Federal Reserves partners with MIT to research creating a crytptocurrency

The United States Federal Reserve December 2018 says, "creating a national cryptocurrency is a bad idea."

Less than one year later Federal Reserve November 2019 says they are not developing but looking into developing a national digital currency.

August 2020 Federal Reserve announces partnering with MIT to develop "hypothetical digital currency"

The Fed is investigating whether a central bank digital currency (CBDC) would be safe and efficient for widespread use.

Why the quick change of heart Fed? Tired of inflating the dollar while increasing national debt? Trying to increase the credit market access and liquidity? Fear of missing the boat and not being country first to market and hindering demand for the all mighty dollar?

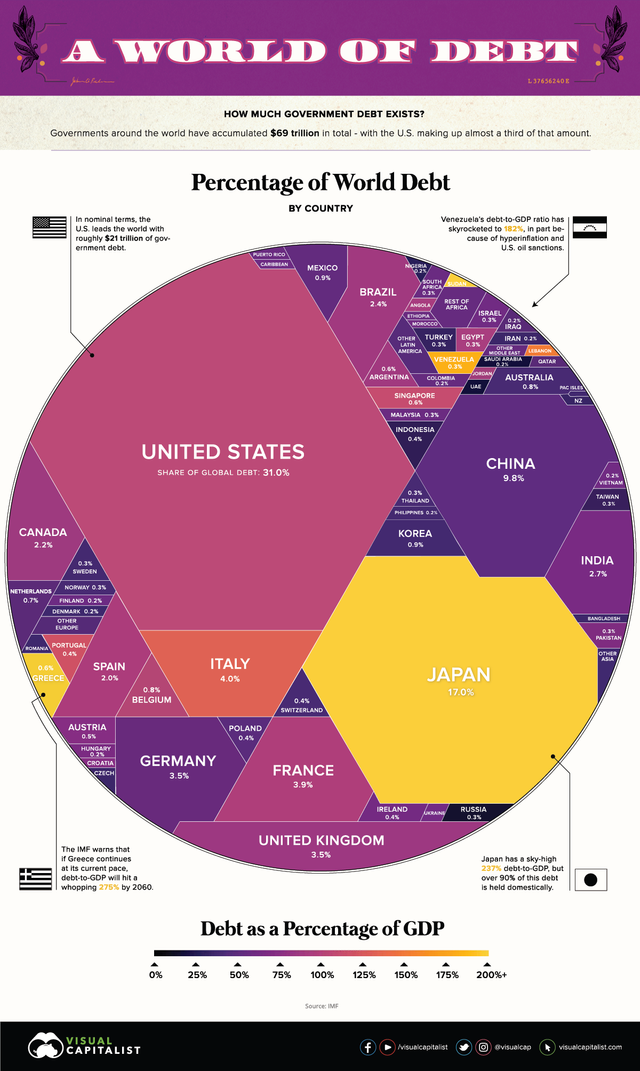

November 2019 announcement was before Covid-19 hit and the U.S. economy was booming full steam ahead. 9 months later the the dollar is trading at $0.93 on the dollar after printing trillions to save the country from another massive recession. The Federal Reserve’s balance sheet has more than doubled in 3 months to an all time high. They are not regulated, bank owned, and are the country's black card and are never paying it off. Currently the United States has about 31% of total global debt followed by Japan at 17% and China at 10%. Three countries with 60% of global debt are of course also the top 3 wealthiest countries in terms of GDP. The U.S. leads at 23%, China 16%, and Japan 6%. So together 45% of total global GDP. So they eventually need a way to create value to remain competitive globally in terms of currency demand. President Trump calling China out was huge. China's nominal GDP is $14 trillion but when adjusted for inflation to get an accurate GDP they are nearly doubled to $27 trillion. Their low cost have been crushing the world since 1978 growing GDP by an average of 10% a year.

So the big question is IF the Fed DID or more likely China created a national cryptocurrency, which platform would they use? The one everyone uses Ethereum. Because it’s based upon smart contracts, open sourced decentralized applications, adaptability and scalability for long term growth. Ether is like a vehicle for moving around on the ethereum platform and is the most sought after coin for developers for developing and running numerous applications and by investors for purchasing other digital currencies. And this year, after 5 years of existing, ether switched from proof of work to proof of stake. It’s like a coin becoming an adult in its lifecycle.

Proof of stake is linear growth and stable for miners and the currency. Proof of work is exponential growth and occurs at the beginning of crytpos life as the supply is mined and makes it very volatile. Biggest thing crypto needs for long term growth is stability and security. Proof of stake delivers that. Ether is the bases for smart contracts and supply can be increased based upon ether community demands and consensus. Miners are rewarded more not for how much they mine but how much they hold. They can only mine based upon what they hold. Currently phase one requires 32 coins to POS mine. So holding equates to a long position in the market. The more they hold the more they make. The more they hold the less sell offs you will see therefore decreasing volatility in the future and increasing value. POS is not a new concept. It was created back in 2011 as an idea to lower mining energy consumption allowing lower cost and increasing efficiency.