Crypto Hype Bubbles - Why You Should Invest Long Term

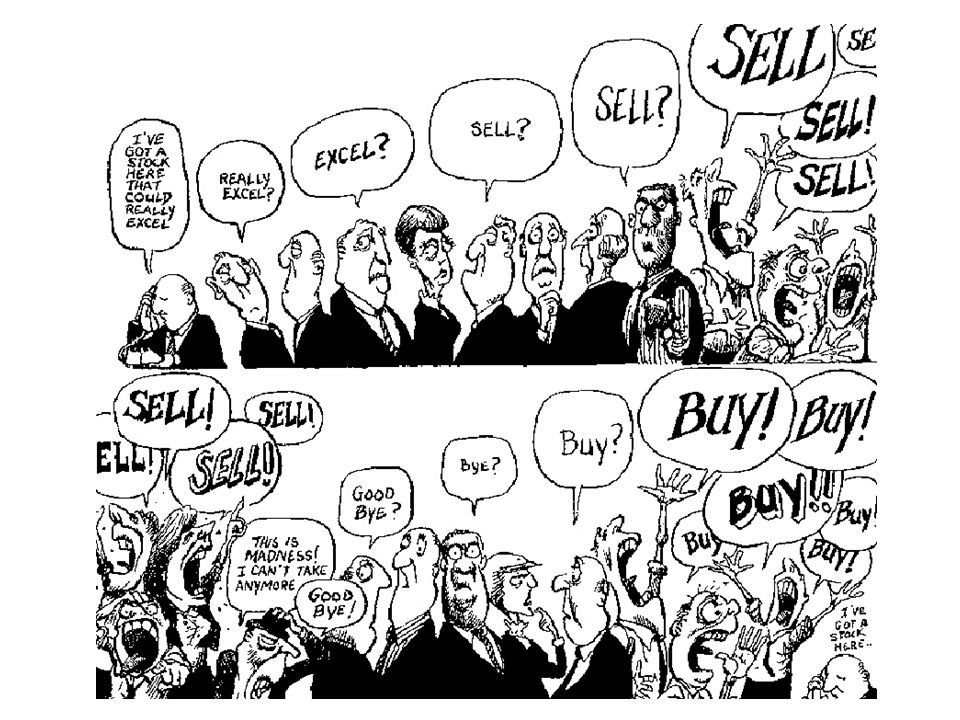

As someone familiar with the stock markets, but with only a few months of crypto experience under my belt, watching the crypto exchanges often makes me feel like the trading trends are formed a lot like the image above. While there is certainly a growth trend underlying all the coins backed by legitimate value propositions, the majority of the market movements on a day-to-day, and often even week-to-week, basis are pure hype and speculation.

This is a double edged sword:

On one hand, there is the potential for a downtrend to begin for no real reason, or because people just see a more profitable coin or token to invest in. You can go to bed with a crypto fortune and wake up to find half of that value missing.

On the other hand, crypto has become the Wild West of investing, where even very small sums of money have the potential to become significant fortunes in a relatively short timeframe when compared to mainstream investing in stocks, commodities or currencies.

What to buy?

With over 800 coins and tokens to choose from, how is anyone supposed to know which best fit their portfolio? For that matter, how would anyone be able to familiarise themselves with all the options?

The safest strategy here is to not try and game the markets, but invest in a variety of different coins, and then forget about them. There is no need to check on your investment every day, or to try and optimise your splits. An expert trader would probably benefit from this, when backed by a constant up-to-date knowledge of the cryptospace and its breaking developments. However, for the average Joe like me that is just not feasible alongside standard day-to-day commitments.

In case the wet and forget strategy does not have you convinced, lets run the numbers. Imagine that you invested USD$100 at the start of 2015 in a relatively random selection of coins. I am going to assume that you spent at least 30 minutes on each to make sure that they were not clear scams, which is to say they have an active community and dev team. They would also have to have a real goal or value proposition. We may have bought:

$20 worth of BTC = 0.063 BTC

$20 worth of BTS = 633 BTS

$20 worth of GRC = 5000 GRC

$20 worth of PPC = 18.9 PPC

$20 worth of POT = 10526 POT

I picked the last 2 at random and manually selected the first 3, but you will find the trend will hold for almost any totally random selection. The value of these coins now is:

0.063 BTC = $252

633 BTS = $101

5000 GRC = $150

18.9 PPC = $33

10526 POT = $1336

That means that out hypothetical $100 has now become $1872, which yields an 1872% ROI. Granted, that randomly selected POT coin I would probably never have bought if I was actually doing this, and we probably got lucky. If we ignore that outlier, we still would have turned $80 into $536, which is a 670% ROI in two and a half years!

No-one will ever play the markets perfectly, and there is no point getting worked up and stressed out trying to do so. Invest what you can spare, and come back in 2 years to reap what you sowed.

You'll probably be surprised.

Content credit:

Hype Train, slideplayer

Crypto Coins, Cryptomining Blog

Plot, Almaes

Footer, @me-shell

Especially in the cryptocurrency sector. We are currently at a 120 billion market cap and headed toward a trillion within the next 3-5 years. Only buy and hold makes sense.

@dutch I really enjoyed how you structured your thoughts. For those that like to gamble, there are several pins that are subject to "pump and dump" on a regular basis. For those coins, it is worth picking them up when they are low, setting the sell order at 2x the price paid, and wait for it to get pumped.

This is not advice, but just pointing out that there are so many startegies to play in this space. I think those that check every single day are waiting for the lottery daydream moment when they think they will open up their account and see Siacoin at $300 like ETH. lol

Thank you for the feedback - much appreciated!

Your system of buying low into pump and dump coins and then waiting with a sell order up is also an interesting approach I have not yet toyed with. Thanks for the info!

The day Siacoin reaches $300 I think we are going to see a lot of people ragequit crypto. =P

Hello dutch I enjoyed your article and have resteemed it to my followers. Thank you for the informative read. I hold Gridcoin, Bitshares and BTC. I consider them long term holds. In 5 years we should do quite well.

There are only 2 kinds of cryptocurrencies a sane person would invest in.

There's huge real trade behind those.

Bitcoin market cap is covered by tens of thousands of businesses and small sellers. Both whitehat and blackhat.

ETH has market cap of $27,000,000,000 just because it attracts so many losers waiting for miracle .... the miracle had happened for few of them.

IRL total net worth of ETH holders is probably 1% of market capitalisation.

And ETH is a vehicle to funnel money from tons of suckers into hands of handful of IPO scammers.

And guess what the scammers do with their loot. Dump it.

Alts based purely on speculation have real value of not more than few % of their market capitalisation.

If I dump 10,000 Bitcoins, the value won't change much and the drop will last couple of hours till the buy/sell orders goes into "equilibrium".

If I dump $40,000,000 worth of LTC, the value will go down by 50+%. And the buy/sell orders won't meet "equilibrium" for weeks .... if ever.

This is because the general market trend is up. There are probably ~10 million people in the crypto markets today, which can easily grow to say 100 million. In that scenario, you will see 10X growth on average across the markets. Over time, people in the game will become more sophisticated and prices will better reflect true value. Also, why doesn't Litecoin ever move? Geez! ;-)

Never move? USD$4 to USD$46 in the space of 5 months!

Of course, I agree with you statement on market growth. As more people buy in, the market cap will naturally rise alongside the user growth.

nice analysis. I almost bought etherum last year when it was just $6 but I couldn't because i was scared. I would have been in money by now. The best is to invest in different cryptos and invest what you can afford to lose.

Totally agree! I had exactly the same experience looking at the markets a few months ago before the massive boom. I would wager everyone feels like they are:

Entering the market too late

Scared to invest

In all likelihood, people will continue to think this no matter when they are introduced to crypto. The best time to buy and mine was at the BTC genesis block. The second best time is now.

That 20/20 kicks my rear everyday when i had 1600 Neoscoin at 0.00000300 btc last FEB. i believe that amount is worth over 5000$ now, i settled for 500$ 😢

Look on the bright side - you made a significant amount more money then if you had put your investment into a savings account like 95% of the population.

No-one hits all the peaks and the troughs.

I don't hold anything for considerable amounts of time. I much prefer in and out trading. I just don't trust developers and hackers.

Fair enough too - if you are up to date enough with crypto to make consistently good investment decisions. For the average Joe investor I would wager this carries significantly more risk than the buy and hold approach.

What specifically are you worried about hackers doing?

(Upvoted)

I totally agree with you, and I don't trade.

My strategy is to buy, hold, and sell when everyone is buying based on a V.E.T.I. system

(So far is working great on my small investment)

Imagine a bank offering 244% ROI even over the course of a decade. People would go insane!

Oh yes...LOL

There is a lot of volatility around this market...

It's all about researching the real deals from the hype and non sense.

More importantly, Goldman Sachs analysts, along with JP Morgan researchers, told their clients in official corporate letters that regardless of their lack of understanding of the technical intricacies of bitcoin and cryptocurrencies, the $135 billion market cap of cryptocurrencies cannot be ignored.

JP Morgan analyst Robert D. Boroujerdi stated:

“With the total value nearly $120 bln, it’s getting harder for institutional investors to ignore cryptocurrencies.There are currently over 800 cryptocurrencies out there, though just nine have a market cap in excess of $1 billion.”

Other analysts including CNBC’s Brian Kelly attributed the elimination of uncertainty in bitcoin’s ability to scale, increasing adoption of bitcoin in regions like Japan and rising demand from institutional investors as the core three factors behind the recent rally of bitcoin price.

I've been thinking about the feasibility an ETF for all coins and assets. If such a thing existed then you could have invested that $100 in lets say CRYPTO1000 on 1/1/2015 when the market cap was 5.5 billion USD and today it is 155 billion USD. That's a 28.2X gain so you'd have $2820.

You could also get lucky and put that $100 in ETH alone at the ICO and have made $220446