Crypocurrency’s Back-End: Why the Bubble is All About Usability

*by A. Horrigan"

1-Oct-2017

The headlines warn that cryptocurrency is a bubble soon to burst, a fear stoked in part by China’s recent ban on initial coin offerings (ICOs) and exchanges. The market cap for coins is on the rebound from the China setback, but as early bitcoin investor Trace Mayer likes to say, “Cryptocurrency markets are kinda like a dog on LSD.”

How do we get this dog to behave?

Some say it all comes down to usability. If people can use a cryptocurrency, it will increase in value. If they can’t, it won’t.

Usability Starts at the Back-End

We tend to associate usability with the user interface. But usability really starts at the back-end--the code that runs a given blockchain. Often, that code is defective, reducing or eliminating its potential to be usable. Mayer, an investor in the Kraken exchange, recalls one of many of examples of this when Kraken went to add Namecoin to the exchange, and in the process of reviewing the code found a critical vulnerability.

That's one of the more innocent examples.

One reason ICOs are under fire is that their code often is not independently reviewed, which makes for a very risky investment. Reviewing code takes a lot of specialty skills and opportunity cost, notes Mayer. “Who’s going to pay to get that done?”

In a lot of cases, no one does. Many ICOs have tissue-thin business plans with coins that are not integral to the platform, meaning there’s no way they’ll be widely adopted beyond the initial investors. This is one reason people say ICOs are a massive bubble.

"A lot of people are really going to get burned by a lot of these ICOs, because they're basically just a bunch of vaporware," said Mayer in a recent interview on Bitcoin TV. In a highly innovative space it's not unusual for a lot of characters to be attracted, many of them bad actors. Regulators such as the Securities and Exchange Commission (SEC) in the United States are stepping in to protect investors from fraud, as evidenced in the recent charges against ICOs REcoin and DRC. ICOs have been given a long leash, notes Mayer, and now they're "yankin' on the leash a little bit."

But mixed in with the impostors are ICOs and start-ups with legitimate business plans, their coins integral to their blockchains, with a back-end primed for adoption.

Adoption and the Crypto Front-End

Many buy and hold cryptocurrency, hoping it will become widely used.

Their hopes may be premature.

Start-ups are good at creating clean home pages to entice new customers, but after the easy sign-up process, the user experience tends to fall off a cliff. It seems few of the companies hire professional writers to produce clear instructions for customers. This problem is not limited to blockchain and crypto companies, but it’s more detrimental to them because the technology is new and complex.

Often the only thing standing between a company and its potential customers is a clear understanding of the technology and how to use it.

Step-by-step guidelines are rare, and when they do exist, they are cryptic in their own right--either leaving out key steps that might be second nature to the tech-savvy but not to the average Joe, or providing too many choices (like choosing the best wallet), necessitating more research. There’s a steep learning curve to interact with cryptocurrency exchanges such as Kraken, for example, to institute proper security measures, and to understand the geeky world of software and hardware wallets, private and public keys, and seeds.

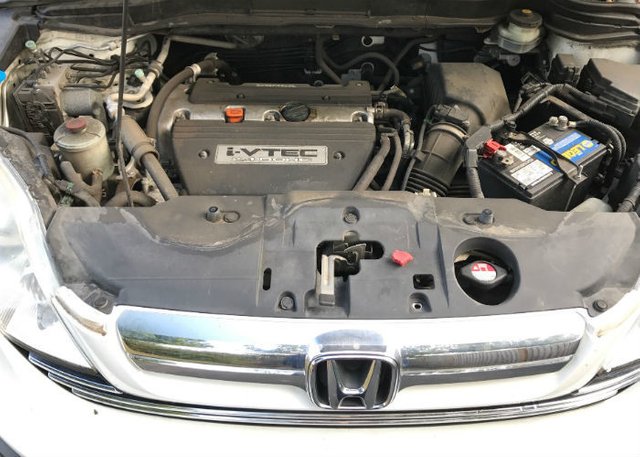

For the typical, non-technical user, the front-end looks not much different from the back-end. It feels like peering into the engine of a car.

Cryptocurrency Looks, Feels and Sounds Weird

I recently asked a food truck vendor in my home town if he accepts bitcoin. “No, but I’d really like to see one,” he said.

Will the majority of businesses and consumers take the time (and assume the risk) of using blockchain solutions and cryptocurrency? According to Amanda B. Johnson, writer and host of Dash School, not until we change the look and feel of the technology.

Cryptocurrencies currently feel like PGP email encryption, she points out, noting that Guardian journalist Glen Greenwald almost didn’t get the Snowden story because he couldn’t understand the 12-minute video Snowden sent to explain how to do PGP encryption.

To be a real competitor with banks, cryptocurrency users should never have to hear the words “bitcoin miner” or “masternode,” she says. They shouldn’t need a tutorial on blockchain technology, how to download a wallet, how to back up their private key. They shouldn’t have to look at a cryptographic address at all, an intimidating string of random numbers and letters. They shouldn’t even have to use the word "cryptocurrency," which should simply be called “digital cash.”

Any network “where only nerds basically can grasp how to use it,” says Johnson, probably won’t survive. Therein lays the bubble. For all those investors “betting that this stuff doesn’t feel like PGP but rather feels like PayPal,” she warns, this means “we’re going to lose our shirts.” It will all go down in history as “akin to tulip mania, except maybe they’ll call it ‘cryptomania’ in the history books.”

Rearranging the Back-End for a Consumer-Oriented Front End

Johnson is convinced Dash is one company that will bring cryptocurrency to the masses. That's why she hosts and writes the Dash School video series, which is funded by Dash's treasury, "making it the world's first YouTube show to be funded by blockchain," the website notes. Last December, she predicted Dash will someday “feel like PayPal, and you’ll get to be your own bank.”

It’s rare to find someone explaining complex technology as well as Johnson does. In the Dash School videos, she speaks in measured tempo, clearly and engagingly, and uses a whiteboard to illustrate her points. If you already understand the basic concept of blockchain, I’d recommend starting with Video #4: “ How is Dash's Blockchain Funded & Governed?”

Like bitcoin, Dash is a decentralized autonomous organization (DAO)--a system for exchanging value where no particular person is in charge. But the Dash team has coded a different back-end to enable offering “money as a service,” just like a bank. And to Johnson, this is the reason why Dash is not part of the bubble. Here are a few of the differences in Dash’s back-end:

- In the bitcoin blockchain network, miners make 100% of the bitcoin. In the Dash network, miners just earn part, and the rest is split between “masternodes” and a treasury” for paying coders, marketers (including Dash School) and the like.

- The bitcoin back-end doesn’t allow for users to vote on how the network should change. In the Dash back-end, the “masternodes” make network-wide decisions. They first must prove ownership of 1,000 Dash. This gives them an incentive to make decisions that will be good for Dash. They make decisions by voting, like stockholders. In exchange for voting rights, masternodes have to keep an updated copy of the blockchain and provide InstantSend and PrivateSend functionality (described below).

- On the bitcoin blockchain, time-stamped updates to a block happen only every few minutes. Broadcasted transactions aren’t confirmed until they’re included in the next block. “In a real-world, person-to-person retail environment, waiting for a confirmation that takes minutes is way too long,” said Johnson in one of the Dash School videos. “I’m a customer and my hot latte is in my hand and I’m ready to get out the door, not wait for confirmations.” In the Dash network, masternodes provide a feature called “InstantSend,” where a smaller quorum of masternodes can provide an irreversible confirmation in about 1.3 seconds. “That’s more the speed of paying for coffee and getting out the door,” noted Johnson.

- In the bitcoin network, every transaction can be traced back to individuals. Contrast this with paper money, which does not tie human history to itself. In Dash, masternodes enable PrivateSend, which swaps coins among users and breaks the traceable history of coins on the blockchain.

One of the most interesting things about Dash is the Network Status page, which shows what the Dash Treasury is spending money on. For instance, 636 masternodes voted in favor of funding 524 Dash for “Marketing & Communication (October)” while 434 voted against funding a “Dash $100,000 PrivateSend De-Anonymization Contest,” which would have cost $99 Dash.

The Future of Cryptocurrency and Blockchain Usability

Dash lead developer Evan Duffield discussed the project in early 2016 with Trace Mayer on Mayer's Bitcoin Knowledge podcast.

“We should be experimenting with every possible solution people come up with right now,” said Duffield. “This is in its infancy, so we want to build everything on the most stable foundation that is possible, because we’re going to get stuck with that at some point. These systems are too large to change radically later. That’s why we’re here.”

Duffield described Dash’s “Evolution” effort, which is going to be a user friendly communication API like PayPal. “We want to make something that’s so ridiculously easy to use that anyone can use it and they won’t even know it’s a cryptocurrency.” Imagine a decentralized PayPal built atop of a decentralized currency, which everyone uses from their mobile devices: “That’s really what we’re going for,” said Duffield.

Dash also has an innovative solution for making sure its code is well evaluated for vulnerabilities and bugs. As recently reported in American Banker, Dash has hired Bugcrowd, a San Francisco-based security company, to run a "bug bounty" program. Independent researchers get paid when they find flaws in Dash’s code.

Dash CEO Ryan Taylor noted that since Dash is an open-source project, “all of our code is available to be audited by anyone.” But the Bug Bounty program will bring a “set of highly professional eyes to the code and make sure that it is as robust as possible.”

If Dash and other blockchain start-ups develop robust and secure back-ends that support inviting front-ends and offer clear instructions to new customers, they will survive the bubble if it bursts, and their investors won't lose their shirts.

Everyone else, beware the dog on LSD.