BitMEX 2020 Review

Welcome to our full review of the most popular cryptocurrency derivatives trading platform – BitMEX. We are ready to get deep into the subject and dissect every single inch of BitMEX and provide a fair and unbiased verdict.

What Is BitMEX?

BitMEX is a Bitcoin-based cryptocurrency derivatives platform where traders can trade various kinds of contracts based on the underlying cryptocurrency asset. In other words, traders are not trading cryptocurrencies but rather place “bets” on the price movement of the given crypto asset.

When we say that BitMEX is Bitcoin-based, it means that all profits and losses are settled in BTC, regardless of the contracts being traded. Moreover, all deposits and withdrawals are possible only in Bitcoin.

BitMEX was launched back in 2014 by the HDR (Hayes, Delo, Reed) Global Trading Ltd. in Victoria Seychelles as a cryptocurrency derivatives trading platform that revolves around Bitcoin as a pivotal asset. However, the platform doesn’t exclusively offer Bitcoin contracts. On BitMEX, traders have the option of choosing between these other cryptocurrencies:

- Cardano (ADA)

- Bitcoin Cash (BCH)

- EOS (EOS)

- Tron (TRX)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

Types Of Contracts Available On BitMEX

We already stated that the platform only offers trading contracts, so now, let’s name and explain each type of contract available on BitMEX.

Futures contract

A futures contract is an agreement to buy or sell the asset at a predetermined price at the predetermined future date.

Example:

Suppose that Chris is a Bitcoin miner. His income is stable in Bitcoin. Nonetheless, due to the volatility of the asset, he cannot plan the future of his business. Chris thinks that BTC is going to tank in the coming month, which would jeopardize his mining operation’s viability.

Therefore, he signs a futures contract to sell Bitcoin at the current price, 30 days from now to mitigate the risk of loss because of the high volatility. This way, Chris protected himself in case he was right and BTC indeed loses some of its value.

Perpetual contract

When signing a perpetual contract, a trader agrees to sell the cryptocurrency at the predetermined price. But contrary to the regular futures contract, perpetual contracts don’t have the expiry date.

Example:

Mia is a cryptocurrency investor and trader. She thinks that Cardano (ADA) is going to rally in the coming week. She has 1BTC deposited on BitMEX and she signs a long perpetual contract, “betting” that the price of ADA is going upwards.

Contrary to Mia’s initial belief, during the first week, ADA slides southwards 4%. Still, Mia thinks that Cardano will eventually rise. Since she signed a perpetual contract, she doesn’t have to close the contract in a loss. Instead, she keeps the contract for another week. Eventually, ADA does rise 13% in the second week of Mia’s contract.

Mia closes her position and records a profit of 9%. Mia now has 0.09 BTC more than when she entered a trade.

Upside profit contract

The upside profit contracts are agreements where a trader pays a fixed premium to sign a deal with a broker, and harvest profit if the asset rises in value. These contracts have expiry dates, and profits are calculated in regard to the percentage of the rise in the valuation of the asset. However, if the price tanks instead, the trader doesn’t lose additional funds.

Example:

John thinks that Ripple (XRP) will rise in price until the same time tomorrow, but his technical analysis reveals mixed signals. He wants to invest 1 BTC but is afraid to lose a big chunk of his money if the price tanks.

John signs an upside profit contract because he calculated that the premium he paid represents a smaller possible loss if the price goes down. Until the contract expiry date, XRP lost 10% of its value, which represents 0.1 BTC. However, John lost only a fraction of that amount in the form of a premium paid on the date of the contract signing.

Downside profit contract

The mechanics of a downside profit contract are the same as for its upside counterpart. Traders pay the premium to be able to profit from the negative price spread, without the risk of losing more funds if the price rises.

BitMEX Fees Review

BitMEX sats the standard in the cryptocurrency derivatives trading in many things, and such is the case with trading fees. Deposits and withdrawals are free of charge, with the exception of regular Bitcoin network fees.

Furthermore, BitMEX doesn’t have the same fee policy for all tradable assets. Alternatively, some fees may be called promotional, some are within the market standards, while some are even non-existent. From the standard maker and taker order fees, across the long and short funding for perpetual contracts, all the way to cashback for market makers trading Bitcoin futures – everything is transparently declared and easy to understand.

In order for you to better understand BitMEX’s fee policy, take a look at the table below.

BitMEX Leverage Trading Review

Like every other derivatives trading platform, BitMEX offers its customers the option to trade certain products with leverage.

What is trading with leverage?

Trading with leverage means that a trader borrows money from a broker (in this case, BitMEX) to enhance the eventual profits. The amount of the funds originally owned by a trader when entering the trade is called margin, while the extra funds provided by a broker is regarded as leverage.

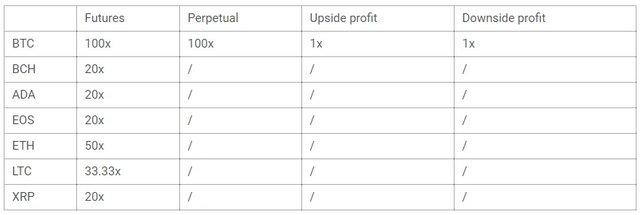

Leverages allowed for contract type and asset on BitMEX

BitMEX doesn’t have the same leverage allowed for trading for every asset they offer for trading, nor can all tradable assets be traded with leverage. However, they do have a well-devised leverage system.

The table below shows which contract type and which cryptocurrency is tradeable with which kind of leverage on BitMEX.

Risks of leverage trading

Like with all the loans, trading with leverage carries a high amount of risk. Just like leverage can enhance a trader’s profits, it can lead to catastrophic losses caused by the market conditions not going in trader’s favor.

The higher the leverage used in a position, the closer the automatic liquidation is to the entry point. To better explain the liquidation, we’ll use the example.

Example:

George entered the long perpetual position on BitMEX valued at $50,000 denominated in BTC, with 50x leverage. The price of BTC at the time of contract signing is $8,204. Since 50x leverage is a lot of funds to borrow from a broker, his liquidation price is set at $8,083.

That means that if Bitcoin slides towards $8,083, at that price George’s contract is going to get automatically liquidated, and he will lose the whole margin he used to enter the trade.

The cryptocurrency market is highly volatile, and momentary slips like the one described in George’s example are frequent. Therefore, trading with high leverage isn’t something that less experienced traders should do.

BitMEX Security Review

Above all, BitMEX sets the standard in the security department. Bitmex implements the most advanced security mechanisms available to the cryptocurrency trading platform.

BitMEX stores clients’ Bitcoin in multi-signature wallets. Therefore, that means that access to those addresses can be gained only through multiple keys held by multiple holders. Moreover, BitMEX introduced Amazon Web Services’ security protocols as an extra layer of security. For all those more tech-savvy readers, it will be informative to know that BitMEX’s trading platform uses the technology often utilized by major banks – kdb+.

Overall, the level of security on BitMEX can be described as top-notch with all the important features currently available in the business.

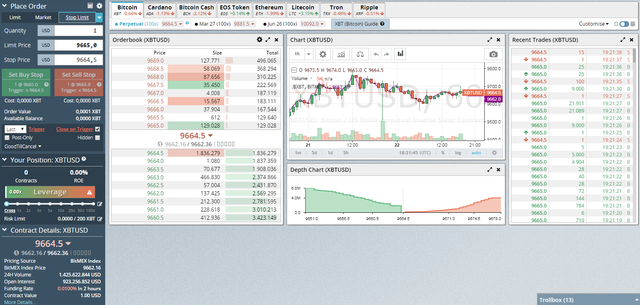

BitMEX User Interface Review

Just like leverage trading isn’t for newbies, the BitMEX user interface (UI) is meant to be used by those more experienced. There are loads of options on the platform, semi-intuitively placed on the trading screen. Those can be utilized in fullness only by those who are completely confident in what they’re doing.

Still, BitMEX was never intended to serve beginners. However, those who want to get the hang of things before they depart into deep waters are able to polish their trading skills through the BitMEX Testnet account, spending worthless coins in search of the perfect trading strategy and testing all those options.

Can US Citizens Use BitMEX?

Despite the fact that there is no apparent mechanism strictly preventing them to do so, US citizens are not allowed to trade on BitMEX according to the platform’s rules.

US citizens are not the only ones forbidden from using the platform. Here is the list of other countries whose citizens are disqualified on BitMEX:

- Province of Québec in Canada

- Cuba

- Crimea

- Sevastopol

- Iran

- Syria

- North Korea

- Sudan

BitMEX Review Verdict

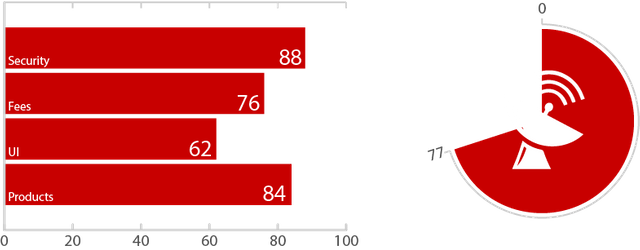

The last part of our BitMEX review is reserved for the general pros, cons, and the final verdict for the trading platform based on everything described.

Pros

- Security

- Low fees

- High leverages

- Advanced trading options

- BitMEX Testnet

Cons

- Complicated UI

- Withdrawals and deposits in BTC exclusively

If you want to get a starting fee discount, register on BitMEX by clicking the button below:

Congratulations @coin.syncom! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!