IOTA, are you HODLING it? We Have HUGE NEWS!

Today we have a Daily Token Review and three really awesome cryptocurrency news segments to share with you. When it comes to today’s news, first up we have Ripple Labs, whose distributed ledger technology (DLT) network has just been used by the Saudi British Bank (SABB) to facilitate fast, cost-efficient and frictionless cross-border payments. Second up, IOTA (MIOTA) has reached another significant milestone as Jaguar and Land Rover automobile companies have adopted IOTA’s technology to enable drivers to earn free MIOTA tokens while driving. Thirdly, Iran and Switzerland are now working together to formulate fail-proof ways of circumventing the United States sanctions with cryptocurrency. Please stick around until the end if you want to know how it unfolds.

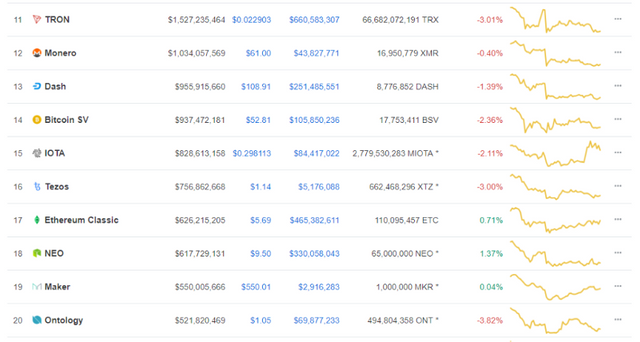

As seen on CoinMarketCap, we’ve got a mixture of greens and reds on the market, with the Bulls struggling to maintain their momentum, overall. The world’s flagship cryptocurrency, Bitcoin (BTC) has decreased by 0.80 percent. Ether (ETH) still maintains its “second in command” status, and it’s currently losing by 0.06 percent. Ripple’s XRP maintains the number three position, and it has decreased by 0.95 percent.

Now, if I scroll down to the top 20, we’re also having a minor bloodbath across the board.

Now onto the news! According to a report by BTCManager the Saudi British Bank, a Riyadh-based financial institution in which Britain’s HSBC Holdings PLC owns a 40 percent stake, has announced the launch of its Ripple-powered cross-border payments platform.

Interestingly, the highly reputed lender has reportedly declared that the move is part of a larger strategic plan towards digital transformation and enriching customer experience. Earlier in 2018, with the support of the Saudi Arabian Monetary Authority (SAMA), SABB became one of the first lenders in the region to integrate Ripple’s highly functional blockchain-based payments solution into their operations, and in December that year, SABB conducted its first international payment in real-time, using the technology.

While top executives of some financial institutions across the globe still doubt the potentials of blockchain technology, the Deputy Managing Director and Institutional Banking Head at SABB, Majed Najm has made it clear that the latest initiative is a strong indication that the bank remains dedicated to offering its customers state-of-the-art banking services.

He also noted that integrating Ripple’s cutting-edge technology into its global banking products creates an avenue for customers to save time and efforts. “This is also to maintain our leading position in achieving the ambitions of the Bank’s customers whether in the retail or corporate sector and to support SABB’s vision to be the leading global bank in the kingdom,” he declared. At this rate, Ripple is fast evolving into a global force to reckon with in the financial technology ecosystem, considering the fact that several banks, including Thailand’s Siam Commercial Bank (SCB), have confirmed the potency of its blockchain solutions of late.

Now, onto the second news item for today! Per a report by Cointelegraph, these are exciting times indeed for IOTA (MIOTA) and its supporters, as Luxury car brands, Jaguar and Land Rover have integrated IOTA’s technology into their processes, to enable drivers of both cars to earn free MIOTA tokens on the go. Reportedly, the initiative is part of Jaguar’s Destination Zero project, which is aimed at curbing road accidents, traffic congestions, and carbon monoxide emissions in the automotive ecosystem.

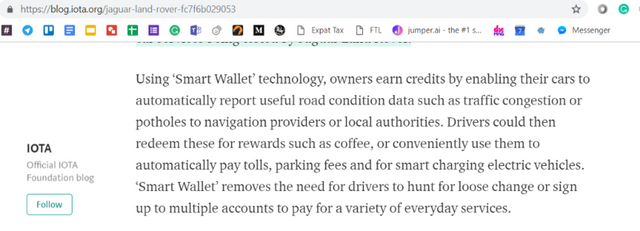

The program will see participating drivers earn IOTA (MIOTA) tokens when they disseminate important information such as road conditions, traffic gridlocks, and more. Interestingly, participating drivers will be able to redeem the earned tokens for a vast array of products and even use the tokens to pay road tolls. “Using ‘Smart Wallet’ technology, owners earn credits by enabling their cars to automatically report useful road condition data such as traffic congestion or potholes to navigation providers or local authorities. Drivers could then redeem these for rewards such as coffee, or conveniently use them to automatically pay tolls, parking fees and for smart charging electric vehicles,” explained the IOTA team via a Medium blog post.

Now, what does this exciting news mean for IOTA (MIOTA) and it’s hodlers? The latest adoption goes a long way to show that IOTA’s technology has all it takes to revolutionize the internet-of-things (IoT) ecosystem as well as the world of machine-to-machine payments.

The news has also boosted the price of IOTA (MIOTA) tokens by nearly 18 percent, at a time when most established cryptos are bleeding.

Now, onto the third news item for today! According to a report by Invest in Blockchain, citing a local Swiss news source, Watson, Iranians will be able to start transacting with cryptos in three to four months, as financial authorities in Iran are putting the finishing touches to the rules that would make cryptocurrencies legal tender in the state. According to Simon Fundel, President of the Swiss-Iranian Chamber of Commerce, companies in Switzerland are waiting anxiously for Tehran to lay the critical legal foundations that would enable them to transact with Iranian firms through digital assets, thereby incapacitating the longstanding U.S sanctions.

Fundel has hinted that the approval of bitcoin and altcoins as a legal means of payment by the Iranian central bank will throw the gates open for Swiss-based fintech firms interested in facilitating money transfers between Switzerland and Iran. “I expect the first transactions to go live in the next three to four months,” said Fundel.

Also commenting on the matter, Philippe Welti, the former Swiss ambassador to Iran reiterated that:

“The motivation of the Iranians to preserve a piece of freedom, at least with cryptocurrencies, is great. Digital currencies are a concrete alternative to payment through the traditional banking system.” Once again, the potentials of bitcoin, altcoins and blockchain-based stablecoins as a viable means of payment has been confirmed. Whether Iran and Switzerland will succeed in their new mission remains to be seen.

So what are your thoughts on this situation?

Do you think Ripple’s blockchain solutions for cross-border payments will attract more financial institutions to it this year? If yes, will Ripple’s success boost the price of XRP?

What are your thoughts concerning the latest adoption of IOTA (MIOTA) by Jaguar Land Rover? Will it spur other leading organizations to join the IOTA bandwagon?

And what do you think about Iran’s liberal stance towards cryptos? Will the nation succeed in circumventing U.S. sanctions through cryptocurrencies? Let me know what you guys think below. If you liked the content, please subscribe and watch our latest videos. It’s Cindy with CryptoPig, Catch you guys around!

Please join us at our Telegram Group and follow us.

Disclaimer: Cryptopig content is written by a team of blockchain passionate people. We are not registered as investment advisors. Don’t take the information in this post as investment advice and make sure you do your own research before investing. Cryptocurrencies are a very risky investment, never invest more money than you can afford to lose.