Security token projects reviews – Bitbond

original post can be found on my blog http://crocotrading.com/en/cryptocurrencies/security-token-projects-reviews-bitbond/

Bitbond (affiliate link) is a lending platform providing working capital financing to small and medium size companies all across the globe. They define themselves as the first crypto-currency based lending platform for business loans that operates globally.

Operating since 2013, they spent the first years developing the proof of concept. In 2016, they received a license from the German financial regulator BaFin. They were amongst the first regulated financial services providers in the entire blockchain space.

According to their website, Bitbond already facilitates more than $1 million in business loans every month. Most of the borrowers are small and medium size companies coming from Europe and Africa but they plan to broaden the scope of customers from a geographical standpoint and in terms of the industries they serve.

The borrowing process with Bitbond is straightforward. Companies first have to complete an online application to get a personalized offer. Bitbond takes no more than 24 hours to approve or refuse the loan application thanks to an automated credit scoring system. Once approved, borrowers can have instant funding access through their platform. In a recent interview, the CEO was explaining Bitbond is using mainly the Stellar blockchain for payment processing which allows them to do highly efficient and very fast international transfers.

The team, partnerships and investors generally gives a good picture of the company. First thing we can notice is that they are totally transparent on those matters. You can find all the information on the about us page. I haven't seen any red flags while checking information provided.

Investing in Bitbond

Bitbound recently launched its first security token offering which is still going on as I am writing this article (10th of April 2019). The security tokens sold are called BB1 and are working as token-based bonds.

The token economics

Once you know how bonds work, the BB1 token economics is pretty straightforward. The hard cap is set to 100 million BB1 tokens. Tokens are only generated if they are bought during the security token offering (STO). Each BB1 token has a face value of €1. Therefore, the issue will be used to raise funds of up to 100 million euros.

As explained in the STO prospectus, owning BB1 tokens grants you a claim against the issuer for redemption of the invested capital at the end of the term and interest during the term. If you own BB1 tokens you will receive interest each year until the bonds mature. When the bonds mature, Bitbond will pay you back the price of the bonds.

I already stated that one BB1 token is worth €1. The maturity of the bonds is 10 years, BB1 owner will get back €1 in 10 years from BitBond once the bonds mature. There is a fixed interest payment of 1% every quarter (4% per year without taking into account compounding effect). The most interesting part is probably the variable component of the coupon token holders receive once a year. The variable component will be equal to 60% of the pretax profits of Bitbond Finance shared between token holders. The estimated total yearly return is to be around 8%.

The BB1 security token is related to the Stellar Lumens blockchain in different ways. First, the token is working on the Stellar blockchain. It will be possible to transfer BB1 tokens between stellar adresses and the tokens will be tradable on stellar decentralized exchanges (Bitbond also plans to negociate with centralized exchanges later on). Also, the repayment and interest payments due during the term will be made directly on the the stellar Blockchain to the token holders and exclusively in the cryptocurrency Stellar Lumens (XLM). The amount of XLM sent will depend on XLM value in euro when payment is due.

The token potential

As token-based bonds, the BB1s shouldn't be compare with equity tokens or utility tokens in terms of returns and risks. For most equity tokens or utility tokens, returns are unknown and depends mostly on speculation around the growth of the network or the company when the return of BB1 are pretty well expected and should be around 4% to 8% a year during ten years.

The risks are also specific to bonds. The major risks is probably the default of too much borrowers which could impact Bitbond capacity to pay interest and repayment. You can find an extensive lists of the risk in the bonds prospectus

The Security Token Offering

As mentioned earlier, the BB1 security token offering is happening right now.

You can purchase token with BTC, ETH, XLM and EUR and it's open to anybody in the world except for US and Canadian citizens.

The subscription period should end on the 10th of May. Once the STO is concluded, every investors will receive the BB1 tokens in their wallet. From there, they are free to use it however they want.

The STO started on the 11th of march and according to the website, 1.7 million euros was already funded. It seems like the hardcap of 100 million will hardly be met. Since there are fixed issuance costs ( more details on costs in the next section), I am not sure what is the minimum amount required for the token to be issued.

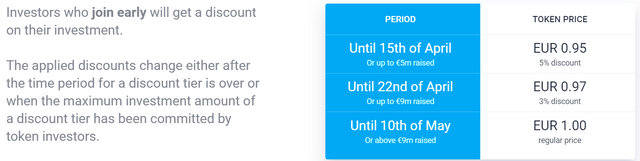

If you invest early enough, you might get an interesting discount as explained below.

Here is my affiliate link if you are interested investing in the project.

Information from the prospectus

I have made a small recap of some useful information I could find in the prospectus but I suggest you to read it all before investing.

The bonds become due for repayment (redemption) to creditors on the first working day after June 30, 2029. The repayment and interest payments due during the term are made exclusively in the cryptocurrency Stellar Lumens corresponding to the subscribed nominal (principal) amount of the bond. Payments will be made to the person listed as the token holder in the register kept on the Stellar Blockchain or to the respective blockchain address (wallet) specified in the register.

The Issuer has the right to terminate the Bonds prior to maturity by giving three months notice to first end at latest on December 31, 2021 and at latest on December 31 in each case (year) thereafter (ordinary right of termination). The Issuer also has an extraordinary right of termination. A contractual penalty is not provided for it.

Qualified subordinated token-based bonds are subject to special risks. Risks may arise individually or cumulatively and, in the worst case, the investor may suffer a total loss of its invested capital. Past returns are not an indicator of future returns. A detailed description of the risk factors can be found in the Securities Prospectus in the "Risk Factors" section.

The securities offered are token-based bonds which grant the creditor a claim against the Issuer for redemption of the invested capital at the end of the term and interest during the term. Redemption and interest payments due during the term will be made exclusively in the Stellar Lumens cryptocurrency corresponding to the subscribed nominal (principal) amount of the token-based bonds. For this purpose, the EUR value at 12:00 CET (Central European Time) corresponding to the due date of an interest payment or the redemption of the bonds will be converted into XLM.

As the targeted total issue volume is EUR 100 million, the costs for the Issuer from the affiliate program thus amount to a maximum of EUR 5 million. The total issue-related costs are thus expected to amount to: 120,000 EUR Legal advice 400,000 EUR Marketing and sale 1,785 EUR Audit and acquisition costs 80,000 EUR Software development 8,000 EUR Interest expense for pre-financing 5,000,000 EUR (max. rewards for Affiliate Partners)

The Offer Period within which purchase offers may be submitted is expected to begin on March 11, 2019 and end on May 10, 2019. The Issuer reserves the right to extend this period once by 8 weeks.

Summary

Category

Token-Based bonds with variable component equal to 60% of the pretax profits of Bitbond Finance

Pros

- Clear estimates of returns, between 4 to 8%

- Liquidity thanks to the tokenization. Easy to access the secondary market

- Generally considered less risky than equity

- Highly qualified team

- Germany’s first BaFin regulated blockchain company

- Working proof of concept

- Transparency on process, parternships and investors

- Low transaction costs on the stellar blockchain

- Discount for early investors increasing the return significantly

Cons

- Have to trust the credit scoring system

- Uncertainty about future regulation

- Limited returns

- Require capital commitment

Investment score

6/10

mostly because the returns are limited compare to equity tokens ( but risks also)

The scores I am giving are purely from the standpoint of an individual investor (estimation of the risk/reward ratio) and in no way is here to give a note on the quality of the project.

Website : http://crocotrading.com/

Steemit : https://steemit.com/@focuscrypto

Tradingview : https://www.tradingview.com/u/crocotrading/

Twitter : https://twitter.com/crocotrading

Legal disclaimer : Opinions, markets informations, analyses and any statements made on crocotrading.com website constitute on no account investment advices. The information provided on this website and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs.

Disclosure: Some of the links in this post are affiliate links and if you go through them to make a purchase I will earn a commission.

Congratulations @focuscrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!