Making sense of the Tether situation

I've found the recent discussions about Tether to be quite one-sided, and it's been hard to find a dialogue where the argument on each side is fleshed out (before it devolves into namecalling or flies off to distant conspiracy land). I've tried to compile all the information I could find on the issue, to help illustrate what shades of grey exist between the black and the white. I hope readers will find this useful to try to determine where you stand on the issue, what level of risk you believe Tether exposes you to (even if you don't own any), and shield your funds from that risk accordingly.

Why does Tether exist?

Tether exists because there is demand for a "stablecoin", a coin that investors can move their money into during periods when they think cryptocurrencies will decline. A stable fiat currency, such as the US Dollar, would meet that demand. However, offering actual USD balances to customers means that the exchanges have to comply with the stringent anti-money-laundering (AML) and know-your-customer (KYC) laws.

Some exchanges, like Coinbase/GDAX, Gemini, or Kraken, have decided that complying with those laws is worth it, which is why you have to do things like provide them selfies and scans of your passport to verify your account. In those exchanges, you are able to hold, as well as withdraw or deposit, actual USD. They are registered financial institutions under US jurisdiction.

Other exchanges, such as Bitfinex*, Bittrex, Binance, or Poloniex, have decided that all that is too much of a hassle. You don't have to send them selfies, but this means you have to use cryptocurrency for all your withdrawals and deposits. Unable to offer you actual USD as a stablecoin, they instead offer trading pairs with Tether (USDT), which is a cryptocurrency issued by the Tether Limited corporation, which guarantees that 1 USDT will always be redeemable for 1 USD.

Belief in that guarantee is what makes the USDT price of BTC on a non-compliant exchange, such as Binance, to be more or less equal to the USD price on a compliant exchange, such as GDAX. Arbitrage, done by humans or bots, makes sure that so long as the market value of 1 USDT is 1 USD, the BTC price will also be equal in both USDT and USD.

Important side-notes about Bitfinex

- Bitfinex and Tether are both part of the same corporate entity. This is not information that either of them willingly discloses (and have denied in the past), but it has been established beyond reasonable doubt that they are.

- Bitfinex offers USD wire transfer deposits/withdrawal, bypassing the AML/KYC laws by not accepting US-based accounts since August 2017, and closing all existing US accounts as of November 2017. However, those transfers are often unreliable and you don't have to look hard to find scores of complaints about lost or frozen funds, and descriptions of USD withdrawal as "impossible".

- Bitfinex claims to offer USD trading pairs and balances, but is actually using USDT instead. This would make CoinMarketCap.com's listing of Bitfinex trading pairs incorrect, and the USDT trading volume higher than previously thought.

Does Tether actually guarantee that 1 USDT = 1 USD?

Yes (with a caveat). Many articles from last year reported on wording in the Tether terms of service that made it sound like they do not offer a guarantee. This Bloomberg article quotes their ToS at the time:

"Tethers are not money and are not monetary instruments," the company says. "There is no contractual right or other right or legal claim against us to redeem or exchange your tethers for money. We do not guarantee any right of redemption or exchange of tethers by us for money."

Tether has since changed their ToS to unambiguously provide that guarantee:

Absent a reasonable legal justification not to redeem Tether Tokens, and provided that you are a fully verified customer of Tether, your Tether Tokens are freely redeemable.

The caveat is, they only extend this guarantee to their customers. But when you try to sign up as a customer, you're met with this:

Tether explains in the linked announcement, which was issued in December 2017:

Until we are able to migrate to the new platform, the purchase or sale of Tether will not be possible directly through tether.to. For the time being, though, we invite you to use the services of any one of a dozen global exchanges to acquire or dispose of Tethers for either USD or other cryptocurrencies. Such exchanges and other qualified corporate customers can contact Tether directly to arrange for creation and redemption. Sadly, however, we cannot create or redeem tether for any U.S.-based customers at this time.

The embargo on US customers is worrying (we'll get to that later), but at least this indicates that exchanges like Binance are able to receive USD wire transfers in exchange for transferring USDT to Tether. To my knowledge, no exchange has made a statement to either confirm or deny this, but it's reasonable to assume that this claim is true. This is also in line with their previous announcement from September 2017, so it's been an issue for a while:

- Large customers are still able to move money into and out of Tether.

- Depending on the jurisdiction, smaller retail-type customers will continue to encounter difficulties in moving funds using traditional payment rails.

- Even as we begin to normalize traditional money transfer operations, we will likely soon enforce substantial minimums on the creation and redemption of Tethers.

Is Tether's guarantee backed up by fiat USD reserves?

We don't know. They very explicitly say, in their whitepaper, in their ToS, and on the transparency page that they have as many USD in their bank account as there have been USDT issued. This is also a reasonable business model to have, as they are essentially given an interest-free USD loan by holders of USDT, and are able to collect interest on those loans by keeping them in a bank.

However, there are also valid reasons to doubt their claim:

There hasn't been a recent third-party audit of those funds.

In their whitepaper, Tether explicitly say that for their "Proof of Reserves" model to work, they need to be audited:

Professional auditors will regularly verify, sign, and publish our underlying bank balance and financial transfer statement.

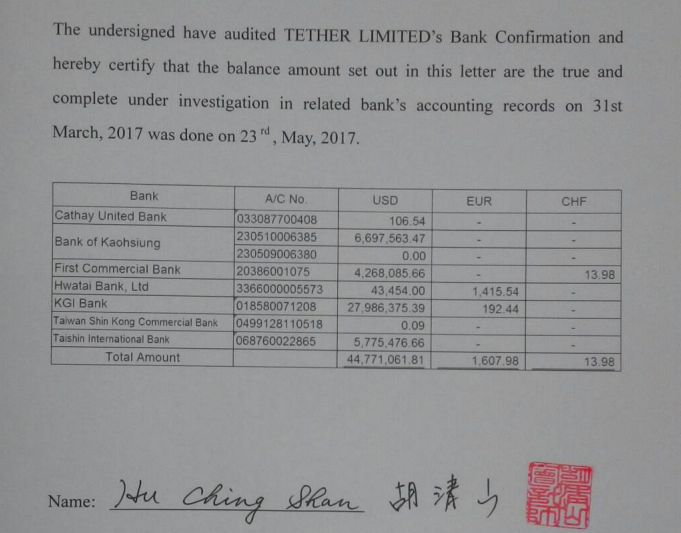

For the first few months, they published such audits, which included the bank names, the account numbers, and the balances, and all was well.

from the March 2017 audit

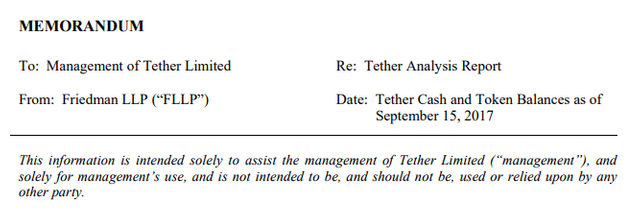

In April 2017, Bitfinex/Tether were hit with an embargo from Wells Fargo, which forced them to move away from the Taiwanese banks they were using, and the audits stopped. In September 2017, as the time passed and the pressure mounted, Tether published a memorandum compiled by Friedman LLP. This document claims that Tether had the 442 million USD in reserves to match the 442 million USDT that had been printed at that time. However, it is explicitly not an audit, as mentioned in their announcement, which states that it "[does] not constitute anaudit[sic]", as well as the phrasing in the memo itself:

it literally says "should not be relied upon"

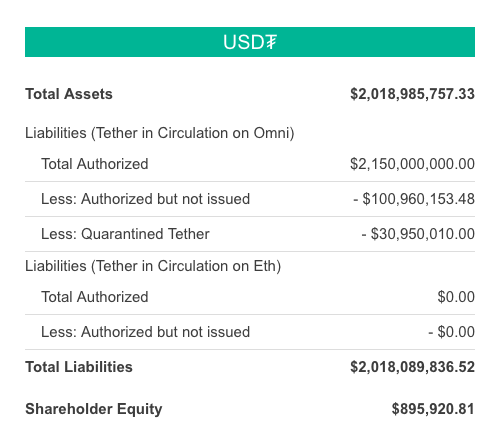

Note that in their announcement, Tether did not claim that this was an audit, but "a good faith effort on our behalf to provide an interim analysis of our cash position". There are multiple articles needlessly tearing apart the validity of the report as an audit, when it never claimed to be one. But that doesn't change the fact that you still have to take them at their word. And regardless of whether you choose to believe them, there is also another factor to consider: the amount of issued USDT has now quadrupled to 2 billion, and there hasn't been an audit since the memo was released.

from this page, as of 21st of January, 2018

We don't know where that money is kept

The published Friedman memorandum is redacted to remove references to the bank names and account numbers. This is intentional, and Tether is actively and openly trying to hide where they keep the money, as stated in one of their announcements:

we believe at this time that it would be a mistake to be too forthcoming about the specifics of any particular money transfer solution.

This is because the very nature of their Tether offering conflicts with various US regulations. As stated by Tether, there are some states in the US where Tether is outright illegal. Since the US Federal Reserve tries to exercise control over USD movements, the intermediary banks that process USD transfers are likely to refuse to process transactions that may go against US regulations. This is what happened in April 2017, when Wells Fargo started blocking transfers to the Taiwanese banks Tether was using at the time.

After filing and then dropping a suit against Wells Fargo, Bitfinex/Tether has now resorted to hiding behind shell companies, so that banks cannot identify them as the sender or recipient of transfers and block them. Some of those shell companies have been exposed, such as "CRYPTO SP. Z.O.O.", using an account in a small Polish bank.

This is the reason why Tether is currently only interacting with their biggest customers, such as the other exchanges. They can trust Binance or Poloniex with their banking details, since it would not be in their interest to publicise them (or this could be enforced with an NDA).

So while it all looks quite dodgy, there's a good reason for it. If you're a cryptocurrency investor, you're probably no stranger to taking on the risks involved in this situation. However, it's unfortunate that you're forced to take on these risks specifically when you're trying to avoid risk by having your money in a stablecoin. Not knowing where your money is held (and it is your money) also means you don't know what jurisdiction it falls under, what geopolitical risks you're being exposed to, and where and under what laws you would be able to pursue legal action if things go sour. The Tether corporation is registered in the British Virgin Islands, which doesn't help things at all.

To muddy the waters further, there has been some suggestion that the US is after Tether's funds, because some of them were deposits from the fraudulent BTC-E exchange, whose assets are subject to seizure after it was shut down by the Fed. There is also a mysterious case that's under seal in the fraud cases brought forward by the Commodity Futures Trading Commission last week. There is no shortage of speculation that the case may be related to Tether. Also interesting to note that the CFTC, as mentioned in that article, has previously sued Bitfinex for offering leveraged trading without approval, settling for $75,000.

I included this previous paragraph mainly to give you a taste of what it's like to follow the accusations into conspiracy-land, if you so choose.

This has been known for months, why raise the issue now?

Correct, this has been known for a while, and people have continued to do business with both Bitfinex and Tether just fine in the past few months. The reason it's becoming a pressing issue now is because of the rapid increase in the amount of issued USDT in the past week. But before we go into that, let's go through how USDT works.

Why 1 USDT = 1 USD

According to the whitepaper, the price of USDT is pegged to the price of the US Dollar by Tether's control of supply. There is only one direct USDT/USD trading pair, which is on Kraken, but as mentioned earlier, USDT and USD are also paired by proxy via arbitrage of the USDT/BTC and the USD/BTC markets. If there's a mismatch between those markets, e.g. BTC is being traded for 14,300 USD but only 14,100 USDT, there are automated bots, as well as humans, who will take advantage of this to buy BTC for 14,100 USDT and immediately sell for 14,300 USD. This will cause the BTC price to move towards 14,200 USD and 14,200 USDT, and helps establish that 1 USD = 1USDT.

When 1 USDT > 1 USD

When the demand for USDT rises, e.g. when crypto prices are dropping and investors are looking for safe havens for their funds, the price of 1 USDT can increase above 1 USD. This is when Tether steps in. It "grants" (creates out of thin air, basically) an appropriate amount of new USDT tokens, and sells them for 1 USD. Since the market rate is above 1 USD, there should be no shortage of buyers. This increase in supply causes the USDT price to decline, and the USD that Tether bought is now (supposedly) used to back the new USDT tokens. So far, this is sound economic theory and exactly as described in their whitepaper.

When 1 USDT < 1 USD

When the price of 1 USDT drops below 1 USD, things get more interesting. According to the whitepaper, what should happen is that traders will buy the USDT at that price (thus pushing the price upward) and sell it to Tether directly at the promised rate of 1 USD. Tether will then "burn" (destroy) those tokens, taking them out of the supply and helping consolidate the price at a lower level. We already know that redeeming USDT for USD from Tether is difficult for mere mortals who are not large exchanges, but what's also interesting is that there doesn't appear to be a record of USDT tokens ever being burned.

There is however a record of what happened when the USDT price fell below 1 USD back in April 2017, when Wells Fargo cut off ties. This is what happened to the BTC prices across different exchanges:

courtesy of @BambouClub on Twitter

Note how the exchanges using USD pairs (Bitstamp, GDAX, Gemini) have a rate that's $50 below Bitfinex and Poloniex (not shown on image, but referenced in the tweet and this article). This is what we can expect in the future if investors lose confidence in the USDT peg: the price will skyrocket on USDT exchanges and drop on USD exchanges, as people holding USDT start to panic-buy BTC to transfer to a USD exchange to sell and cash out. They take this route because withdrawal of USD from Bitfinex or redemption for USD from Tether do not appear to be viable options for mere non-high-value mortals, as we've already established. There is also the USD/USDT market on Kraken, but it won't have the liquidity to handle large sales of USDT.

Getting back to the present day...

OK, so here's what happening now: in the past week, Tether has created 650 million USDT tokens, granting 100 million every day for 6 days. This can be viewed on the USDT blockchain. Throughout the last two months they have granted over 1.3 billion USDT, bringing the total up to just over 2 billion. Keep in mind that the NYT, Bloomberg, and Fortune Magazine were already ringing alarm bells when that number was at 500 million, and we're 4 times that now. The rate at which they were issued in the last week is also unprecedented, and getting quite ridiculous, frankly.

So? You just said that's how it's supposed to work.

Correct. As long as they've been receiving fiat USD for every USDT they created. If you believe that Tether has 2 billion USD sitting in an undisclosed account in an undisclosed bank in an undisclosed country, you can stop reading now. If that is true, there is no cause for concern.

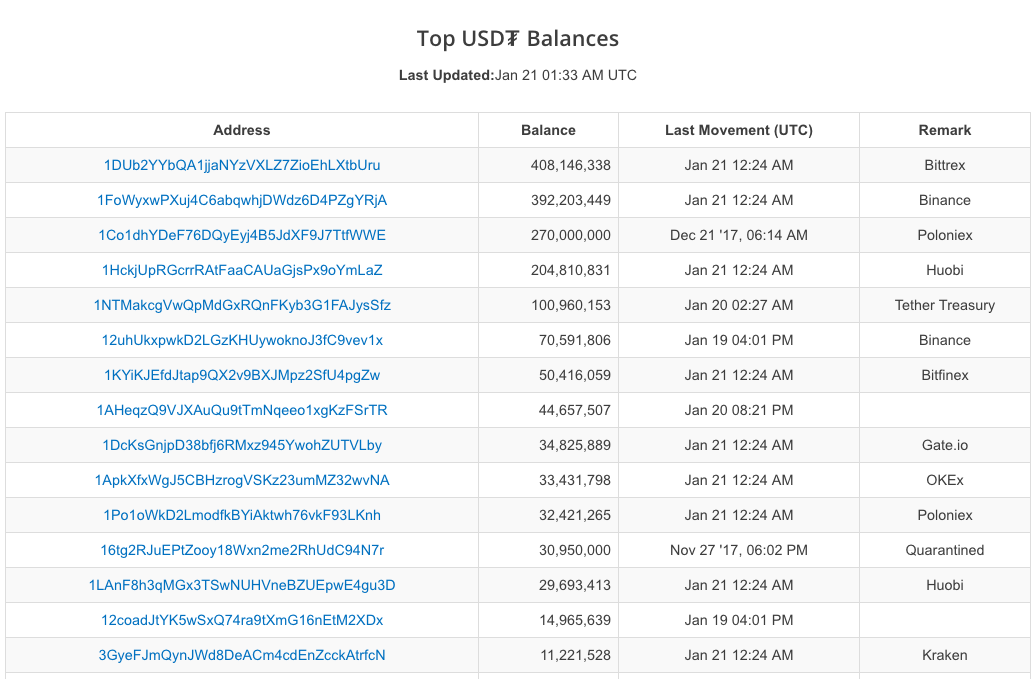

I'm actually not being facetious or trying to call anyone naïve, there is good reason to believe their claim. This is the USDT "richlist", the largest current holders of USDT:

Over 1.5 billion USDT is currently in the wallets of exchanges unaffiliated with Tether: Binance, Bittrex, Poloniex, etc. These are now large corporations, matching or even eclipsing Bitfinex in size. They are also the ones with the knowledge of where the Tether bank account is, and have probably been shown proof of funds. They are the ones currently holding most of the bag on USDT, carrying most of the risk, and they're unlikely to have done that without demanding and receiving concrete assurances.

There is also this poorly translated article from today, alleging that in the course of courting the BigONE exchange into using USDT, Bitfinex/Tether have shown them evidence of 2.9 billion USD in total fiat holdings. Unfortunately, this is not a very reliable source, and there isn't even any information about what country BigOne is based in. So it requires taking with a massive grain of salt, but it's something.

Also, if Tether were some kind of exit scam, it would be in their interest to have the fiat holdings they claim to have.

OK, so what if they don't have the money in USD?

Then, they're practicing what's known as fractional-reserve banking, where they only maintain a fiat reserve of a fraction of their liabilities. There's both a good side and a bad side to this.

The good side is that this is a standard way of operating for banks. In the US, banks are only required to keep a reserve of 10% of what they owe. If Tether's last "audit" was accurate, that would put them at a reasonable 20% at the very least.

The bad side is that US banks are able to operate at 10% reserves because the Federal Reserve acts as a guarantor for their debts. If a bank were to collapse, account holders would be paid off (up to $250k) by the Fed. This guarantee does not exist for Tether, meaning that if the market drops sharply, or faith in USDT collapses, holders of USDT will be left with nothing, and with no recourse for seeking damages. They could try flying to the British Virgin Islands and lodging a suit, but that's probably an exercise in futility.

OK, so as long as the market doesn't crash, it's all fine?

Yes, but first of all, the likelihood of a crash isn't particularly low right now, and secondly, Tether's actions may in fact be contributing to that likelihood. Every single issued USDT that isn't backed by actual USD falsely inflates the overall market cap, and props up BTC prices at unnatural levels.

if those 2 billion USD are revealed to be non-existent in a "bank run" on Tether that extends past their reserves, then 2 billion will instantly vanish from the overall market cap, bringing down prices across the board as valuations are adjusted. 2 billion may seem insignificant in comparison to the current 500 billion market cap, but you need to keep in mind that those 500 billion do not accurately represent the money that has entered the market. Many billions need to be subtracted to account for lost wallets, for initial holdings of founders that they acquired for free, for large wallets that cannot be cashed out without sinking the price, etc. The fraction of the total market cap that is actual money that has entered the market is anyone's guess. Could be as little as 10 billion. After all, people keep saying that the institutional money hasn't arrived yet.

Meanwhile, the 2 billion USDT that was wiped out, by its very nature, does represent USD that's supposed to have entered the market, and may be a fairly large proportion of it. Even if you don't hold any USDT or have holdings on exchanges that use USDT, you would be greatly affected. And this is before taking market sentiment into consideration, which would have a huge impact as trust in the market is lost.

What if instead of 2 billion USD, Tether was holding 2 billion's worth of BTC?

This might actually be even worse, and it's alarming how likely this scenario may be. It wouldn't be much of a stretch to presume that some of the funds that Binance/Bittrex/Poloniex, and especially Bitfinex, send to Tether in exchange for USDT are actually in the form of BTC, instead of USD. This is a problem because it provides Tether with powerful incentive (and ability) to manipulate the market, artificially inflating it. This is the scenario that doomsayers like Bitfinex'ed have been on about.

When Tether receives BTC in exchange for USDT, they are essentially buying BTC with imaginary money. This pushes the BTC price up without money entering the market. And once Tether receives the BTC, they are now exposed to losses if the price drops below the amount of USDT they got it for. They now want to prevent the price of BTC from dropping. Well, we probably all do, but Tether has the actual ability to make it happen. By creating more USDT and buying more BTC, they can push the price of BTC up further, again, with imaginary money. With the ridiculous amount of USDT they're been granting recently, they are able to have a significant effect on where the price of BTC is going.

Now this is where you have to decide how much of a pessimist and/or conspiracy theorist you are. People like Bitfinex'ed and most of the /r/Buttcoin subreddit believe that this artificial pumping has been going on for months, and that without it, BTC would have already crashed. They propose that every time the BTC price takes a nosedive, Tether injects USDT into the market, turning it around, and preventing a long-overdue crash. Keep in mind that via Bitfinex, Tether can essentially sell BTC to itself.

They point to the timings of the USDT grants as supporting evidence, but this isn't as clear-cut as they present it. To exercise proper due diligence, I decided to generate my own graph of the BTC price and the USDT grants, just to make sure they're not misrepresenting the data:

the orange lines are 25 million USDT grants, green ones are 50 million, and blue ones are 100

And here is a closer view of this past week:

an interactive version can be found here and the grant times and amounts are sourced from here

Personally, I don't see much of a pattern. Yes, some grants precede price spikes, but others come right after, and there are many outliers. It's fair to say that the latest market correction has prompted a frenzy of grants, and that the market started turning around as they began being issued. However, I'd rather not speculate, and leave you to draw your own conclusions from the data.

Whoa, this is totally a conspiracy, how deep does it go?

Well, if you're keen on heading towards conspiracy-land, here are some paths to explore:

- Bitfinex refused a 1 million USDT withdrawal request. This reddit thread may or may not be by the same person, who indicated that some of it may have been tainted darknet money, and commenters called him out in it. They could be paid shills though.

- The non-Bitfinex /Tether accounts on the richlist may or may not be still under their control, deciphering the blockchain is hard.

- There will never be an audit, because it would reveal past misdeeds.

- Info on previous "runs" on USDT and a spreadsheet that predicts how close we are to the next one.

- Bitfinex might be buying USDT and using it to fund margin calls.

- Gee, this looks pretty suspicious:

- After Bitfinex was hacked and lost 72 million USD, they passed the loss onto their customers, and issued BFX tokens, that served as I-O-Us that they would eventually purchase back to repay those customers once they could afford it (this is all factual so far). But they may have created a Ponzi scheme instead.

- Ever since the buyback the BTC price may have been inflated and Bitfinex has had to double-down on it to keep it from falling ever since.

- Bitfinex may have been spoofing their order book and manipulating prices by wash trading.

But that's not my thing. I'll wait here.

I do hope I managed to get across both sides of the argument in this article, so you can make your own decision. Thank you for your attention.

Thanks for this post. I always thought Tether was a stable coin. I had no idea it was such a scam!

Nice article. On one hand I worry a great deal about Tether and that they either can't or don't want to get an audit done. On the flip side I think that even if it collapsed at its current size it is smaller than MtGox was when it happened and the whole Bitconnect fiasco lost essentially that much in market cap and still we chug along.

My bigger concern is that I feel like we really need something like Tether but with real transparency run by a company willing to be regulated. Note that the regulation doesn't have to be government. It could be a consortium of all of the major exchanges and possibly some other large businesses that can keep each other in check.

It is interesting to think about the current state as far as exchanges go. If there is no way to change USDT to USD on an exchange then it probably doesn't matter much to the exchange. For instance on bittrex you can wire a minimum of 100k to have them purchase tether for you. Assuming they wire the money to tether and then receive and credit you with 100k USDT they lose nothing if the value of USDT goes to .01 the next day. If someone sends in 100k tether and then buys BTC it isn't as if bittrex sold them the BTC. It is another customer that now holds that tether and again if they become worthless it really isn't the exchanges concern since they never told you you had dollars in your account.

Mitsubishi Bank is introducing MUFG in March as a stable coin. They have the backing, assets, and recognition to actually succeed, unlike Tether.

Had Tether been more transparent I think they could have pulled off going from nothing to bank of the world. But now they have apparently parted ways with their auditor so not looking good.

I look forward to someone stepping up to have a truly stable coin.

Nice contribution and indeed a needed grounded approach. I think it's impossible to judge because there is just too much data missing, so I think you did a good job describing bringing this in a neutral way.

This is the best article on the internet I've ever read! Thank you.

One point about the "richlist" is not to forget is that the Tethers in those addresses most likely don't belong to the exchanges themselves but rather to their customers.

Yes, thank you. It hadn't occurred to me until someone pointed it out.

"Tether will then "burn" (destroy) those tokens, taking them out of the supply and helping consolidate the price at a lower level."

Tether Co. does not have to explicitly burn USDT to remove them from circulation, all they need to do is refuse to sell USDT and they achieve the same effect.

Regardless... minting more and more USDT in a sideways market shouldn't be necessary... so, why in the hell are they doing it?

Excellent post. I suspect Tethers will not lead to systemic risk and in all likelihood are backed 1:1. I believe the skeptics overplay their hand in underestimating the number of whales that trade on Bitfinex and other tether enabled platforms. I have seen large volumes of new money flow into these exchanges. Given the profitability of exchanges in these volatile markets, it is furthermore likely Bitfinex is earning in the tens of millions monthly.

A really well balanced, thoughtful presentation of a difficult subject. As adverse as I am to conspiracy theories by-and-large, you can't help but wonder!

Good write-up! I appreciate your approach to this subject.

I spotted this on reddit and wanted to say hello.

The fact that registrations are still offline is the major red flag for me. Smells fishy!