The market metric: Wealth Per Follower

The main problem of crypto investors is the lack of reliable financial metrics. In the world of stocks, we have many methods to determine the quality of our investments. Some of them are based on company's earnings ratios. But crypto markets are different.

So we can develop new metrics. I created one called WPF (Wealth Per Follower). The formula is very simple:

Why does it matter and what we can learn from it? Well, it literally tells us how rich is the average follower (Twitter follower in this case).

I think that old coins with high WPF values are conservative investment tools. This means that most likely they will grow at about the speed of the market.

And new high-WPF coins are obviously overbought because they don't have a good distribution yet. And when people become too rich they start to sell.

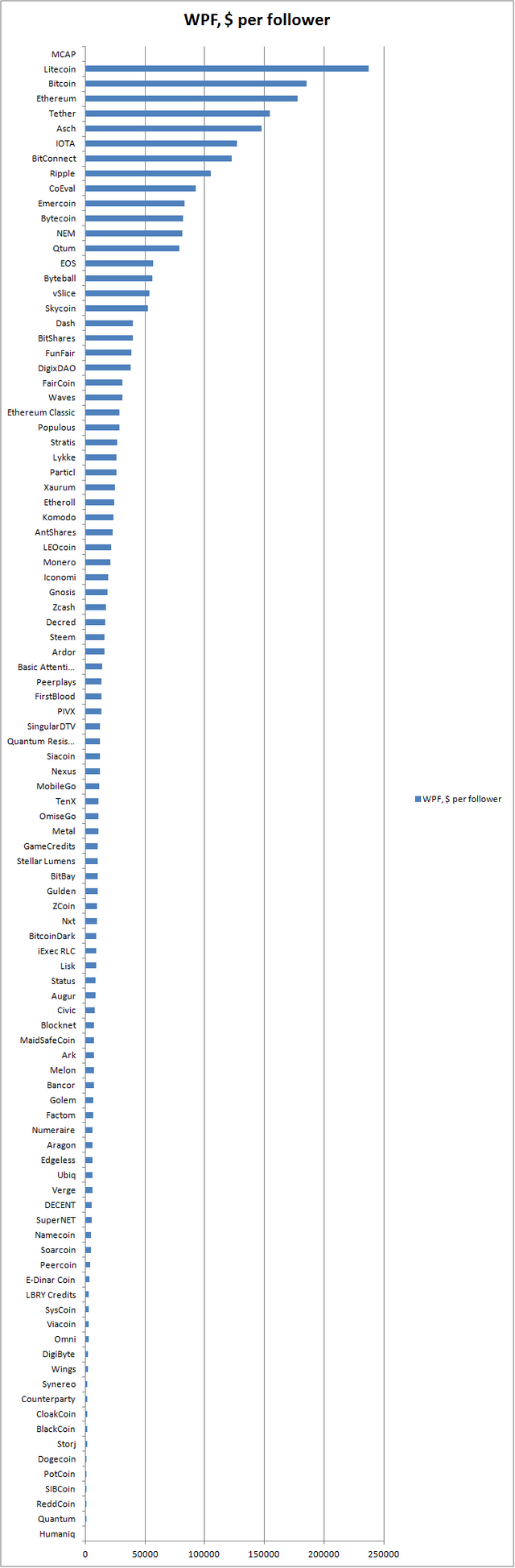

Let's look at the table of top 100 (data from coinmarketcap.com):

Let's look at some exceptions and interesting cases.

MCAP

WPF value is too high. It is twenty times higher than Bitcoin's, so it looks totally unhealthy.

Tether

Obviously, this is a special case because we don't need to consider it as an investment instrument. However, we can say that the average crypto trader (typical user of tether) has $ 150000 deposit.

Bitcoin, Ethereum, Litecoin, Ripple etc

The elders with high WPF. Litecoin seems little overbought compared to Bitcoin. But many people have huge expectations about this coin.

IOTA, Bitconnect, CoEval, EOS

According to the metric, these projects seem to be bad investments for now.

Stratis, Steem, Pivx, Factom

These are my favorite projects and they seem ok.

Storj, Omni, Counterparty, Syscoin etc.

Old enough and have great potential for growth.

Dogecoin

Wow, it was a little surprise. Huge fan base, but extremely low capitalization. I think it's a very clever decision to buy a few Dogecoins now.

Conclusion

Of course, this metric is far from ideal and can be improved. For example, we can find a more accurate way to determine an actual count of holders and take into account the lifetime of a project. But even now it seems to be pretty helpful. I'll try to keep this list updated and also improve the formula. Stay tuned!