Payment Tokenization Explained

Tokenization” is a super-buzzy payments word at the moment, especially because of the“ increased attention on mobile payments apps. Basically, tokenization adds an extra level of security to sensitive credit card data.

What is tokenization?

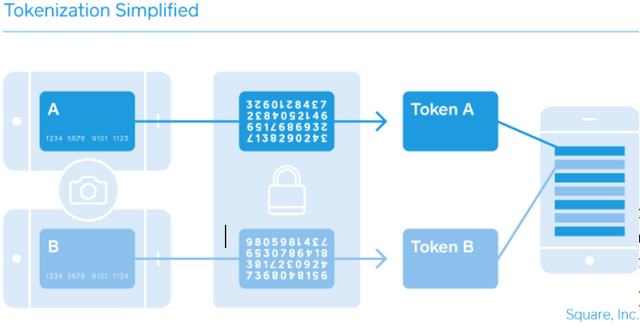

Tokenization is the process of protecting confidential data by replacing a number generated by a token called an algorithm. Often, tokenization is used to avoid credit card fraud. In credit card tokenization, the customer's primary account number (PAN) is replaced by a series of randomly generated numbers called "tokens". These tokens can be transferred over the Internet or different wireless networks are required for processing. payment without disclosure of bank information. The actual bank account number is held safe in a secure token vault. Just like the nationwide shift to chip cards , tokenization’s end game is to prevent the bad guys from duplicating your bank information onto another card. But although smart cards protect against fraud that occurs when someone pays in a physical store, tokenization is designed. primarily to combat Internet or digital breaches History of Credit Card Tokenization alternative techniques such as tokenization have been used for decades to isolate data in ecosystems, such as databases. Historically, the encryption of a "key" is a reversible cryptographic method of protecting confidential data. According to Stanford University encryption expert , "encryption is transforming data into an unreadable format for anyone without a secret key to decryption." Its purpose is to provide privacy by keeping information hidden from anyone not targeted, even those who are not. You can see the encrypted data, for example, someone may want to encrypt the files on the hard drive to prevent the reader from being intrusive. "Encryption is a wide variety of uses of cases, as it hides private messages in P2P applications for the transmission of sensitive information in vulnerable environments But lately, payment experts see that more and more companies use encryption tokenization as a cheaper (and more secure) way to protect and protect sensitive data One of the most widely used methods to use tokenization is nowadays in the payment industry. Tokenization allows users to store credit card information in mobile wallets, e-commerce solutions and POS terminals to allow the card to be loaded without displaying information on the original card owner.

Nice read. I leave an upvote for this article thumbsup