Why the Bitcoin & Crypto Market Remains Bearish in 2019

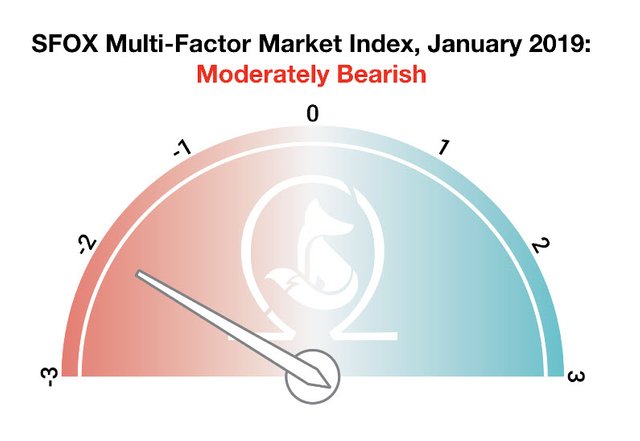

Source: SFOX Volatility Report However, unlike many price predictions based on the instincts of even the most credible CEO or economist, the SFOX Volatility Report is based on more than just sentiment.

The cryptocurrency dealer and market analyst takes into account trading volume, price, and volatility data from eight major exchanges. They then come up with an index by analyzing three major factors: market sentiment, volatility, and how the sector, in general, is advancing.

Throughout 2018, this index ranged from highly bullish to positively bearish with November and December the most volatile months on record.

What Drove Volatility in 2018?

A hellish November aside, SFOX pinpointed two other major periods in the year when cryptocurrency volatility saw increased spikes. These were between January and late February and mid-August through September. What happened to send the markets swinging? A whole bunch of external events placing pressure on prices.

To start with, towards the end of January there was a major hack on Japanese exchange Coincheck. Thieves made off with north of $500 million in NEM. China began to talk about banning cryptocurrency, and Facebook prevented ICOs from advertising on its social media platform.

To add insult to injury, concerns rippled through the industry about Bitfinex and Tether. Their alleged role in manipulating the market during 2017’s late rally was thrust into question as both companies were handed a subpoena by the CFTC. SFOX notes:

From Jan 28 to Feb 6, the price of BTC dropped from $11,670 USD to $6,828 USD.After a sensational year for crypto in 2017, the 30-day historical volatility of Bitcoin in early 2018 went from 117 percent on Jan 28 to a whopping 139 percent on February 17. Naturally, all major crypto assets followed suit.

The Next Major Sucker Punch: Mid-August through September

During this time period, all crypto prices began to spiral once more due to a series of external events. This time around, it was the SEC that seemed to have the biggest influence on crypto’s downturn. In August, they delayed a much-anticipated Bitcoin ETF decision and later rejected a further nine more. They cited concerns over “market manipulation” and insufficient regulation for this.Moreover, Coinbase CEO and newly-turned crypto billionaire Brian Armstrong dealt the industry a cold hard dose of reality on August 15. He came out in an interview with Bloomberg telling people that mass adoption was much further away than people realized.

A subsequent dip starting September appears to have been caused by one single entity unloading almost $1 billion of BTC on the market.

While Bitcoin’s volatility certainly spiked between this period, altcoins went on a bigger rollercoaster ride. Litecoin volatility soared from 56 to 92 percent over 30 days, while ETH went from 52 to 98 percent.

Bitcoin is Less Volatile than Other Crypto Assets

Despite the 80 percent drop since late 2017, Bitcoin is actually the least volatile of the major crypto assets. As the biggest cryptocurrency, Bitcoin serves as what SFOX calls a “crypto volatility index” by which to measure altcoin volatility.

Taking into account the volatility of BCH, ETH, LTC, and BTC, BCH had by far the highest number of large swings in volatility relative to BTC.

ETH, on the other hand, had the biggest total range in volatility compared to BTC (88 percent compared 317 percent).

SFOX points out:

While volatility doesn’t inherently warrant avoiding an asset class, it does contribute to the risk of entering or trading that asset class.

There’s No Correlation with the Stock Market

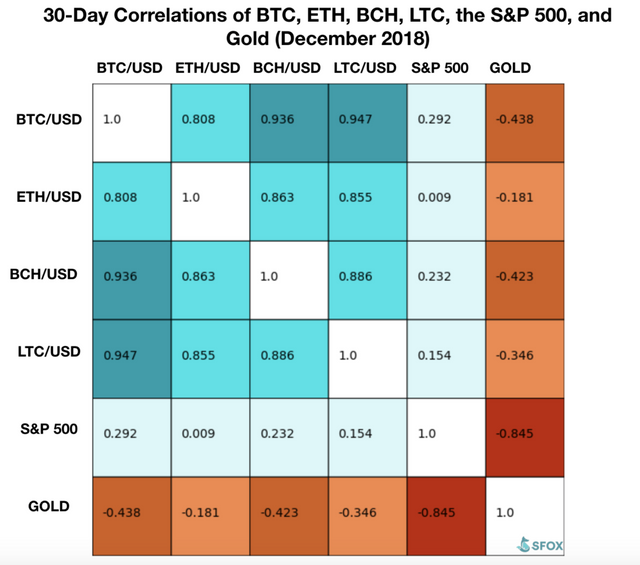

Despite the multiple analysts attempting to correlate crypto to the stock market, SFOX found absolutely no correlation in December — or, indeed, throughout the rest of the year.

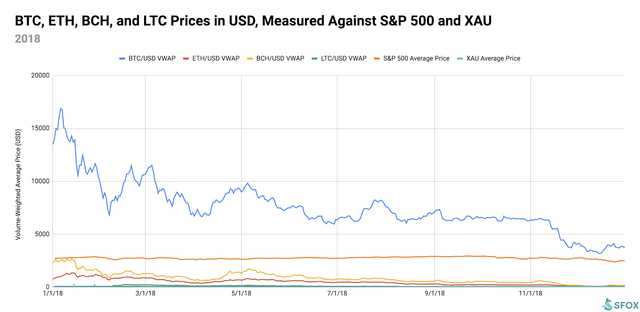

Source: SFOX Volatility Report All crypto assets listed on SFOX demonstrated more volatility than the S&P 500 during the whole year. There was one exception, and it was during crypto’s most volatile month. In November, even gold was more volatile than Bitcoin.

Source: SFOX Report “BTC, ETH, BCH, and LTC maintain strong, positive correlations with each other; they are largely uncorrelated with the S&P 500, and slightly negatively correlated with gold,” the report said.

Market Sentiment: People are Bored of Crypto

Perhaps unsurprisingly after a rampant 2017, interest in cryptos dwindled in 2018. However, this seems to be piquing again slightly thanks to the recent uptick in crypto volatility (they’re interesting again!).Industry insiders are undecided over whether the market has bottomed out. Some analysts are calling for a $1,500 floor while others believe that $3,000 will be lowest.

While talk around the dinner table has diminished in 2018, institutional investors are increasingly adding crypto to their list. It seems that 2019 will see more blockchains becoming useful, (even if they are a bit boring).

Continued Advancement of the Sector

Here’s where crypto enthusiasts can take heart. Prices may be in the gutter, but 2018 saw massive technological advances in crypto. Not only companies but governments and regulators worldwide made moves to bolster the sector, from Malta and Switzerland to the US.

As Walmart and Wall Street begin to get in on the game despite the moderately bearish sentiment for the start of the year, development in infrastructure remains constant. And that’s a good sign for the industry in general.

What to Look Out for in 2019

A potential economic recession could have a profound impact on the crypto market, SFOX said. As we can see from the SFOX report, the market is susceptible to external events, regulation, and institutional investment. According to SFOX, the following key factors will have an effect on volatility in 2019.

ICOs, STOs, or Whatever Acronym You Prefer to Use

Initial coin offerings have seen a sharp decline since 2017. But as the new wave of ICOs regulated by the SEC (or STOs to be more accurate) comes into play, this could affect ETH volatility. While 2017 saw a veritable plague of unregulated ICOs, with rules in place, this could send ETH volatility skyrocketing again.Crashing Stocks and US Recession

Nearly 50 percent of all US CFOs are projecting a national recession by the end of the year. Seeing as crypto has no correlati0on with the stock market, SFOX believes that a recession could actually have a positive impact on demand for cryptocurrencies. This would drive volatility, particularly in BTC.Speculation Over New Products

Delayed decisions over Bitcoin ETFs and their influence on volatility will be a continued trigger to watch for in 2019:If the ETF specter rears its head again, or if similar sorts of speculation about new crypto instruments emerge, we could potentially see concomitant shifts in volatility.2017 was all about noise and hype and raising uncapped funds. 2018 was a big disappointment all around. And while we’re not yet sure what’s in store for 2019, it seems that institutions are likely to have the biggest impact of all.

Featured Image from Shutterstock

Posted from my blog with SteemPress : https://bittreat.com/why-the-bitcoin-crypto-market-remains-bearish-in-2019/

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.