What cryptocurrency projects will remain long term, grow, and provide a valuable service to the world?

I've been trying to find out the real value of cryptocurrencies. And the real value for such a new asset class is difficult to find. Sometimes the only true way to rate cryptos is to compare them against each other. The assumption is the cryptocurrency that is in the use the most will out preform those that are less used. In the short run, this isn't true. Things like Tron, EOS, and Cardano are out preforming - in terms of price movement - market leaders like Ethereum and Bitcoin. But, in the long run, network usage or consumer demand will be the deciding factor.

The questions one should be asking are:

What cryptocurrency projects will remain long term, grow, and provide a valuable service to the world?

Everyone has their own opinions on what coins will remain long term, which teams will adapt to a changing landscape, and which provide actual value to the world. But as predicting the future is difficult, if not impossible, we can only look at current data. You might be asking what types of statistics should I be looking at?

What stats are important?

For long term investment, the stats you should be looking at are likely the following:

Activity - number of transactions on the blockchain.

Average activity per day

Record number of transactions per day

Max transactions they can produce per block - you should then extrapolate that into max transactions the block-chain can produce per hour and per day.

Network fees - If the fees are prohibitively high for the average consumer this discourages usage and thus demand.

(only for platform coins) Network use on coins that will be leaving the platform - If I'm right, and network usage is the fundamental factor in a project's survival, then it makes since to weigh which tokens will be leaving the platform to develop into their own blockchain.

Network usage - Take the daily transaction volume and divide it by the total possible transactions per day and it will yield you a percentage.

a. If the percentage is over 100% it means that blockchain isn't scaling to the demand they have.

b. If it's near 100% you should be asking "Are they developing solutions to scaling? Will it be implemented in a timely fashion? Is it even possible?"

c. If it's near 50% that's an okay sign.

d. if it's near 0% it either means they are scaling remarkably well or they do not have demand. But, if you decide on they are scaling well, ask yourself WHY they are scaling well. Is it due to centralization? Or better coding protocol, like adjustable block sizes or proof of stake algorithms?

- Max network usage - Do what we did for number 7 but use the record number of transactions ever recorded. (The number should say 8 but steemit changes it to 1)

But those are the main statistics everyone look at while attempting their own research. They give you a good idea of the overall network utilization. And those statistics attempt to give you an idea of the demand for each blockchain, particularly if you do the research for a lot of coins.

Some other thoughts:

One extra thought was on number 6. You should be weighing those coins because they could make up a lot of the network activity. At the time of writing EOS is number two on Ethereum’s network for gas usage. That’s a ton for an ICO that will leave the network – adding no real long term value.

Where can I find all this information?

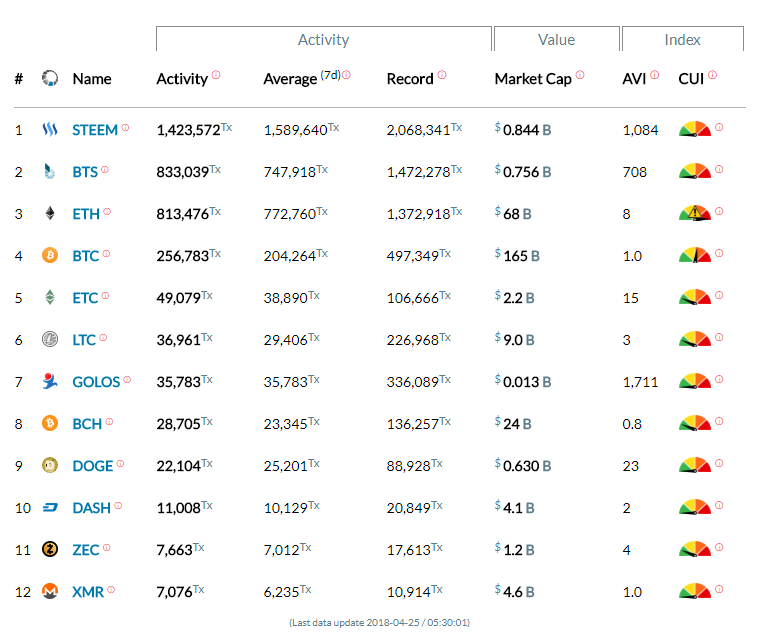

The first one I want to direct you to is block’tivity. It is great because it does a lot of what I outlined for you! Saves you time and effort! Unfortunately, Block'tivity does discriminate against centralized projects like ripple and stellar – among others. But it’s a good starting point.

Picture taken from Block'tivity on 4/25/2018

But since we all use steemit. Block'tivity shows it as being one of the most richly used blockchains out there. Which is a very good thing for our community! Congrats fellow steem users!

Then I’d go to https://bitinfocharts.com/

That gives you access to a lot of the stats talked about above.

If you can't find your coin on bitinforcharts then try, for specific coins, going to each coins subreddit and looking at the sidebar. Or asking at the subreddit, or telegraph.

Conclusion:

The most important thing is finding what cryptocurrency projects will remain long term, grow, and provide real value to the market place. Predicting this is a difficult task, likely impossible, but using the statistics on each blockchain to determine network usage, we can cut through the noise. Those statistics above should give you a better idea on which blockchains are being used, which ones are struggling with scaling, and which are highly used and ready for more demand.

Hopefully, this was useful. Please leave a comment below. Thanks for reading!

Disclosure:

I try to be as unbiased as possible but my opinions are my own.

As always, do your own research and do not invest more than you can afford to lose. Best of luck.

I believe only scalabale solutions along with privacy coins will last in the long run. A majority of these coins can't handle adoption or just flat out don't have a good use case. Infrastructure like EOS has a really good chance at making even more waves. Ethereum has some scaling issues to overcome but there's still a lot of potential there. BTC's lightning network just doesn't do it for me. I'm more of a BCH fan. But scaling is still a problem for both of those too.

A lot will depend on how well these developers scale and the use case of the coin.

Do you think steem will be worth more than bitcoin?

Coins mentioned in post:

Interesting analysis. Thanks! Always good to have more information in the crypto-sphere.

Thanks! I try!