Cryptocurrency vs “Intellectual Mastrubation”

Originally published on our blog: https://cryptolo.io/cryptoblog

Can cryptocurrencies and ICO restore capital formation in a free economy?

Looking at many altcoin pump-and-dump schemes and many recent ICOs, the title of our blog can probably elicit no more than a smile. After all, didn’t ICO market become synonymous with half-baked projects, outright frauds, and intergalactic bridges to nowhere never to be built?

Yes, there is quite a bit of fraud going on. However, what people forget is that this fraud pales in comparison to the fraud we witnessed in the current financial system over the past two decades. Just recall the housing bubble of 2003-2008. Garbage real estate loans were securitized and sold as investment vehicles. Investment banks have taken CCC rated loans, combined them into tranches and somehow put out AA securities (magic!). Of course, S&P and Moody’s had to rate those vehicles. But the mathematical models used to create those instruments were so opaque, that it was not hard to fool the public. And rating agencies were only happy to be paid to rate those pyramid schemes.

The instruments that came out of this voodoo process were called CDO (Collateralized Debt Obligations) and CLO (Collateralized Loan Obligations). But the voodoo didn’t stop there; there were CDO made out of CDOs i.e. CDO-squareds. You guessed it, another round of mathematical pettifoggery and combining various tranches of various CDOs gave you CDO-squared. There were actually CDO-cubed and if you can believe some CDO-quadrupled. On top of that there was a huge market of $200 billion for synthetic CDOs i.e. instruments that simply had no loans behind them. They were pure bets on value of the loans in certain CDO tranches and are separate from the rest of the voodoo finance (Goldman Sachs is trying to create something like that for crypto with their non-deliverable forwards, but that is a separate topic). No wonder Goldman Sachs Managing Director Fab Tourre famously called the whole exercise “Intellectual Mastrubation”. Here is his actual quote from 2007:

““Just made it to the country of your favorite clients!!! I’m managed (sic) to sell a few abacus bonds to widow and orphans that I ran into at the airport, apparently these Belgians adore synthetic abs cdo2.”

Note, that he was but one careless perpetrator, but the whole industry was engulfed with this type of fraud. Here is another one of Fab’s famous quotes:

“When I think that I had some input into the creation of this product (which by the way is a product of pure intellectual masturbation, the type of thing which you invent telling yourself: “Well, what if we created a “thing”, which has no purpose, which is absolutely conceptual and highly theoretical and which nobody knows how to price?”) it sickens the heart to see it shot down in mid-flight... It’s a little like Frankenstein turning against his own inventor ;)”

At least he was honest about it. And who can forget the NINJA loans. They enabled people with No Income No Job No Assets to actually take out large loans and own expensive houses (for a while). Interest only loans where borrower actually paid no principal and was hoping to flip it for a higher price. All those loans were then repackaged and sold to ‘widows and orphans’ around the world i.e. various pension plans.

By the way, did you know that synthetic CDO market has roared back recently after plunging the whole world in one of the worst depressions ever seen in 2008? Yes, as of 2017 it is a $70 billion market and is closing in on $100 B now. (Source)

Note, that these are only synthetic CDOs i.e. those instruments that have no loans or any economic activity behind them, they serve absolutely no economic purpose other than pure betting that will ultimately enrich citibanks and goldman sachs’s of the world. The size of the whole ICO market pales in comparison to just the tiny sliver of the “intellectual masturbation” created on Wall Street. Yet, we hear exponentially more about dangers of ICOs and scams that go on in that space.

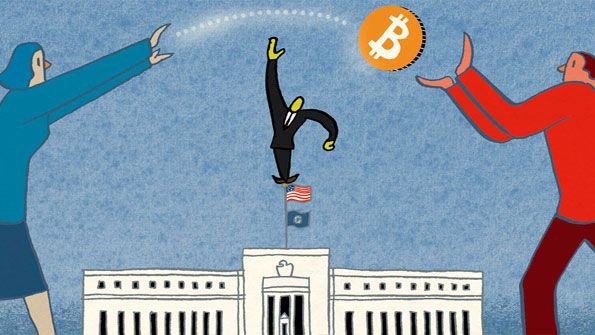

There is price manipulation in crypto and it certainly needs to be regulated. But we rarely hear about the fact that corporations and central banks are biggest buyers of stocks propping up completely unsustainable valuations. It is estimated that corporations will pour $2.5 Trillion (!) in 2018 into their own stocks via buybacks and M&A. How do they do it? By using the low interest rate provided to them courtesy of Federal Reserve, which in itself leans on the solvency of US Government ultimately falling on shoulders of every taxpaying American.

And let’s consider the fact that the size of the financial derivative market is estimated to be $1.2 quadrillion (that is $1,200 Trillion in case you were wondering!!!), the whole media circus around ICO and cryptocurrency starts reeking of a hitjob. Put things in perspective for you, oh media screamer about volatility in cryptocurency? Do you now understand why people like Warren Buffett and Charlie Munger lose their cool and are reduced to insane insults when talking about cryptocurrency. Munger actually compared trading bitcoin to trading baby brains! How do you really feel about losing your government next-to-zero interest rate subsidy, Charlie?

But besides all that, there is another reason why crypto and ICOs are different from CDOs, CLOs etc. They are comparatively transparent. Financial Frankensteins (as per Fab Tourre) are specifically created in the dark; detailed data for the composition of those instruments is not available to anyone, except people putting them together. ICOs on the other hand operate in broad daylight; anybody can see the claims that people are making. Let me put it this way. If someone invests in a whitepaper with grammatical errors put together by kids with no experience, they should know they are risking their money. However, when a pension plan without asking its participants buys into toxic trash financial instruments that even professional investors do not understand, that is not the same thing.

So, even taking the worst of the crypto market, the danger that it poses to financial stability is far less potent than the one brought by the current financial system. Most people have no choice, but to participate in the current system. You participate in pension plans; you pay taxes, which are then used to bail out financial institutions when their gamble turns against them. And this issue goes far beyond United States, every financial system in the world is now structured to privatize gains and socialize losses.

Initial Coin Offerings certainly need to settle down. They need to be regulated. Fraudsters need to be punished. However, the nature of ICOs is such that they are extremely risky fundraising schemes, not complex “intellectual masturbation” vehicles barely comprehensible to quants who create them. ICOs have an economic purpose, capital formation. Most derivatives just serve to enrich those who create and trade them.

https://cryptolo.io is home to successful crypto investors and entrepreneurs.

Join our network today to connect with top cryptocurrency legal and investment experts.

✅ @cryptolo-io, I gave you an upvote on your first post! Please give me a follow and I will give you a follow in return!

Please also take a moment to read this post regarding bad behavior on Steemit.

good post, but will add more pictures) subscribed to you