How will Proof of Entitlement (PoS) generate a cryptocurrency bank partial reserve system?

Poin system part of the reserve system internal problem

part of the reserve banking system is the basic system of China's traditional financial structure, the bank through the partial reserve system to lend idle funds. However, this system has led to several inherent problems of the entire system in a serious crisis. Therefore, when cryptocurrency first appeared, one of its main goals was not to replicate the financial system responsible for the legal currency circulation and management of the world.

Ironically, it takes the cryptocurrency community to a crossroads where it must decide whether to stick to its own commitments, distinguish it from the traditional financial system, or be willing to allow the establishment of a banking system by providing services. A fractional bank of cryptocurrency.

![154952806352491.jpg]

( )

)

The hard fork of

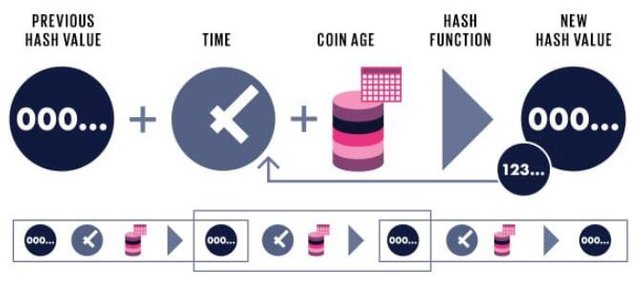

Constantinople's hard forks has been postponed, and this seems inevitable. The hard fork drive Ethereum moved from the Work Proof (PoW) consensus algorithm to the Proof of Entitlement (PoS) algorithm. This change seems to subtly shift the steering wheel from miners to stakers in the name of efficiency.

However, this is not just a simple technological shift, because Ethereum, as the second most important cryptocurrency, seems to irreversibly legalize the proof of the equity algorithm. Therefore, other relatively large PoS-based algorithms such as Cardano and QTum show that it is time for the community to seriously consider the possible adverse effects of this conversion. In addition, the results must be compared to the experience of using DPoS systems' cryptocurrencies such as EOS, Lisk, and Tron.

Although these currencies, including Ethereum, add up to less than one-third of the value of Bitcoin, the issues and scalability issues of the PoW system are still being considered, but the PoS system should be seriously considered.

Legitimacy of Proof of Equity and Part of the Reserve System

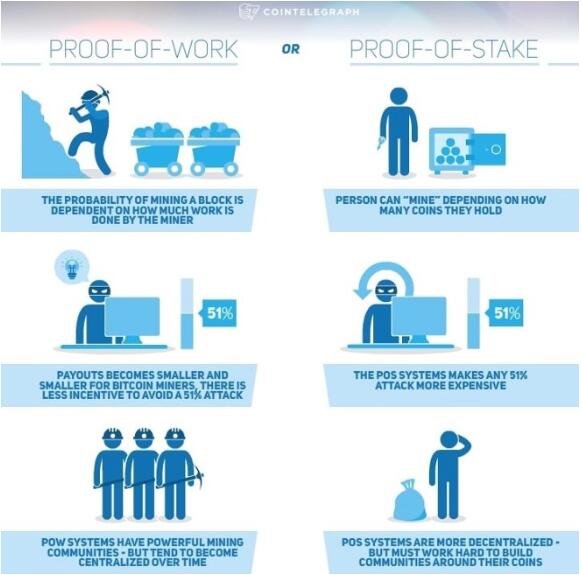

Although POW seems to be a very inefficient job in terms of energy and time, it tends to reward the best miners who maintain the system's decentralization. However, over time, such rewards often lead to centralization. In addition, the disproportionate computing power of token ownership has led to the sale of coins to meet energy demand, which in turn has led to downward pressure on the valuation of cryptocurrencies.

In terms of security, once the concentration reaches a significant level, the probability of the entire blockchain being attacked is 51%, which will prevent other miners from mining and getting rewards. Therefore, in the long run, the POW system constitutes a security threat.

On the other hand, the PoS system claims to prevent these problems. The PoS-based blockchain implements a distributed consensus based on token ownership or the interests of each user, resulting in greater security and efficiency and preventing currency depreciation.

However, although the PoS system seems to solve the common problems in the PoW system, it also has its own problem, that is, the problem of the partial reserve system of the bank. When centralized exchanges tend to place equity as a service on the user's dormant currency, they reject the user's control over their cryptocurrency assets.

What's next?

Although we all agree that this transition is inevitable, we should start to discuss options to prevent this trend. Currently, the best solution seems to be to block producer pools and other similar systems that can facilitate community involvement in tokens.

Congratulations @extraz! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!