anything on Discord https://discord.gg/tNWJEAD

@captainquenta purchased a 67.51% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com