Buying Gold on the Blockchain

The conventional stock market’s bull run has come to a screeching halt, interest rates are on the rise, and the smell of political and financial instability is in the air.

Under these conditions taking a position in gold is a no-brainer. Gold has been the go-to safe haven in times of uncertainty. Gold’s history as a store of value predates civilization itself. The shiny yellow metal is the Bitcoin of the ancient world.

However, the Bitcoin of the modern world is Bitcoin. The Blockchain based currency is heralded as the new technological safe haven, digital gold, a place to find shelter when the government fiat money implodes. But Bitcoin is volatile. Its use as a “store of value” is questionable. Gold is still the better safe harbor in times of distress.

However, in 2014 an 18-year-old Blockchain developer was busy cooking up a new Blockchain. This Blockchain could handle smart contracts. Vitalik’s Ethereum, as it’s called, opened doors and a group of savvy gold traders and techies were quick to walk through one.

They called themselves Digix, and they used this new Ethereum Blockchain to do something special. They put gold on the Blockchain. It was a match made in heaven. A marriage between the old safe haven and the new. And the best part? It works.

The only thing that remains to be seen is if the market will accept this new paradigm.

What is Digix?

The Singaporean-based company, Digix, was started in 2014 by a Wall St gold trader, KC, and a software specialist and Ethereum developer, Anthony Eufemio. They saw a need in the crypto verse for a stable currency and a true store of value.

The story of Digix is a story of two tokens. The first is DGD. DGD is a governance token that enables holders to vote on Digix policy and the release of funds for future development. DGD holders also collect income derived from transaction fees paid by holders of DGX.

DGX is the gold token. One DGX is worth one gram of gold and for every DGX in circulation, a real gram of gold exists to back it up.

DGX is real gold on the Blockchain.

How Does DGX work?

DGX are purchased on the Digix marketplace: digix.global. Investors must register for an account, complete KYC requirements, and link their identity to an Ethereum address. Then DGX tokens can be purchased on the marketplace using Ethereum or DAI.

If one DGX token is purchased, then a real one gram bar of gold will be minted by the gold trading company The Value Max Group. That Gold is placed in a vault run by The Safe House in Singapore. The entire process is kept in check by an independent auditor: Inspectorate at Bureau Veritas.

That DGX token can be held in a compatible wallet, sold on an exchange, or redeemed by the owner at The Safe House. Yes, DGX holders can go to Singapore with their ID documents and make an appointment with The Safe House to redeem their physical gold.

You could skip the KYC requirement and just buy DGX tokens straight from an exchange. However, with this method, the holder of the DGX tokens cannot redeem them in Singapore for real gold, but would still be able to sell them on an exchange.

There is one caveat. The price of one DGX equals one gram of gold, but DGX is not a gold peg. Stable coins such as Tether, DAI, or USD Coin are designed to maintain parity to the USD. DGX has no such mechanism to maintain price parity to gold. If one purchases their DGX tokens from Digix, they are guaranteed the spot price. However, the exchanges are a different story.

Low liquidity on exchanges results in prices that can be above or below the spot price, and these price variations aren’t the only problem low liquidity is causing.

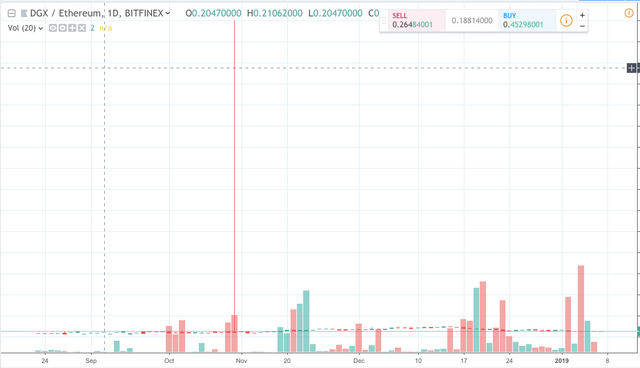

Erratic volume on the DGXETH chart (tradingview.com)

Problems with DGX

The biggest problem with the DGX tokens is a lack of adoption. The abysmal trading volumes are a cause for concern.

If you purchase $1k USD of DGX tokens from the digix.global marketplace, you would pay the spot price plus fees (Digix is waiving fees now). If you then sell your DGX on an exchange, you could find the exchange price above spot which is great, or below spot which is undesirable. Your 1k sell order on some days could equal 5% of the days trading volume. At the time of writing, 24hour trading volumes have been north of 200k, but sub 20k across exchanges in a day has not been uncommon.

Trying to get out of your DGX investment may be difficult depending on the amount you hold and the volume being traded when you want to sell.

The obvious opportunity is to buy DGX tokens when they drop below the spot price. However, these dips happen on low volume making the proposition not worth the effort.

Another problem with DGX results with how the gold is minted and stored. DGX may be a decentralized gold token, but the gold is minted by a centralized company, stored in a vault by a centralized company, and the process is audited by a centralized company.

To achieve decentralized Blockchain gold, three centralized organizations need to be trusted.

These three companies have impeccable records and there is no reason not to trust them. However, their presence is required for the system to work, but they do not require the Digix system.

Why would a gold investor who could otherwise purchase gold with fiat money, have it stored in a vault in Singapore, and pay an auditing company to check it, want to go through the hassle of navigating the Ethereum Blockchain?

The prospect of tokenized gold seems very appealing to the die-hard crypto enthusiast, but what about the die-hard gold bug?

To this person, doesn’t the Blockchain aspect of Digix bring an unnecessary and complicated middleman to the process of buying gold?

Owning DGX tokens requires you to go through KYC if you want to redeem them. The anonymity angle doesn’t apply. Plus there are established ways to buy gold anonymously outside of the Blockchain.

Why do gold investors want DGX in place of traditional gold investments?

This is a question only seasoned gold traders can answer. As of now, adoption is a hurdle in the way of Digix’s success.

What About the DGD Token?

The DGD token is the governance token. Holders of DGD are not investing in gold per se, but rather in the Digix platform itself. DGD token holders derive income from transaction fees charged on DGX transfers.

When a holder of the gold token DGX makes a transfer, a 0.13% fee is applied. These earnings are distributed to DGD holders quarterly.

DGD holders are also required to vote in quarterly governance decisions. Failure to cast a vote means you won’t collect dividends for that quarter.

Even though the fate of the DGD token is tied to gold, the token’s value has taken a southwards trajectory with the rest of the crypto market in 2018. The bear market has smashed the price DGD to historically low levels.

There are two ways to look at this. A gold bull run could spark Digix adoption. This could create lots of DGX transactions and lots of income for holders of DGD. Here, DGD may outperform DGX.

However, this adoption would have to be mega. DGD would need big numbers to muscle its way out of the bear. Without “killer” adoption, a gold investor may be better off sticking with the DGX token and profiteering from any rise in the price of Gold that way.

As of now, even with its relationship to gold, the 2018 crypto market crash has not been kind to the DGD.

(DGD tokens can be purchased here)

The DGD token has been pummelled by the crypto bear market ( tradingview.com)

What About Competition?

There is a handful of projects that are attempting to create a gold token, however, there’s little information available on these and their tokens don’t seem to maintain parity to gold at all. The competition also lacks active communities. The Digix community may be small, but it’s active and loyal. The competition doesn’t deserve a mention.

There is the Russian based goldmint.io that is building a Blockchain for the pawnshop industry. The proof of stake Blockchain pays gold tokens to the master node operators and they claim their tokens are backed by physical gold. However, unlike Digix, the gold isn’t stored in a secure vault and audited. Their Blockchain just keeps a record on which pawnshop is holding what gold - not ideal.

The Digix team has a stellar reputation and is one of the most trusted teams of the ICO era. It would be ill-advised to invest in any alternatives.

The Pros of Digix

- Real gold on the Blockchain

- An easy way to transfer cryptocurrency net worth into stable gold when needed

- A safe way to store gold without having to set up a home safe

- Fungible tokens

- Easy to move gold value across borders

- Can buy and sell gold on crypto exchanges

- In the future, the ability to take out loans with DGX as security

The Cons of Digix

- Low trading volumes

- DGD holders need more adoption for their investment to work

- Cannot redeem gold without completing KYC

- Traditional gold investments may seem easier to the crypto illiterate

- Three centralized companies need to be involved for the system to work

- If Digix fails, a trip to Singapore will be required

Conclusion

Gold is more than just a shiny yellow rock, it’s a financial instrument. Unlike the modern banking system, gold is a financial instrument that has and will continue to stand the test of time.

However, today we have a new financial instrument: Blockchain. The blockchain is destined to change the financial landscape. It's just too good. How way we think of and interact with money will never be the same again.

This marriage between the old and new is inevitable. Gold and the Blockchain were meant to be together. Nothing can stop them. The only thing that remains to be seen is if it’s Digix that will do the consummating.

Digix has the right team, the right idea, and even the right tech. Their platform works and works well. But it’s the market that decides.

Will Digix get the adoption it so desperately needs?

Will gold traders see the advantage of Blockchain and flock to this new financial instrument?

Will DGX become a mainstream method to hold gold?

Will the DGD moon?

Both Blockchain and gold are here to stay.

Both Blockchain and gold have stood the test of time.

And it’s time that will tell.

---------

If you would like to invest in the Digix platform, DGD tokens can be purchased here

If you would like to invest in digital gold you can purchase DGX tokens here

This is a great post mate and you've knocked an item off my own TODO list - Thanks!

Sounds like there is an arbitrage opportunity here for the patient trader and if there is proper auditing in place for these counter-parties then this looks as safe a place for a gold bug like me to park wealth in crypto as anywhere else.

Thanks mate.

So let me see if I got this right..... If I register with the company and provide all relevant ID, I can buy DGX at current spot price from them 1:1 with a gram of gold and then go get my gold from them in Singapore??

So if I do all that then go to an exchange and buy them for under spot price I can still go exchange them for 1:1 gram of gold??

I can see a "big" investor sweeping up a lot of cheap gold at some point.

You only need to register if you want to claim the physical in Singapore the way I read it. I don't see why you couldn't just buy DGX on an exchange if it's under spot and then store it on your ETH address with no KYC needed.

If you don't hold it you don't own it!!

Makes an interesting coin if, like you said, a visible audit trail is provided. I like the idea of DGD also. Pays out quarterly from the 0.13% fees charged per every transaction to share holders.

Could this be a very inexpensive way to have a company store/vault your gold for you. Those 0.13% fees would clbe cheaper than any storage fees charged tlby other gold storage companies (GOLDMONEY)

There are storage fees charged to DGX holders. 0.6% pa that is charged daily. It happens automatically as part of the DGX contract. I don't know if this is considred cheap or expensive though.

Yes, but the price difference happens when the order books get very thin. You wouldnt be able to buy much at the lower price. At the moment the volume is decent so the market forces are doing a good job at keeping parity.

I'm trying to avoid KYC these days myself but it sounds interesting

Yea I hear ya. KYC isn't my style either.