Why did Bitcoin dump? Bitfinex Tether New York lawsuit

Bitcoin has been looking very bullish lately, as noted in my previous post here:

https://steemit.com/crytocurrency/@cryptoweekly/major-bullish-signal-for-bitcoin-imminent

However, it suddenly experienced a sharp decline in price, briefly wicking/touching below $USD5000 before quickly rebounding to above $USD52000. At the time of writing, according to Coinmarketcap (CMC), Bitcoin is currently trading at $USD5293.77 slowly edging up.

Many attributed this sudden price movement to the news that the state of New York has filed a lawsuit alleging that Bitfinex broke the law when it turned to Tether for a loan when Bitfinex was facing liquidity issues and to cover their losses. This could have major ramifications for the crypto market if faith and trust and lost in Tether.

So should you be worried about this or is it just FUD (Fear Uncertainty and Doubt) which will blow over in a couple of days?

One of the benefits of a lawsuit is that the filing provides a lot of transparency and it lays out the evidence which the attorney general has and spells out why there is alleged misconduct.

In the filing, the Attorney general of New York alleges "ongoing fraud being carried out by Bitfinex and Tether". At the heart of the claim is the allegation that Tether reserves are used to cover Bitfinex's losses to the turn of "at least $USD700 million".

This is very significant in relation to Tether as it is supposed to be 100% backed by reserves. Prior to March 2019, according to the tether website, tether.to, it is supposed to be backed 100% by currency, but the wording was changed to the below:

The highlighted wording of "receivables from loans" is extremely significant as it changes the nature of Tether. The appeal of Tether is that it is a stable coin because it is supposed to be backed by currency. So in theory, when I go to purchase $USD1000 of Tether, there should be $USD1000 held in Tether's reserves, so that when I choose to redeem my Tether back into fiat, it is there and there shouldn't be any issues.

The problem of adding "receivables from loans" into the reserve wording means that credit risk is introduced to the system. So now, instead of being 100% backed by currency (eg a pile of cash sitting in an account) Tether has loaned out some of that pile to third parties. What if those third parties default? Then my Tether would not be 100% backed then.

Furthermore, the introduction of the "other assets" into the reserve wording can also be problematic as that can mean Tether is now using that pile of currency it is supposed to be keep safe to back each Tether to purchase other assets, which may decrease in value. So what happens when third parties default and the "other assets" they purchased with the reserve funds decrease in value?

Tether appears to be running on a system of fractional reserves, very much like how banks operate. Banks take deposits from savers and then loans the money out as mortgages, credit cards and other loans. So the money savers deposit are never backed 100% by currency.

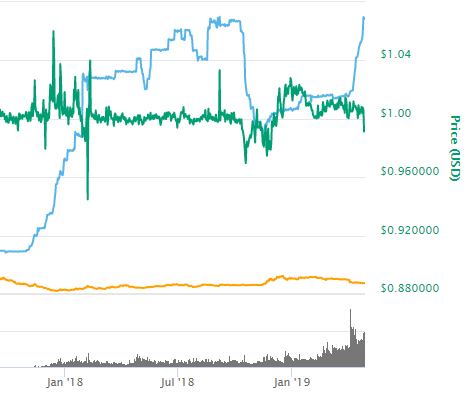

This can erode the faith of Tether. If that happens, holders of Tether could start a bank run and try to convert their Tethers into fiat. Many crypto commentators fear that this can cause the cryptocurrency market to collapse, however I think this is unlikely to happen as the crypto space has growth to enough of a size to be able to absorb this kind of shock. It may cause a pull back in price in the short time, but it would not be as impactful as the Mt Gox was to the price of Bitcoin when it was hacked. At the time of writing Tether appears to be holding steady with no sign of a bank run:

The whole problem started when Crypto captial withheld about $USD850 million worth of Bitfinex's funds saying it has been seized by various governments include the US and Portugal. This is disputed by Bitfinex.

Tether FUD is not new, do you think Bitcoin can shrug this off and continue its climb higher?