The Ethereum Outlook For Early 2019

MIT's Technology Review put out an article a few weeks ago titled 'Ethereum thinks it can change the world. It's running out of time to prove it.'

I tend to agree. Ethereum has been hailed as a technology innovative enough to usher in a new internet, a new legal system, and new payment systems-all three based on its 'smart contract' platform.

And, yet, we've seen a great deal of speculation behind this, sending ETH prices near $1,500 and then the deflation down below $100 once many realized that technology is not here. And not just that, but the technology that is here has some serious flaws: mining ETH has become unprofitable, and the ETH blockchain is over 1TB. Technological innovations have been promised to meet these problems, but that takes serious time with such a new technology that has no intermediary party to fully "release" updates as a company might, and it distracts the developers from the kind of disruption that Ethereum promised.

But it's fully needed. As the MIT article explains, thanks to a 2018 Ethereum-based site called CryptoKitties, the world saw:

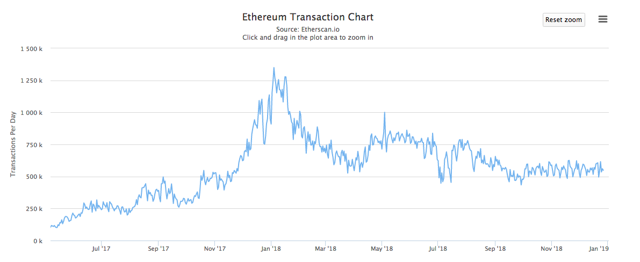

The mad rush to breed them led to a sudden sixfold increase in transaction volume that clogged the network and slowed Ethereum to a halt. It exposed the truth: the technology is immature, incapable of handling the kinds of workloads that big dapps would demand.

From there, it went on:

The problem Buterin [Ethereum's founder] and a few trusted collaborators have spent years laboring to crack is that the fundamental weaknesses of Ethereum, and the reasons why CryptoKitties was able to bring it crashing down, stem from the very core of how almost all existing cryptocurrencies are built.

Constantinople

These lingering issues are meant to be addressed in the Constantinople upgrade scheduled for mid-January 2019. It has some bullish potential. Just the announcement of the upgrade's date sent ETH prices up 10% (though the rest of the market went up that day, so it could be a residual effect of a Bitcoin price increase).

The biggest part of the upgrade is the decreasing of the mining block reward from 3 ETH to 2, which will reduce the incoming and inflating supply of Ethereum. Analysts are calling this bullish, but that has to be long-term thinking.

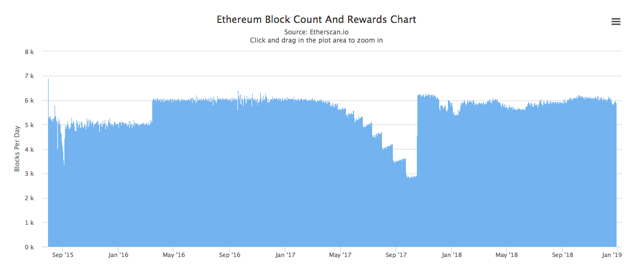

Though it's not completely set (graphed below), the Ethereum blockchain produces about 6,000 blocks per day, so the incoming supply will decrease by that amount per day as it's run throughout 2018.

The more bullish idea for me for ETH is the end of the ICO craze. New crypto companies are looking less for public raising of funds - mostly done through ETH - and are exploring other methods. This is a net positive for ETH, even if it slows demand for getting coin to get in on ICOs.

Why? Because when an entire financial ecosystem of young, unestablished companies is creating or distorting ETH value, you have days where companies that raised $200 million and then dumped 200,000 ETH this month. That dump, along with other high-raising ICOs emptying their treasuries has wreaked havoc on the market this year.

Without ICOs, interested ETH investors will hold their ETH in hopes of future value coming. And what will that value look like?

Network Usage

Here are charts on ETH daily transactions and ETH price. Look similar right?

Constantinople is a net positive for the network, and the long-worked-on Casper will be as well (to be discussed in future articles); but ETH will need more coming in the next months to increase its value as a transactional utility before it returns to the heights - in price and in premise - as the game changing technology that so many have flocked to. Bitcoin may have come down from the stratosphere, but there’s still an abundance of opportunities in cryptocurrencies. At the Coin Agora, our focus is on altcoins - the smaller cap cryptos that have massive potential to disrupt business ecosystems. Invest with us for your chance to get in on the ground floor. Our mission is to help you find small, new and growing coins and reap rich returns. Let us help you cut through the noise and find winners - join the Coin Agora community today!

Posted from Cryptotreat Cryptotreat : https://cryptotreat.com/the-ethereum-outlook-for-early-2019/

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://seekingalpha.com/article/4230583-ethereum-outlook-early-2019