Understanding The Cryptocurrency Token and Network Equity

Since the inception of Bitcoin, it has been regarded as the trailblazer and the gold standard of the cryptocurrency realm. Its influence extends beyond being a digital store of value, as it is often used as a reference point for other digital assets in the crypto finance industry. The emergence of thousands of crypto tokens has led to a plethora of use cases, but the Securities and Exchange Commission's (SEC) tendency to classify most tokens as securities might be misguided, as they have not fully appreciated the groundbreaking potential of these tokens.

The concept of tokens is a foundational permutation in blockchain technology, and it is essential to explain this new concept in a way that is easy to understand. Doing so increases the likelihood that the general public, regulators, and the myriad of established entities will grasp the importance of this paradigm shift. This article aims to demonstrate the various aspects of a cryptocurrency token and why it is crucial for those in positions of authority to gain a deeper understanding.

The complexity of understanding the token stems from its nature as a multi-functional abstract. We are not accustomed to encountering something that possesses multiple functional properties, represents diverse units of value, and exists in a digital form that unifies it all. Tokens are a relatively novel concept, and if we persist in attempting to categorize or categorize them using our previous frameworks, we will miss their potential. In essence, tokens can simultaneously embody the characteristics of currency, equity, financial instruments, rewards, rights, and, since blockchain, digital assets.

Traditional Thinking

Until now, we’ve only been familiar with fragmented structures to represent each of these roles. For example;

CURRENCY: We have employed currencies such as the dollar, yen, euro, pound, and numerous other sovereign fiats for currency.

EQUITY: In the equity realm, we have shares or stock units, commonly referred to as securities.

FINANCIAL INSTRUMENTS: Regarding financial instruments, we have an array of options, such as derivatives, bonds, futures, options, swaps, and so on, which brokers, agents, custodians, or exchanges typically manage.

REWARDS: For incentives or rewards, we have various companies doling out reward points, frequent flyers, loyalty cards, and the like.

RIGHTS: For rights, we have government-issued identity cards or share proxies that enable us to participate in the governance of matters that concern us, effectively giving us a voice in decision-making processes.

However, introducing a token that combined all these facets into a single entity led to much confusion in traditional finance, corporate, private, and public arenas.

The advent of blockchain technology has created a distinct category of digital assets: non-fungible tokens. (NFTs) These tokens are unique and transferable units of value that can represent a wide range of items, including a digital artwork of a cat, such as CryptoKitties, a cartoon character, a virtual toy, or a rare in-game item.

They can also represent real-world items like concert tickets or collectibles. This classification encompasses all the possible use cases for crypto tokens, opening up new possibilities for the future of digital ownership and exchange.

The Six Roles Of A Token

Currency can be exchanged for goods and services or utilized to access computer resources associated with blockchain technology, such as Ethereum’s gas, Bitcoin’s miner fees, transaction fees, etc.

Equity signifies owning a tangible asset such as real estate or a representation of a commodity like gold.

Financial instruments encompass a wide range of financial services products, both existing and emerging that are destined to transition to a fully digital format in the future.

Rewards are work tokens, representing a tangible outcome that can be earned through various forms of human or computer-based effort. This can include active contributions, such as completing tasks or providing services, as well as passive contributions, such as sharing valuable data or content.

A Right may encompass the ability to participate in decision-making processes such as voting (governance-related) or the ability to access resources like digital content or services that offer tangible benefits.

The Digital Asset signifies a virtual entity, an NFT (non-fungible token) within the blockchain community. These tokens are unique digital objects that exist solely in a digital format and do not have a physical counterpart.

Additionally, tokens can also have a time-based restriction, meaning their usage is limited to a specific period. They can be locked or unlocked, which determines when they can be used.

A crypto token can potentially encompass all of these functions simultaneously, or only a few of them. Alternatively, it might initially serve one purpose and evolve into others. This challenges regulators and others as they struggle to comprehend and regulate this innovative concept that exists in multiple forms concurrently, contrary to our accustomed perception of them as separate entities.

Moreover, each token can have numerous variations in its lifecycle, including creation, acquisition, purchase, sale, granting, storage, and utilization. The most crucial aspect is that these tokens can be exchanged, traded, or transferred between individuals without the need for intermediaries, fostering a seamless and decentralized process.

The token embodies the adaptable spirit of a chameleon, utilizing cutting-edge technology to shatter various barriers imposed by society, government, and commercial entities. This versatile tool condenses numerous constructs into a single, potent symbol of innovation and progress.

This leads us back to the topic of regulation. The focus on securities regulation for governing tokens is misguided. It's like trying to force a square peg into a round hole or applying a solution where it's not needed. This approach not only hinders the development of new business models but also stifles the potential of token-based innovations.

Accordingly, it is essential to acknowledge that the token represents a distinct category of assets. To succinctly describe it, we can refer to it as a novel asset class that warrants its own legal and regulatory framework. Unlike the term "security," which regulators may use to classify it, a token does not always signify a personal financial stake or equity share in a larger financial entity. Instead, it serves as a novel representation of our progressively digital existence.

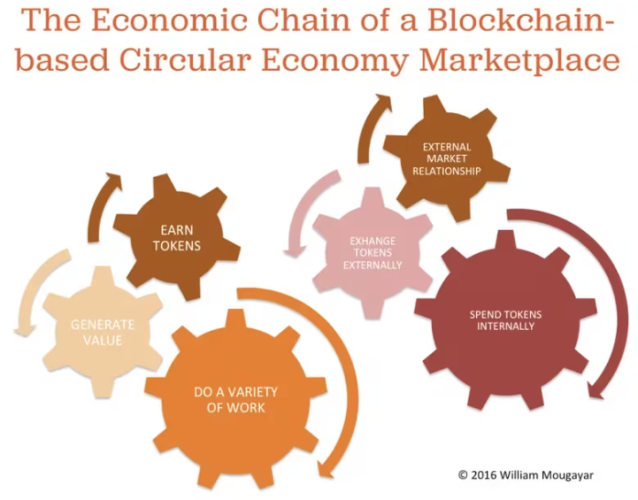

William Mougayar's Blockchain Marketplace. Source: Coindesk

Tokens Create Value Through User-Generated Work

Apart from tokens, protocols, and new forms of securities, there is a broader concept at play here. This concept revolves around the work that is indirectly symbolized by the tokens and its connection to the generation of value through user interactions. In other words, it pertains to the paradigm of creating value through work.

Tokens serve as a tool to achieve a goal. User actions yield tokens, which represent their value in the digital realm. These tokens are directly tied to the worth generated by users' efforts, benefiting both the network and other users.

Social networks have long been associated with user-generated content (UGC), which refers to creating and sharing original content by users. However, as the concept evolves, it may be more accurate to refer to it as user-generated work (UGW) in order to highlight the importance of diverse user participation that yields tangible financial benefits.

Categorizing Token Functions in Three Components

1. Tokens that enable a protocol's functionality, like Bitcoin or Ethereum, are primarily utilized for software development activities carried out by the network participants.

2. Tokens that are inherent to a vertical-specific area of operation, such as Steemit, Filecoin, and Storj, are used for tasks like curating or creating content, storing files, sharing data, etc.

3. Tokens that expand existing businesses, such as loyalty points provided by established companies, have the potential to create an ecosystem that drives more transactions. We can refer to this as "hybrid models," which is the classification that Markethive belongs to.

The underlying principle is that users' behaviors and engagements within the platform create value, which in turn allows them to earn internal tokens that can be used to facilitate new transactions within the network, thereby generating further value.

► The tokens that are generated resemble the outcome of the user's activities.

► Tokens embody a multifaceted purpose, transcending their traditional role as a medium of exchange. They also serve as a measure of reputation, a reflection of engagement, a symbol of influence, and a gauge of activity within a given community or platform.

► Tokens serve as a representation of the economic activity occurring within the network.

► Acquiring tokens should be achieved honestly, not through manipulative gaming tactics.

► The more aligned the token is with a company's core values and business model, the greater its long-term viability will be.

► Value creation is aimed at various categories of individuals or customers, such as core developers, creators of applications, end-users, speculators, ecosystem collaborators, founders, buyers, sellers, readers, writers, investors, influencers, partners, and more.

The foundation of these tokenized structures is the principle that every participant is entitled to receive a portion of the total value generated through their combined efforts.

The Evolution Of Digital and Social Media

Facebook's business model revolves around capitalizing on its users' attention and engagement, including likes, shares, posts, and comments, yet users don't receive any compensation for their contributions. If Facebook were structured as a decentralized entity with a token, users would earn tokens for their participation, which could be traded or redeemed through a liquid marketplace, both within and outside the platform.

Facebook does not engage in economic sharing. However, billions of individuals create and share content for them. Meanwhile, Facebook has been researching user data to understand how friendships on the platform are linked to economic opportunities. They have found that social connections greatly influence people's ability to secure employment, excel academically, and receive assistance in times of crisis. This behavior may harm Facebook as other business models centered around sharing network equity gain popularity.

X (formerly Twitter)

In contrast, Elon Musk's X has relaxed its censorship rules and is currently prioritizing the development of a peer-to-peer payment system. Musk envisions a platform where users can easily transfer funds to others and withdraw their money into verified bank accounts. Furthermore, there are plans to introduce a high-interest money market account to incentivize users to keep their funds within the X platform. This strategy would directly challenge PayPal's dominance in the market, as Musk aims to revolutionize the current banking system.

The payment system will also facilitate X's expansion into the creator economy, which rewards users with at least 500 followers and 5 million organic post impressions in the past three months. These users can now participate in X's Ads Revenue Sharing program, furthering the platform's commitment to empowering creators in the digital economy.

It’s yet to be determined whether the payment system will include cryptocurrency even though Musk hinted at supporting crypto on the platform, briefly switching out Twitter's bird logo to dogecoin's dog before its rebranding to X.

Markethive

Markethive understands and has embraced the concept of "Tokenization of Work" and has leveraged cryptocurrency and blockchain technology to create a revolutionary platform that is trailblazing a new path in the digital media landscape. This groundbreaking project is the first to venture into uncharted territory that no other platform has dared to explore. Its innovative hybrid model serves as a benchmark for the future of digital media.

Markethive’s vision is a fully decentralized social network inbound marketing and broadcasting platform integrated and operated on a massively distributed database system (the internal giant blockchain), controlled by a smaller external blockchain Markethive’s dApp wallet will utilize.

Essentially, the Markethive ecosystem has its own financial operating system with its native token, the Hivecoin (HVC), which is used as a medium of exchange and will continually be circulating, earned, and accumulated by users within the Markethive economy. It allows us to be completely decentralized financially with complete autonomy and protection of our intellectual property, ascertaining a viable and comprehensive ecosystem.

Every member of Markethive, free or upgraded, is rewarded and can earn income with Hivecoin in many different ways daily. The only prerequisite is to refer three people to Markethive. Other opportunities include becoming a shareholder through its Founders Token representing the ILP or the Entrepreneur One Upgrade and using the staking advantage provided by our crypto wallet with Markethive Credits.

Additionally, members can profit from the multiple cottage industries within the Markethive ecosystem. It is important to note that venture capitalists or corporations do not fund Markethive. Instead, it is the community itself that owns Markethive, with no hierarchy in place.

In Closing

We have come a long way since the advent of social media, and tokenization is just one of the ways to reward its users and promote a more equitable distribution of wealth. However, regulatory obstacles pose a significant challenge to the widespread adoption of tokens. So, to overcome these hurdles, it's crucial to facilitate open discussions about tokens and embrace the various applications that incorporate them. By doing so, we can create an environment conducive to the growth and acceptance of tokenization.

.png)

Originally Published @ Markethive.com