Cryptocurrency Market is Still in the Infancy Phase

The recent pump in the US stock business has enhanced the interest in an already pumped market. The extensive analysis published by Trustnodes states that this week alone, the total market capitalization of publicly traded stocks gained $1 trillion. This is important because, in comparison, the cryptocurrency market's combined market cap stands at only $191 billion.

Cryptocurrency Market is an Infant

The cryptocurrency market is 10 years old. While those years may not count as human infancy, it is obvious that it is still an infant. And there are many signs of that phase.

The first and most notable is the high volatility of crypto assets. Since most cryptocurrencies are in the market for less than a decade, investors still have a hard time to agree on their realistic price. This leads to price inconsistency. Therefore, it is not uncommon for even the most stable of cryptocurrencies to increase or decrease in value by 10 or more percent in a single day. The market sentiment changes frequently as traders try to determine the price of the asset.

Furthermore, the infancy is manifested by the lack of regulatory wireframe in many jurisdictions. While countries like Malta or Switzerland were among the first ones to regulate the cryptocurrency market, things are not so clear in some countries. This often leads to unethical behavior from market players. Especially since cryptocurrencies haven't been defined by the asset kind. So, during the ICO era, many project leaders abandoned their ventures and, with them, their investors holding bags of utility tokens without any real utility. The decentralized nature of crypto is what needs to be supported, of course. However, when it's being bent and leads to malpractice, the whole thing screams for regulation. Widespread regulation will eventually provide the way out of the infancy.

Just for the comparison, the first recorded stock market was in the Netherlands, the Amsterdam Stock Exchange (now Euronext Amsterdam), back in the early 17th century. Imagine how many times the regulations changed in the last 4 centuries.

The Power of Information Flow

Of course, we cannot compare our times with the early 17th century. The modern world has one significant advantage compared to those times - a fast flow of information.

Imagine if a stock was traded in Europe and Japan back in those days. How would the two markets agree on the realistic price of the asset? It would take days if not months for the information to reach from one market to another.

Nowadays, world-wide-web not only allows us to share the latest news in seconds but also to develop something like cryptocurrencies and trade them in non-stop working global markets. Therefore, it would be entirely wrong to expect that it will take as much time for the cryptocurrency market to settle in and become widely adopted.

Cryptocurrency Market High Point - the Proof of Infancy

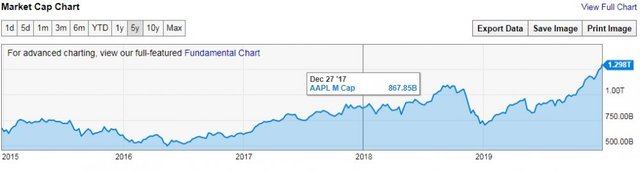

At the end of 2017, the overall cryptocurrency market capitalization climbed up to $830 billion fueled by the biggest bull run in history. The whole community was ecstatic as the new money came flooding into the market. However, at the same time, the market capitalization of Apple was roughly $880 billion. In other words, the cryptocurrency market combined couldn't reach the market capitalization of a single traditional company. Regardless of how big that company is.

Source: ycharts.com

Currently, Apple has a market capitalization of $1.3 trillion. Moreover, the top 30 publically traded companies all have a market cap of more than $200 billion individually. This means that even the whole cryptocurrency market can't compete with the top 30 individual companies at the moment, let alone individual coins.

Source: dogsofthedow.com

The Future

The cryptocurrency market is in a fragile period with the majority of coins in the severe bearish formations. Nevertheless, 2020 is going to be the year that will show if crypto has the potential to grow up and reach adolescency. The potential is, undoubtedly, huge. Even more so because the highly anticipated Bitcoin mining rewards halving is going to take place in May. However, there are some prerequisites for this maturation to happen.

1.) The Incentive for Big Players

The incentive for big investment players is still too low to enter the market. Crypto holders don't receive dividends or any other rewards for backing up the companies. That is, apart from the possible profits from speculations. This is the case because issuers of coins are still looking to avoid regulations. Simply put, they don't want authorities to mark their cryptocurrencies as securities. If they would be found as such, they would have to invest much more in becoming regulatory compliant. This would leave much less maneuver space in their ICO funds usage too, and they simply don't want that to give up the freedom to use that cash as they like.

2.) The Infrastructure

Cryptocurrency infrastructure is still too complicated for an average user and its nature isn't optimal for custody solutions. CoinSyncom already discussed how it is difficult enough keeping 20 cryptocurrencies in wallets that constantly need to be updated. Furthermore, keeping track of all token migrations and procedures that these require is another cumbersome obstacle in the crypto infancy problem. I mean, another one of many. Then, there is the fact that the catchphrase for cryptocurrencies is still "not your keys - not your crypto". While that may be true, there are no institutional investors without regulated custodians.

3.) Regulations

Since the previous paragraph speaks about regulations, let's just emphasize the undisputed truth that without a clear legal wireframe, heavy-hitting investors aren't going to risk their funds. Especially in the world's biggest markets. Without them, there is a certain limit to which we can take the cryptocurrency market, and we may have reached that in 2017.

There is no doubt that the crypto market has as much potential as any infant industry. The financial mainstream media started covering the cryptocurrency phenomenon during the 2017 bull run. This is a great cornerstone for the progress as visibility is the key to adoption. Now, it is time to materialize this potential and take another step forward in the maturation process. 2020 and 2021 may just be the years when it will happen.

Until then, we'll keep telling our friends how it will change the world.

Everything written in this article is the author’s personal opinion. CoinSyncom and its editors may or may not agree with the author’s views and opinions.

Originally published on CoinSyncom: https://coinsyn.com/column/cryptocurrency-market-is-still-in-the-infancy-phase/