Are We on the Brink of a Crypto Crash? Time to Take Action?

The cryptocurrency market faced a notable setback, experiencing a 3% drop in its total market capitalization over the past 24 hours, reaching approximately $2.4 trillion as Monday's early Asian session unfolded. This decline comes amid a bearish turn triggered by Bitcoin's recent price struggles.

Bitcoin's Price Movement

Bitcoin (BTC), the leading cryptocurrency, closed last week around $63,000, a critical support/resistance level that now looms ominously as the price dipped. Over the past day, Bitcoin's price slipped by 2.3%, settling around $62,800 on Monday. Analysts fear further downside if Bitcoin consistently fails to hold above the $63,000 mark in the near future, potentially retesting support levels above $60,000.

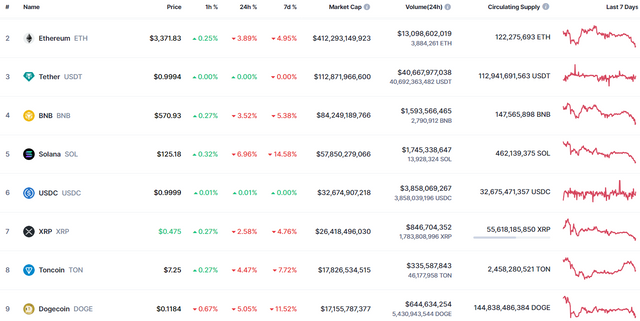

Altcoin Market Dynamics

While Bitcoin's struggles dominate headlines, the broader cryptocurrency market, excluding Bitcoin, has seen a 3% decline over the past week and nearly a 10% drop over the last month. This suggests a trend of capital moving away from alternative cryptocurrencies (altcoins), which could face continued depreciation. However, altcoins with strong fundamentals or limited supply may present opportunities for recovery.

Investor Sentiment and Market Outlook

Impact of Bitcoin's Decline

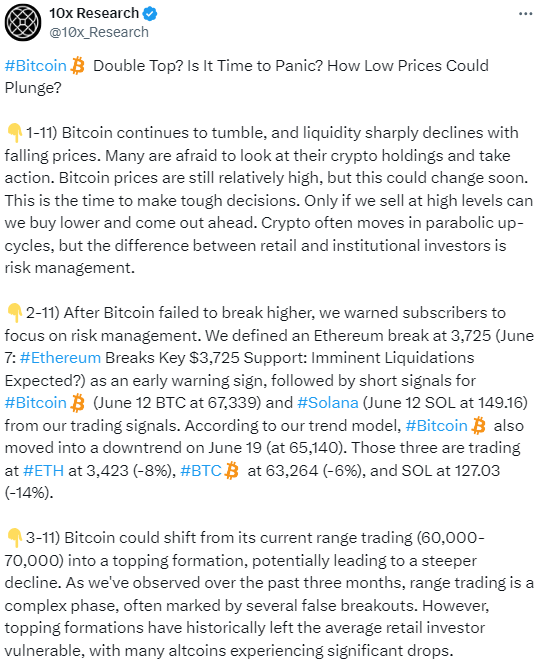

Bitcoin's ongoing decline has not only eroded prices but also liquidity within the market. Many investors are hesitant, uncertain about the future of their crypto holdings amidst the current volatility. While Bitcoin's prices remain relatively high, the risk of further declines prompts difficult decisions for market participants.

Strategic Considerations

In this environment, strategic decisions become crucial. Selling at higher levels to potentially buy back at lower prices emerges as a prudent strategy, particularly in the cyclical nature of cryptocurrency markets characterized by parabolic upswings and subsequent corrections. The disparity in risk management between retail and institutional investors underscores the complexity of navigating these volatile periods.

Technical Analysis and Future Trends

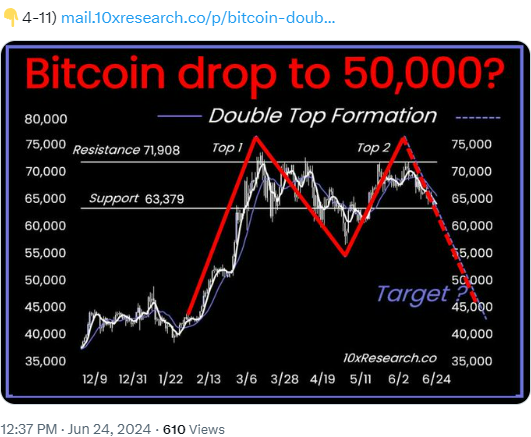

Looking ahead, Bitcoin's price movement between the $60,000 to $70,000 range may transition into a topping pattern, potentially signaling a more pronounced downturn. Recent months have shown that range trading phases, like the current one, can be deceptive with false breakouts, leaving retail investors vulnerable. Such patterns historically lead to significant corrections, affecting not just Bitcoin but also various altcoins in the market.

As the cryptocurrency market navigates through a period of heightened uncertainty, characterized by Bitcoin's struggle to maintain key price levels, investors face challenging decisions. Whether Bitcoin consolidates above critical support or triggers further declines will determine the broader market sentiment. Understanding these dynamics and adopting a strategic approach will be pivotal for investors aiming to navigate these volatile conditions effectively.