HOW TO NOT BE DUMB IN A MARKET DOWNTURN

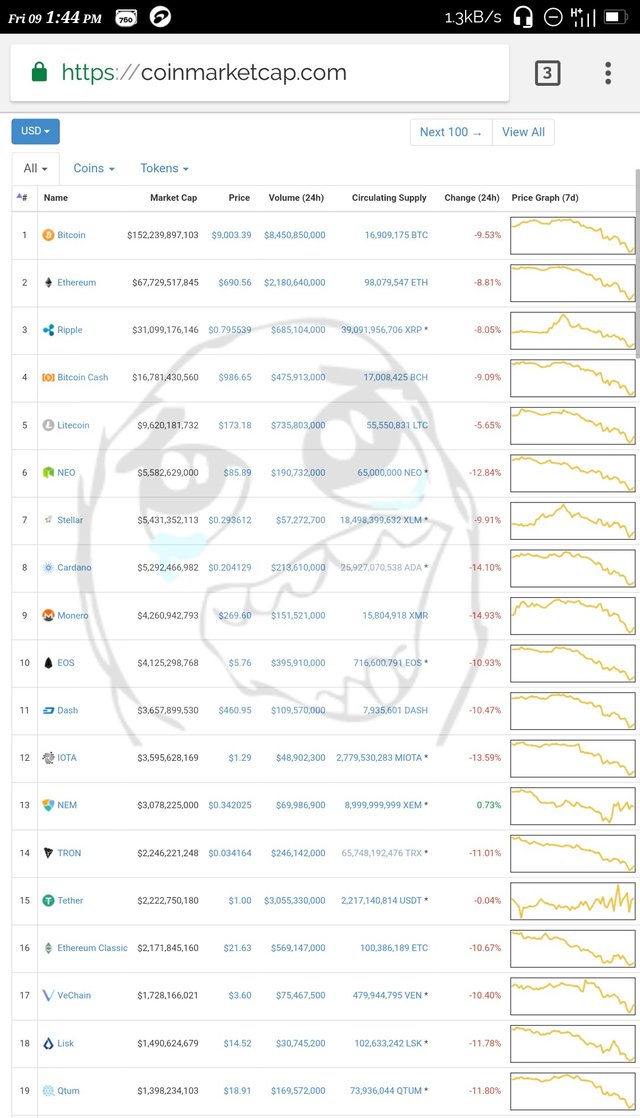

For those willing to invest or currently vested in cryptocurrencies, you'd agree with me that the market going down can bring disillusionment and sometimes even disbelief in the future of cryptocurrencies. This is worse for some; especially those people that invest in crypto because they believe it'll always go up. At first they might be willing to believe in HODLing but when they realise they bought in at the top and are already in over 50% loss, they throw in the towel. Smart investors don't try to avoid a down turn; they make sure they're in a good place when the markets go back up because that's inevitable too. You'd be surprised to know that people lose more money in crypto through panic than they do through theft.

The following rules, if taken seriously, will help curtail your losses in crypto:

1. Do Not Panic Unless You Like Losing Money

You have to either keep your emotions in check or pay the heavy price that comes with it. Learn how to go against the herd mentality and conformation bias (where you agree with only those their paradigm aligns with yours).

2. You're Not Trading Against The Market, You're Trading Against Yourself

The market is trying to give you information. It's trying to tell you exactly what you need to know at that very minute but you can't see it because you're trying to interpret things through your own lens of confirmation and that's why you're trading against yourself. Quite simply, the markets operate through pain. It's proven that pain of watching the market leave the station without you is worse than the pain of taking the loss. So why are you fighting and blaming the market for your losses? Often times you find that people that are acting irrationally has put too much in, thereby breaking the golden rule of risk management which brings us to the next rule..

3. Only Invest What You're Willing To Lose

....otherwise you will be constantly on blockfolio at 4am in the morning.

The thing about investing is that new investors tend to be more emotional than the old hands. Which means that when the market goes down, they tend to panic. If new investors can take the decision making ( should I put more money in or take more out, e.t.c) out of the process and just stick to small regular deposits of the entire capital they want to invest in crypto regardless what the market is doing , emotional stress will gradually cease to be a challenge.

4. Do Not Try To Time The Market

Everyone knows the goal of investing is to buy low and sell high, so you're thinking: "If the market is bound to go down sooner than later, why not liquidate my assets right now and snap up those bargain price cryptos after the inevitable downturn?" You might be smart but not smart enough to perfectly time the market unless you're a bot and constantly plugged in to everything going on in the crypto markets. Smart investors just stay the course and stay vested despite any market fluctuations. Research shows that trying to time the market, more often than not, leads to worse results.

The "steady-as-she-goes" investment strategy beats pretty much everything else unless you're some kind of financial genius or have a crystal gazer predicting the market for you, hahahaha.

Thanks for reading! Check my blog often for more interesting content.

I can relate.. Lmao!

You got a 1.80% upvote from @postpromoter courtesy of @geniusvic!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

Some solid tips there. Im just sitting here like waiting for my price point to increase my position even though im losing hella money right now its money i wasnt prepared to pull out at a ATH so why when its dropping

That makes two of us.

Like Warren Buffet said,

Boost Your Post. Send 0.200 STEEM or SBD and your post url on memo and we will resteem your post on 6000+ followers. check our account to see the follower count.