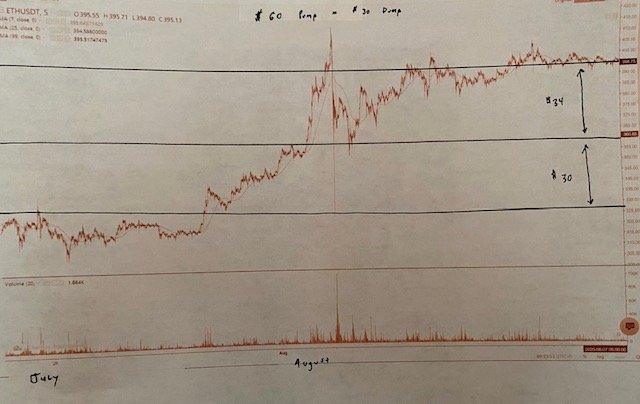

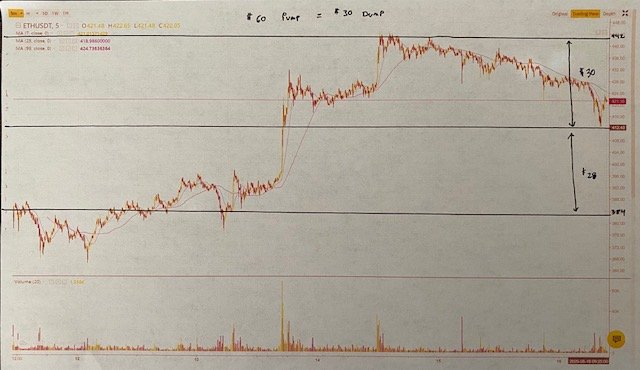

Ethereum Growth and Corrections Analysis. Pump $60 Dump $30 Theory.

Pump $60 dump $30. What is it? So we got the “pump $60 dump $30 theory” holding 100% correct on pumps right now for ETH since July 31st 2020. As the price increases we are seeing a decrease in the variance of pump to dump spread of around 12% each time. Whales and profit takers are showing their hand to the market and how they will profit take as Ethereum rides higher. It takes less than 48 hours after the pump, but a correction always happens.

After dumping and starting to settle in the $430s as of August 16th, 2020 will be like the new $380's last week. U.S. stock market is going to be flat at best as most of the earnings reports are all out, stimulus bill is factored into the market yet we don't have one, Covid-19 remains uncontrolled and uncertain; along with many other factors I will discuss in another post.

If trend continues factoring a 12% decrease in variance with the climb in price a sell would be $477-$482 and buy back at $448-$453. Below are some examples from the past few week of Ethereum 5min charts.

Variance decreases with the climb in price and is running at about 12% narrowing the range each time. This is essentially decreasing volatility. All things the same this will hold true. However with the U.S. stock market about to experience the “Dog dDys of August” over the next 2 weeks we could see more bull action as investors seek safer returns than an uncertain stock market. BTC needs to break $12k and hold. It’s still 55% of the total market cap so regardless what Ether wants to do, BTC will keep the market in a check of sorts. Pivotal breaking the bears back point will be breaking and holding above the $12,500 mark for BTC.

Remember the 2018 run lasted 8 months and there was low value, high cost and little knowledge of the block chain technology. Now the Ether and defy platforms are building apps, integrated in financial platforms, reducing the cost of international remittances, protecting identity of users, lower transaction fees for businesses than credit cards, security and fraud protection for payments, easier access to the credit market, fluid international trade, easier adaptability, platforms to protect against voting fraud and much more.

Thanks for reading and please share your thoughts and feedback below.