Proof-of-Stake (PoS) CryptoCurrencies Market Cap

The original article can be found at CryptoStone Report . Please sign up for the newsletter and stay tuned with our new posts.

Proof-of-Stake (PoS) and Proof-of-Work (PoW) are two different algorithms to validate transactions and achieve distributed network consensus. Since each user can directly verify the information, no third-party services is needed when the peer-to-peer value transfer (i.e. sending and receiving money) occurs in such a trustless and distributed consensus system. PoW algorithm rewards miners who solve the mathematical problems in order to create new blocks and validate transactions. On the other hand, PoS algorithm validates transactions and creates new blocks in a deterministic way, which depends on the wealth (also known as "stake") of each block creator. In the anology of Proof-of-Stake system, the block creators are called "forgers" instead of "miners". Forgers take the transaction fees.

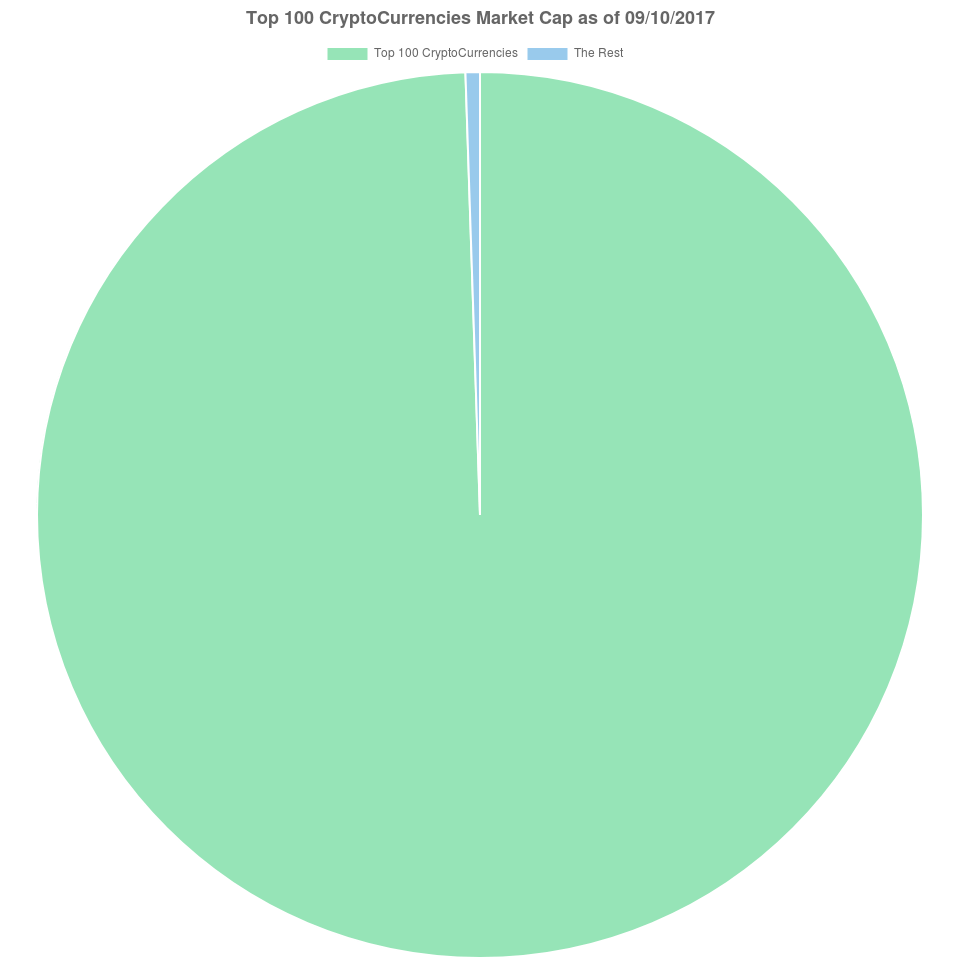

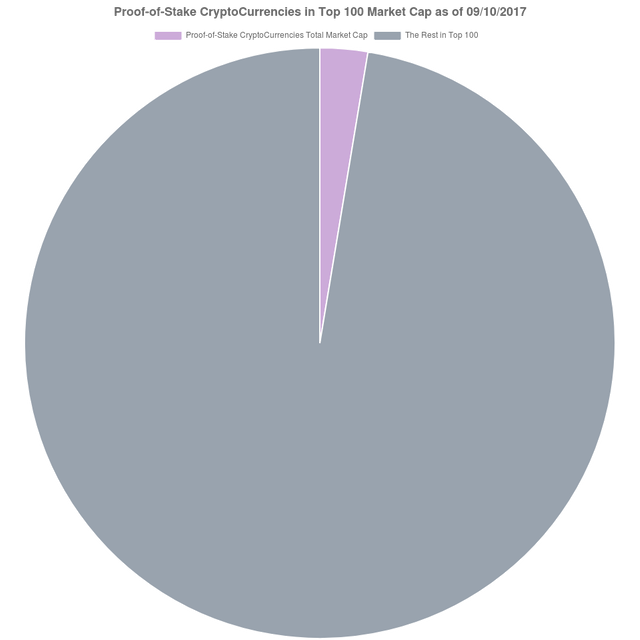

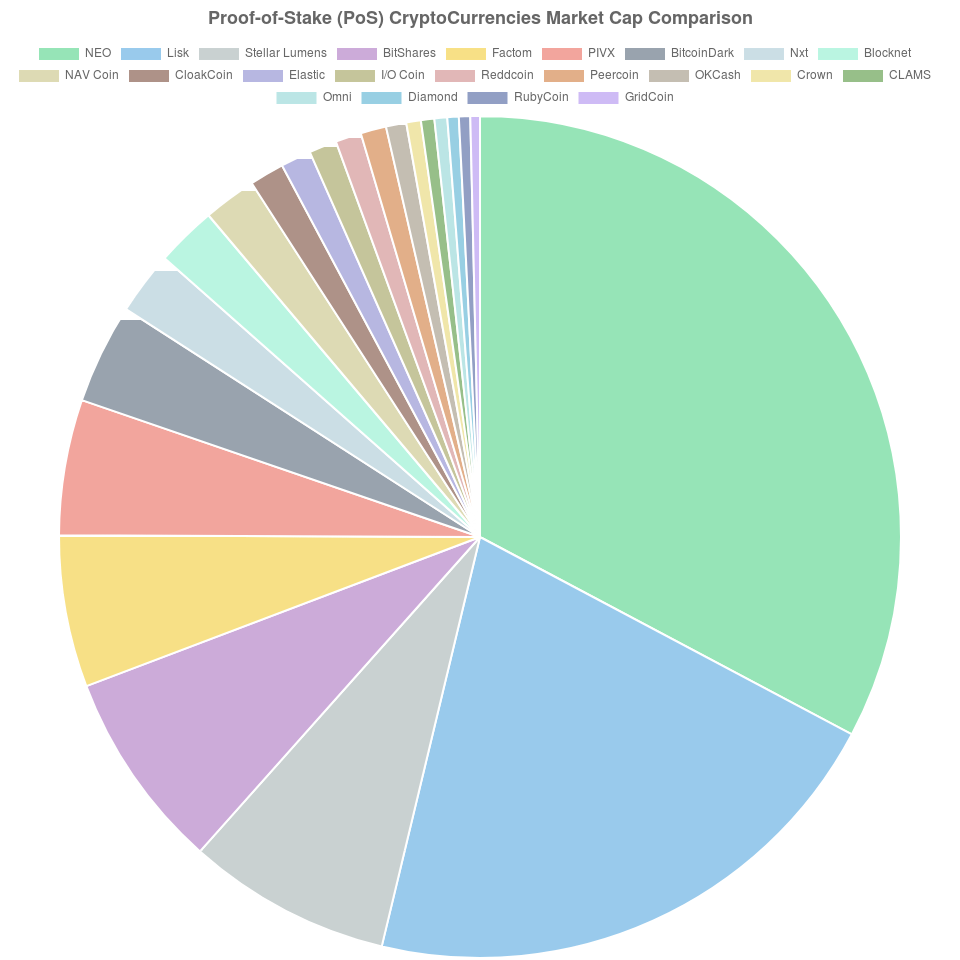

Comparing to it energy intensive counterpart Proof-of-Work (PoW), Proof-of-Stake (PoS) only has a significantly less support in cryptocurrency community. This report will give a brief overview of major PoS cryptocurrencies and their current market cap. According to CoinMarketCap.com, we have 866 different cryptocurrencies (excluding ERC20 tokens alike) as of 09/10/2017. Top 100 cryptocurrencies take up 99% in market cap. It would be reasonable enough to take a look at all major Proof-of-Stake cryptocurrencies within Top 100.

All major PoS cryptocurrencies roughly count 3% of all market cap as of today.

Leave you comments below, and we would like to know what you think of PoS and its future presence in cryptocurrency. Please sign up for the newsletter and stay tuned with our new posts.

Thanks for sharing... Love it.

Thank you :)

Congratulations @csreport! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!