Regulation and centralized exchanges harming Bitcoin

Bitcoin’s price was hovering at around $11,000 on Tuesday, not far off its low point for the year as the South Korean Government began to implement a ban on all anonymous traders in an attempt to crack down on criminal activity. There are also fears that centralized exchanges may restrict the coin’s tradability and status.

All coins suffered a severe crash in the middle of January when the Koreans first announced they intended to ban all anonymous cryptocurrency trading. Regulation in general, while a good thing from the point of view of our own DasEcosystem, is not being welcomed so enthusiastically in some quarters of the sector.

Blockchain expert Simon Taylor, speaking on BBC Radio 4’s Today programme, said: “I think it’s evidence of a government trying to get its hand around a subject which was seen as ungovernable. Historically we thought this thing was decentralized, there was no way to control it but what you have here is centralized exchanges. This is the same as a bank. This is something that holds the Bitcoin or the digital currency on your behalf.”

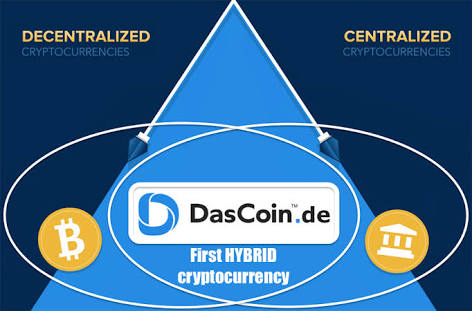

This could be less of a problem for the NetLeaders community once DasCoin becomes publicly traded on April 28. Firstly, we already prevent anonymous trading through our bank-standard KYC identification process, and secondly we intend to take advantage of our own user-friendly exchange that will operate with a third-party clearing house and a range of fiat currencies.

The South Korean Government’s decision to ban cryptocurrency trading has been taken to crack down on all possible criminal activities the anonymity of bitcoin trading could have facilitated. NetLeaders News understands there is also concern in London that cryptocurrency is facilitating drug traffickers.

The Korean market has been one of the biggest globally for Bitcoin. Taylor said: “I’ve seen various estimates that between 20 and 30% of Bitcoin trading has been through South Korea at some point. Same for Ripple and some of the other key currencies. They were holding currency on behalf of anonymous actors. What South Korea has now said is ‘we think there could be fraud, we think there could be money laundering.’ All kinds of bad activity could be happening. If we prevent anonymous people from being on these exchanges then maybe we can rein in some of that.”

New regulatory noise emerging from New York will also concern wallet holders. Fortune reports that Federal judges in Brooklyn, New York, are about to rule on the question of what exactly bitcoin is and whether it can be regulated.

A cryptocurrency robbery of nearly £380 million at Bitcoin rival NEM has prompted Japan’s financial watchdog to launch an investigation on all exchanges to better prevent future thefts. (Source: Daily Express/BBC)