Stablecoins: An Overview of Tokens that defy the Waves of the Markets / Bitcoin Cash: Happy Fork Day! 32MB

As the crypto prices fall and sometimes increase, it is convenient to park values in stable tokens. Stablecoins, which have been on the market for some time now, offer traders an ever-increasing choice. I introduce some of them.

With Gold Cover

CryptoGoldCoin:

The newest Stablecoin is the CryptoGoldCoin. It is published by CryptoGold, a provider of mining contracts based in Dubai, but operated by Germans. Among the cloud miners, CryptoGold is considered to be relatively reputable and reliable.

CryptoGold has now published the CryptoGoldCoin (CGC) in cooperation with the Cologne gold dealer "Deutsches Edelmetallhaus". Each unit of this coin is represented by 0.02 grams of gold. The gold is stored in the vaults of the German precious metal house and insured by the insurance company Allianz. From 100 grams, the gold will be sent on request by mail.

The CGC is an ERC20 token on Ethereum. To make it easier for users to use it, CryptoGold has developed a special wallet for it, which unfortunately only exists for Windows and OSX. This wallet is the basic requirement to use the CGC. When you transfer the tokens, a small fee is payable in CGC that is not paid to miner or anyone, but destroyed. Thus, according to the white paper, the number of CGC should decrease over time, while the amount of stored gold remains stable. So should the weight of gold, which represents a CGC, increase in the long term.

So far, 334,000 CGC have been created, which corresponds to about 7 kilograms of gold.

Digix DAO:

The Digix DAO promises to reach a gold-covered Stablecoin decentralized. DAO stands for "decentralized autonomous organization" and means that there is no central basis in the provision of a service - as with the CryptoGoldCoins of the German precious metal house - but only a decentralized organization managed by smart contracts.

However, the gold tokens themselves are not fundamentally different from other centralized gold tokens because they represent a certain amount of gold (1 gram) deposited by a company in a safe. The DAO, which is run by the owners of the Digix Dao Token (DGD), does not appear to be responsible for depositing the gold, but merely examines the onchain activity of Digix and actively participates in advancing the project. So whether the Digix DAO actually upgrades the concept of gold tokens, is likely to be questionable. But it manages, after all, to create a stable value in the stormy crypto markets.

With Dollar Cover

Tether:

We already know Tether: US dollars, which are supposed to be in the accounts of unnamed banks, and will be transferred to Bitcoin or Ethereum in token. Despite many doubts about publishers associated with the Bitfinex exchange, the Tether dollars hold their market value of $ 1 and are so heavily in demand on the exchanges that they are now one of the most widely traded cryptocurrencies. But it seems like Tether is getting competition from two projects.

True USD:

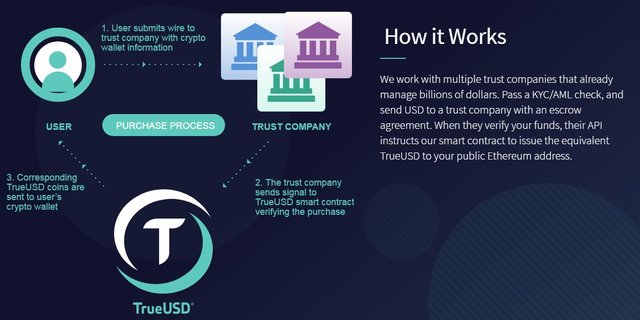

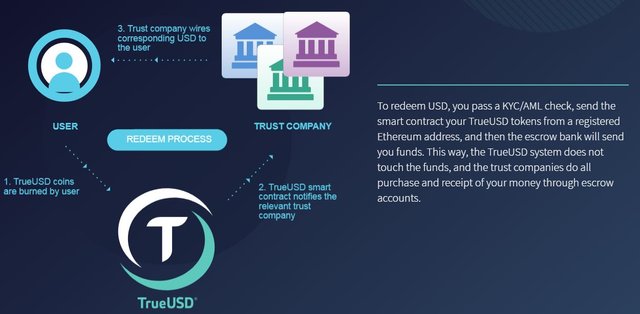

Recently Binance and Bittrex are trading not just USDT but also a TUSD. This abbreviation stands for the "True US Dollar", which was created by the company Trusttoken.com. In itself, the TUSD works the same as the USDT, except that not one company, but a consortium of companies deposit the money in different bank accounts to issue the True Dollars as ERC20 tokens.

The companies of the consortium will use several trust accounts, and regular audits will confirm that the dollars actually exist. The users who use the TUSD should prove their identity by KYC procedure.

The TUSD should actually be traded on May 18th on Binance. This was postponed to May 21st. For several days now the TUSD is tradable on Bittrex and Binance. The volume seems to be low at the moment.

Circle US-Dollar Coin

The crypto wallet Circle recently announced that it is issuing a USD Coin (USDC) in partnership with major miner Bitmain. Again, the dollar tokens correspond to the dollar deposits in a bank account. The USDC seeks to provide an open regulatory framework that can be accommodated by any financial institution to issue such a USDC through ERC20 tokens.

DAI Stablecoin

The most interesting thing I've picked up for today is a decentralized version of the centralized dollar trustee - the DAI Stablecoin on Ethereum. DAI is a kind of DAO, a decentralized autonomous organization in which the owners of special tokens (maker tokens) are responsible for ensuring that the DAI tokens are in parity with the dollar. That's why the organization is called Maker-DAO. It should be one of the first truly functioning DAOs.

"Dai," writes Airfox CEO James Seibel, "is a masterpiece of game theory that carefully balances the economic incentives to achieve a goal": to create a $ 1 token. The white paper explains how it works: A dynamic system of collateral debt positions, automatic feedback mechanisms, and incentives stabilize the DAI tokens. To establish DAI tokens, the owners of the maker tokens must deposit counterweights through an Ethereum transaction, which are then frozen according to the value of the tokens. Depending on how Ethereum trades, the Maker ethers need to add or subtract Ether to hold the value of the DAI.

I do not quite understand how exactly it works, but it seems to work amazingly well: according to Coinmarketcap, the price of the approximately 38 million DAI tokens oscillates around one dollar each. Thanks to the DAI tokens and decentralized exchanges on Ethereum, it becomes possible to swap all tokens on Ethereum, including the ethers, for a token-linked token - without relying on any central middleman in this way.

A maximum block size of 32 megabytes, larger messages in the OP_Return field, and a handful of new opcodes: Bitcoin Cash made another hardfork on May 16, 2018. Negative side effects do not seem to have occurred so far.

Some call it hardfork, the others an upgrade: Few things evoke so much disagreement as the network wide, not backward-compatible rule change at Bitcoin. While Bitcoin developers themselves are still shying away from using a hardfork because they fear they will be able to split the network, Bitcoin Cash developers understand hardfork as a very normal tool to further develop the protocol.

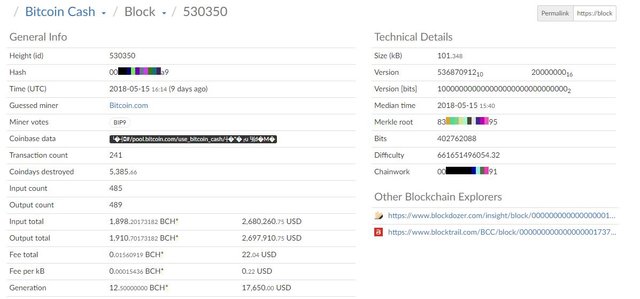

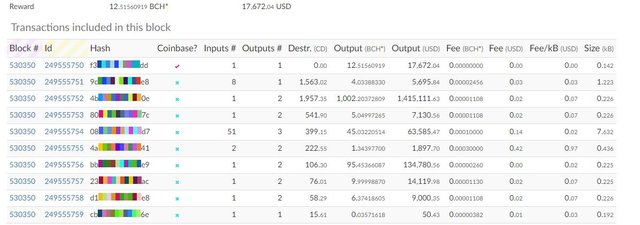

On May 16, 2018, they once again demonstrated that hardfork, at least for Bitcoin Cash, is actually just a way to upgrade. At block 530.350 the hardfork was initiated, six blocks later the changes to the rules were activated. Nodes that have not upgraded will no longer be part of the network as soon as a block appears that uses the new rules.

The hardfork has three main changes:

First, the maximum blocksize is increased from 8 MB to 32 MB. For everyday transaction patterns, this means that Bitcoin Cash has the capacity for about 11,200,000 transactions a day or 130 transactions a second. So far, not much has been used. On average, Bitcoin Cash has about 0.3 transactions per second, or about 20,000 a day. A good visualization of this somewhat sad state is the website TX-Highway again. The highway has been extended to 32 lanes, although as far as the eye can see only one car is visible.

Second, the size of the standard messages in the system is increased from a maximum of 80 to up to 220 bytes. This is especially important for OP_Return, a popular method for writing messages to the blockchain. OP_Return is used to bring tokens such as Colored Coins or Counterparty on the blockchain and has been known lately mainly by Memo.Cash, a kind of Twitter on the Bitcoin Cash Blockchain. Thanks to the hardfork fit now 220 instead of previously 80 characters in a memo. As the screenshot below shows, this is already being used extensively:

The third part of the hardfork is the hardest to understand, but most importantly according to the developers: a number of opcodes that were originally in Bitcoin code but have been turned off have been reactivated. Opcodes are part of Bitcoin's scripting language, which is used to verify transactions. The following codes are now reactivated: OP_CAT, OP_SPLIT, OP_AND, OP_OR, OP_XOR, OP_DIV, OP_MOD, OP_NUM2BIN, OP_BIN2NUM.

What you can do with it is hard to say. Steve Shadders, the developer of BitcoinCashJ, and the one who first suggested reactivating the codes, explains it this way: "Among developers, one could say that the uses of fundamental script language operations are so commonplace that you can do them do not have to enumerate. We use such basic operations as math, string operations, and bitwise logic so often every day that it's almost impossible to produce a useful code without them. "

A bit more concrete were on 16 May 2018 Chris Pacia of OpenBazaar and Emil Oldenburg of Bitcoin.com. Pacia has used OP_CAT to build a multisig address based on a Merkle Tree. This method has the advantage that the public keys that are not involved in a payout are also not published, and that the amount of data required decreases significantly with an increasing number of parties involved. The process was developed, as far as I know, under the working title "MAST" by Blockstream for the Sidechain Alpha. Oldenburg has meanwhile formed a puzzle transaction using OP_XOR. Whether and how useful this will all be, is currently not to say. If you are interested (and have enough knowledge) you can experiment with the new codes on the OpCodes playground.

Problems have not yet occurred after hardfork. There is no movement to preserve the old Bitcoin Cash chain ("Bitcoin Cash Classic"), no signs that the number of active full nodes has collapsed (because they've missed to upgrade on time), and no reports of crypto exchanges or wallets that have been removed from the blockchain. Fears that the new Opcodes would open new attack vectors have not yet been confirmed.

On the course, this good news does not seem to have any influence. Since the hardfork the Bitcoin Cash price has fallen and stands at the editorial time at $ 979.28 USD.

Video Source:

Image Sources:

- Article headers created by myself

- https://cryptogoldcoin.io/

- https://digix.global/

- https://www.trusttoken.com/trueusd/

- https://blockchair.com/bitcoin-cash/block/530350

- https://txhighway.com/

Short note:

Since I'm moving from Mauritius to Germany in the next few weeks, I do not have much time to post on Steemit at the moment, I hope you understand and we'll see each other again when I'm settled in my new home.

Have a nice day!

LOVE&LIGHT

Thank you for putting your effort bringing this together into a one article. The stable coin is one of necessity in a volatile market like cryptocurrency. Many of us are even afraid to touch it because its volatility and some called it risky.

When I researched it before, the one reason its volatile is because only 1 percent of the people are engaged on it. Hopefully in the future as more people have known it the higher the prices and the less volatile market could be.

I am not against Bitcoin Cash and hopefully in the future it can prosper as like as other crypto in the market. Thanks you @danyelk

This post was showed by 4 different accounts to 18.000+ followers.

18.000+Followers can see you.(@tenorbalonzo,@hakanlama,@cemalbaba,@asagikulak) Send 0.200 Sbd or Steem. Post link as memo for (minimum 15 upvote)

is hard to die ...............

Great!

Hi @danyelk,

Really enjoy your posts and want to see if you'd be interested more profit potential. TIMM is not quite out yet, but is looking for creative talent. If you are not sure, give us a follow and at least get a free trial to check us out.

We've posted more information here: Introduction and here Leverage TIMM for profit.

We are also on Facebook so if you'd like to send us a private message you can here

Cheers!

Thank you okay I follow you but I have very little time at the moment will check you out when I have more time.

Here's our new Discord channel invite, so you can join us there.

Stable coins seem to be the new hotness. The ones I find most interesting are the ones that are decentralized and have a coin that grows in values when the community keeps it stable.

Stablecoins are awesome - amazing application of crypto

MoneyToken ICO check it out also will have there own stable coin but also crypto based loans no more credit scores.!

Okay cool thanks I will have a look at it.

I met some of the guys from DAI Stablecoin last night in New Orleans. Gave a big group of them a pedicab ride to dinner. they seemed super excited about what they were doing, and they also tipped well, which is always a sign of stability! :) thanks for the article. Finding stability in the crypto market seems important if these coins are to become more like actual currency and less like investments or stocks...

Did you look at havven? It’s like Dai but backed by transaction fees.

Nice have to check that out thanks.

I’m very excited about BlockOne and everything Dan Larimer has done for the blockchain community. EOS i’m All In!! Check out Dan Larimer’s interview here and please follow me as we will show you the throughput technology in real time and daily updates on how my organization is helping gentrify Los Angeles , pushing the homeless out into the suburbs and raise property values via crypto currencies and un blocking the chains!!

For any of you who feel pitty for my lil bro, DONT!! His life is probably a whole lot funner than yours...

I hope these stablecoins, in particular TUSD, help reduce volatility in the market and bring some maturity to the crypto space in the second half of this year. It does look like a good development.

Don't hope but believe ;)

Really interesting, I should invite you to steemit school to lecture us.

Thank you!

What is steemit school? Not that I am a good teacher just like to know what it is ;)