What we know and don't know from regulatory decision on Initial Coin Offerings

The U.S. Securities and Exchange Commission (SEC) released its highly watched announcement warning that token sales (aka Initial Coin Offerings) conducted by blockchain startups could be subject to securities laws.

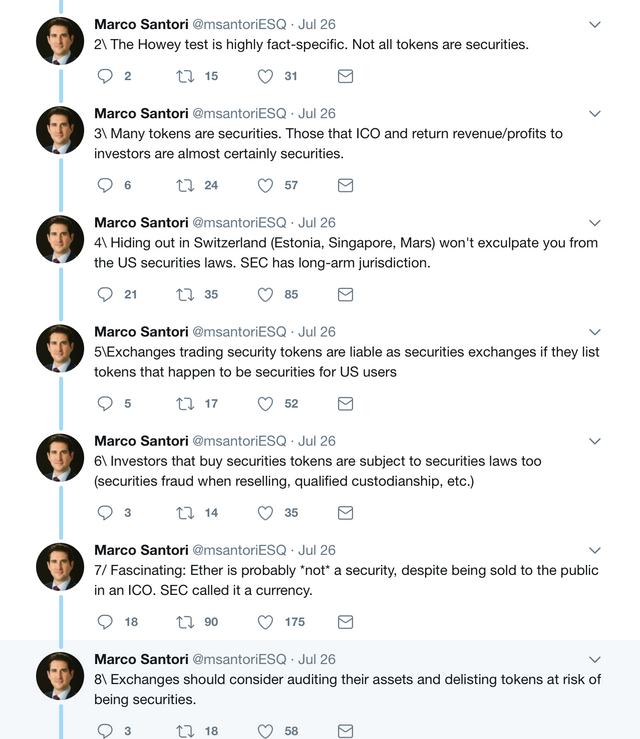

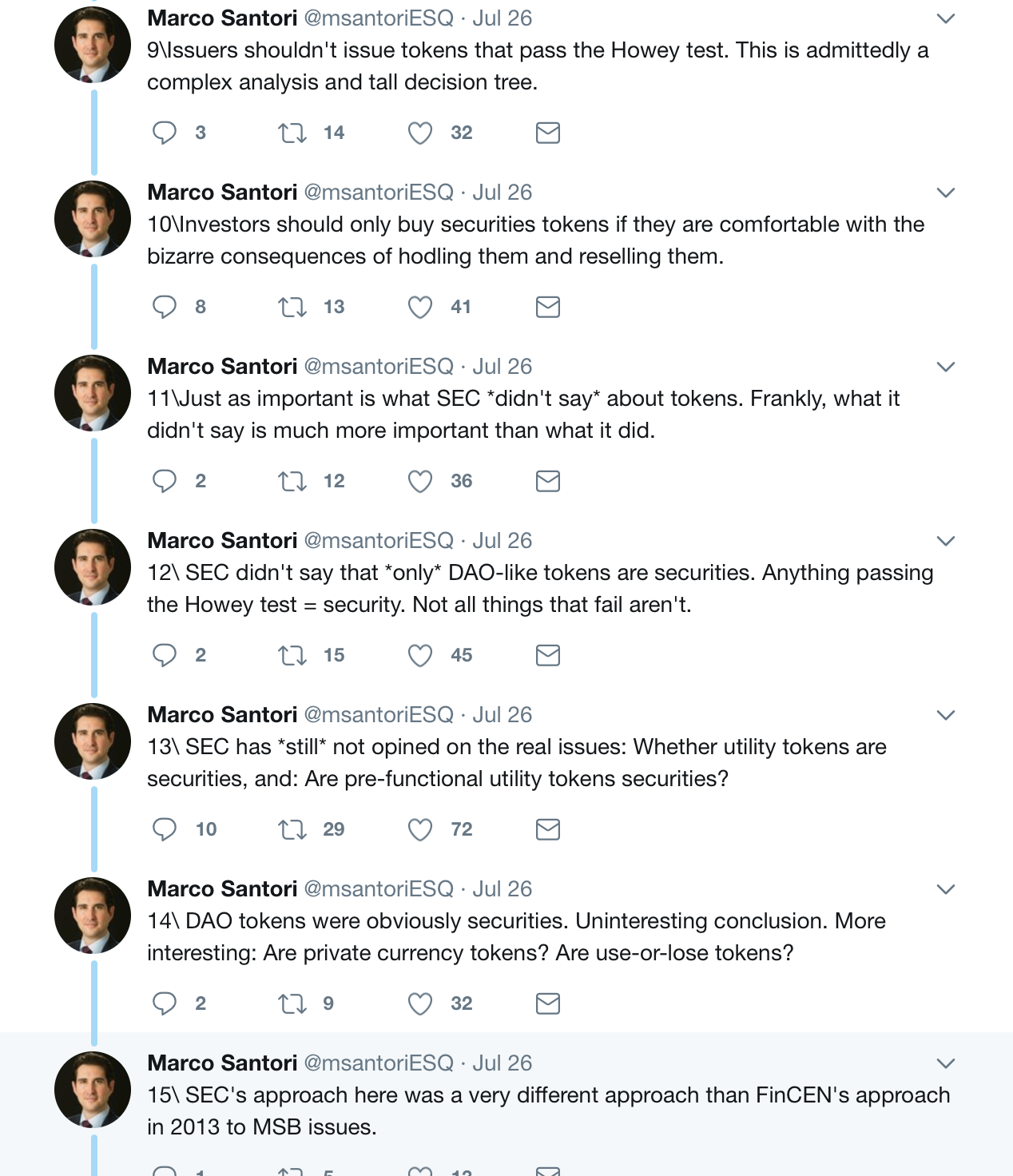

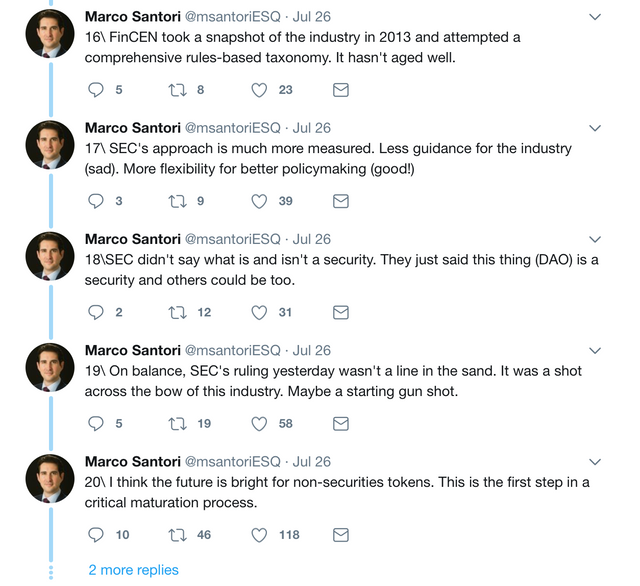

Marco Santori, a legal advisor on the frontline and an authority on the regulatory aspects of digital currency and blockchain tech, offers his takeaways below. Since Santori chairs the Bitcoin Foundation's Regulatory Affairs Committee and has extensive experience helping clients navigate the complex regulatory landscape, his thinking is informed by real-time developments.

Bottom line: the SEC guidance follows principles-based regulation, lacking clear parameters, what is a security will depend case-by-case (per Howey Test), but an indication of a gradually maturing marketplace. On balance, it's a mixed story for innovators, businesses and investors, who will increasingly rely on compliance experts and fintech lawyers to manage their risks.

you can get $10 in free Bitcoin by signing up on this exchange using this link

Donations are welcome

BTC: 1NtJHdH7Brx9cx3Ux48ZFdTP3TYPTfHdrw

ETH: 0x3F4e503c18f9B3C0A9f975d7B18aeD1da22D39f5