Bitcoin Blockchain Got Congested in the Middle of the Rally

The recent BTC price rally revealed all the weaknesses of the Bitcoin blockchain. During the pump that lasted since January 5th, the Bitcoin network failed to support all on-chain transactions. While the price went from $6,800 to $8,500, recording almost 20% profit, Bitcoin had 8,144 unconfirmed transactions.

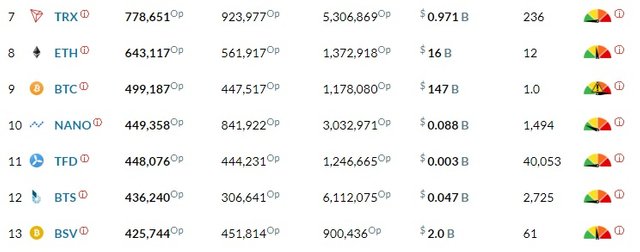

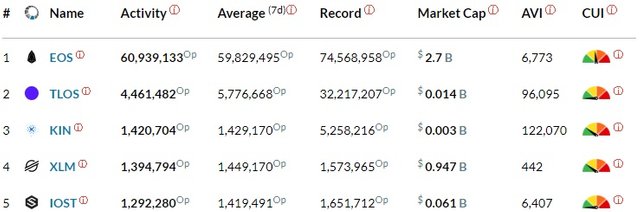

The data gathered by Block'tivity shows that the pump stretched the BTC network to its limits. This means that 7 transactions per second, which is roughly maximum for Bitcoin, wasn't nearly enough. Even though Bitcoin is at the 9th spot by daily operations, obviously, the king of cryptocurrencies still can't handle the pressure.

Bitcoin Blockchain Troubles Not Shared by the Competition

For the comparison purposes, the 10th cryptocurrency by daily on-chain operations, NANO, with only 50,000 fewer operations, processes everything at under 25% of its network capacity.

Let's take a more drastic example. EOS is, by far, the blockchain with the most daily on-chain operations. During the last 24 hours, it processed roughly 61 million of various actions. However, the EOS blockchain is doing it with 50% of its overall capacity. In fact, all top 5 networks by on-chain operations don't have any trouble performing their tasks.

Why Is That Important?

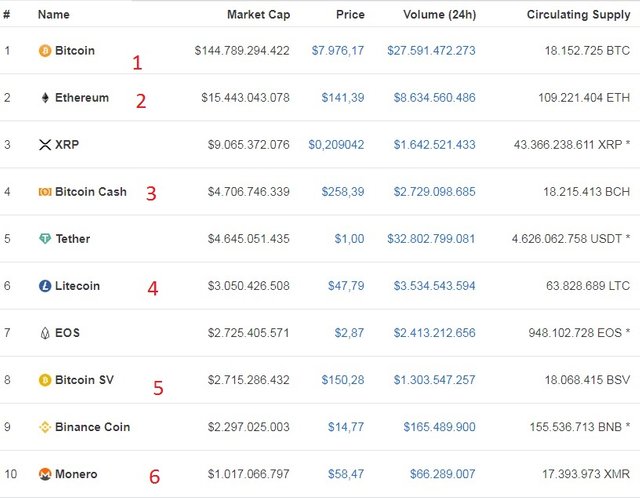

The cryptocurrency market still very much revolves around Bitcoin. As such, BTC is a pivotal point of crypto trading across the globe. This presents even more of a problem for the king. If the network gets congested during such a small price bump, imagine how will the biggest cryptocurrency by market capitalization support a real bull run.

Moreover, Bitcoin transactions are of a financial nature exclusively while other blockchains have various projects pegged to their network. For example, EOS, besides being traded on exchanges and used as means of payment, acts as the mother chain for many projects. All projects using another blockchain as a host have to use that network's cryptocurrency. This is where all those operations come from. Moreover, that is why transactions have to remain as cheap as possible without jeopardizing network security.

Bitcoin, even without unconfirmed transactions, is the most expensive blockchain in the market. The next bull run, if it comes, will bring much more on-chain operations to Bitcoin blockchain. This will raise the price of transactions. In turn, it will seriously hamper Bitcoin's potential to be used as means of payment. Again, in turn, this shows that Bitcoin isn't ready for mass adoption.

Is Proof-of-Work Obsolete?

Various versions of consensus reaching mechanisms secure various blockchain networks. Bitcoin uses Proof-of-Work (PoW) where miners secure the network by verifying all on-chain transactions. The majority of top coins utilize it too. At the moment, six of the top 10 cryptocurrencies by market capitalization use PoW.

Moreover, out of 6 mineable cryptocurrencies, 3 are forks of Bitcoin. This fact alone shows that classic PoW is still dominant in the cryptocurrency market. Nevertheless, motivated by obvious scalability problems, Ethereum is leaving the traditional consensus reaching algorithm to implement Proof-of-Stake.

This means that, once Ethereum makes the move, two of the top 3 cryptocurrencies in the market will not use PoW. This may be a sign that cryptocurrencies have overgrown Proof-of-Work and more efficient mechanisms are available to developers. If we just look at the possible TPS rate, Bitcoin may soon face more problems similar to the one explained above. Until now, Bitcoin refused to change, which resulted in Bitcoin Cash hard fork. Also, it is highly unlikely that skyrocketing network fees will force Bitcoin developers to make any alterations.

On the other hand, the Lightning Network may present the solution to the problem presented. Therefore, it remains to be seen if it will be enough for Bitcoin to finally become a viable digital cash solution as it was envisioned to become.

Screenshots in the article are taken from Block'tivity and Coin Market Cap

Originally published on CoinSyncom: https://coinsyn.com/news/bitcoin-blockchain-got-congested-in-the-middle-of-the-rally/

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://coinsyn.com/news/bitcoin-blockchain-got-congested-in-the-middle-of-the-rally/