Build A Crypto Portfolio That Will Stand The Test Of Time

How Do You Build A Crypto Portfolio Pyramid?

I find wealth building and investing to be fascinating for many reasons. Firstly, you begin to see the world differently. You notice opportunities and trends that float right on by those that don’t invest.

Secondly, you get to see how powerful investing can be. You can earn more in one year by investing that you can by work. The increases to your net worth can be substantial and allow you to retire early, should you choose to do so.

Third, there are just so many ways to build wealth that no one way is correct.

It is this last bit that I want to expand on today. One way that you can build up a crypto portfolio to stand the test of time – a pyramid!

No, not a pyramid scheme (que BITCONNNNEEEEEECCTT!). But to use the powerful strength of a pyramid to create lasting crypto wealth.

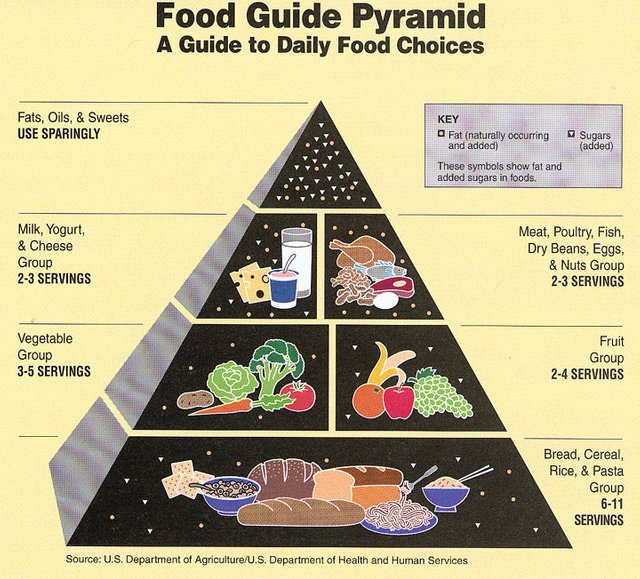

THE FOOD PYRAMID

Back in my school days we all learned about the food pyramid. It went something like this;

The base of the pyramid is your healthy carbohydrates – grains like rice, bread, or pasta. Because your body burns this for energy they make up the bottom of the pyramid and are the largest portion of your diet.

Next tier up are your fruits and veg. Important for the vitamins they provide, they should be eaten every day but in a slightly smaller amount than the grains.

The third tier is your dairy and protein consumption. Important nutrients, but you don’t need as much of them.

Lastly is the very top, your fats, sugars, and oils. To be eaten rarely.

You can build your crypto holdings the same way and enjoy the strength that a balanced investment portfolio achieves.

Crypto "Grains" – 40%

These coins will form the base of the pyramid and so we are looking for long-term strength. We are not expecting them to double overnight, but neither will they crash to zero.

Just like how a marathon runner might eat a plate of pasta the night before the race, we are loading up on coins that will remain a key part of the market well into the future.

However, nobody knows exactly what the future holds so we have to have a few stipulations on what we include here.

1: The coin must have been around for at least two years

The crypto market is very young, all things considered, with much of the latest coins being created within the last year or so.

This means most are untested. I’m not saying that any coin under two years old is bad, just that it doesn’t belong in the base of the pyramid – yet.

2: The coin must be globally used

Sorry, that coin that is really popular in Korea but nowhere else in the world won’t make the cut here. We are looking for worldwide popularity as it shows diversity. Diversity helps to mitigate risk.

For example, say that Korea decides to clamp down on crypto then that one coin popular there will be hurt greatly. A globally used coin might take a small hit, but it will keep on going.

3: The coin must serve a key societal need and have made large progress towards that goal

Words can get a coin moving in the short-term, but action always wins out in the long-term. This is the base of the pyramid, the long-term is all we have room for here.

We are looking for a moat, and you cannot just talk a moat into existence. Only action (not words) will provide the security that the coin will not lose market share.

In short, we are looking for the coins that might not grow so fast but will surely be used by a large portion of the crypto market in the years to come. If you think in stock market terms, these are your "blue chip" coins.

Crypto "Fruits and Veg" – 30%

This category is crucial for your crypto portfolio to run properly and grow but don’t meet all the criteria to be in the base of your pyramid.

These coins are your “up and comers.” Maybe they haven’t been around long enough, or they are not widely adopted yet but you believe that the team behind the coin can solve the problem the coin is aiming to fix.

So these coins have great long-term prospects that haven’t been proven – but your research shows that the chances of success are high enough to buy in.

These coins should grow at a more aggressive pace than the “grains” giving your portfolio a great return, but with increased risk.

Ok, so these two categories of crypto should take up 70% of our pyramid. Much like the food pyramid, we can do quite well with just those two coin groups. This is because those tiers are the most important. Next up we add a little bit of flexibility to our crypto diets.

Crypto "Protein and Dairy" – 20-25%

This level of the pyramid are your short-term holdings. Coins that have a short-term catalyst or momentum. Coins to buy, ride the wave, and then sell. Trading coins.

While this tier is not required, it can add a large amount of profit should you know how to handle trading them.

I don’t mind if you prefer to avoid this tier, you can just as easily “buy and hold” more of the coins you identified as strong long-term contenders. Many people in the crypto market of today like to trade, and this is the tier to do so.

The most important thing to understand is that you need to have the first two tiers in place! Your base and your growth prospects need to be solid before you start trading in this tier. Otherwise one bad trade can wipe out a large chunk of your money.

Crypto “Sweets” – 5-10%

The very top of the food pyramid is your fats and sugars – basically your candy and junk food. You don’t need any of this to live, but it sure is fun to eat.

In the crypto field, these are your pure speculation coins. Maybe you just have a hunch that this obscure and lightly traded coin is going to gain 10,000% in a week and you want to take advantage of that.

It’s fun to think about, right? However, these are just treats that should not make up a large percentage of your holdings. While a few coins might see huge gains, many are destined to remain in the dregs.

So just like it might be fun to have an ice cream cone or a candy bar every once in a while, you don’t want to base your whole diet on it. So for a healthy crypto portfolio, keep this amount under 10% at most.

Before any investment in this category, you should ask yourself “Am I OK if I lose everything here?”

Conclusion

- Base coins – 40%

- Growth coins – 30%

- Trading coins – 25%

- Speculative coins – 5%

Using the crypto pyramid is just one method you could use to blueprint your crypto investments, but is far from the only way. I wanted to show people one more option that they have and if you think this is a valid structure please let me know in a comment below.

My hope is that this example will help you align your portfolio is with your crypto investment goals. By defining your goal, and following through with an appropriate plan – whatever you decide - you will maximize your success as an investor.

Food for thought.

Nice idea. In time it will be good to see how this becomes integrated into a wider portfolio view of the world. For me, crypto remains part of the risky part of my portfolio to which I allocate no more than 10%. Included in this 10% are all the new business ventures and crowdfunding type things as well. For the rest of my portfolio I have an 80:20 split between stable returns and asymmetric returns.

Within the crypto space, I have taken a slightly different approach because I do not have enough time and resources to do the analysis required to work out who the likely winners and losers are going to be. I have basically split the portfolio into 4 parts

As crypto becomes more mainstream and as my holdings grow, the 10% allocation will change. My STEEM holdings alone are driving that.

You can read about my approaches in my Steemit posts http://mymark.mx/BehindTIB5, http://mymark.mx/BehindTIB6, http://mymark.mx/BehindTIB7, and http://mymark.mx/BehindTIB9.

Yeah, the sheer amount of coins to research is something that one person cannot do. I do like your categories here, looks like a very good way to break them down into sectors.

Thanks for the resteem too!

I will read deeper into your method....interesting.

Incredible way to split the coins imho! What coins are you mining atm? and do you think it's worth to mine? I don't have any mining rig, i would have to use my GTX970 to mine

Coins I am mining are BTC, ETH, ZEC, EXP, CLUB. I use mining pools to do it. ROI's are not fabulous (certainly less than 5% per annum) but I like the way that coins grow independently of the way markets go.

I should start doing it but mining with a GTX970 would just spend more money on the electrical bill then i would get coins... wish i had a solar panel to power my pc xD

Mining pools via cloud or via hardware?

I am cloud mining through Bitclub Network (not available in US), Lifestyle Galaxy, Hashflare and Genesis-Mining.

My favourite is Lifestyle Galaxy.

@getonthetrain, great “food for thought”... resteemed your post!

Thanks for the resteem!

Thank you , thank you @getonthetrain !! Resteemed and Bookmarked in my Get Pocket account. I really needed something like this Post to give me a Compass in investing in Cryptos. Mainly, becuase I am so new to it. Again, thank you so much

P.S. Hey g.o.t.t, just a heads up. I've written a Post and publishing it tomorrow. It's something I planned for a little while and doing a kind of a special series on featuring different Steemians, either weekly or bi-monthly (hadn't decided yet) but it will be on Tuesdays. I hope you don't mine and it may be a little embarrassing but in a totally, totally good way (don't worry :) ) Thnx and take care

At first you had my attention, now you have my curiosity

Thanks for the resteem!

Good advice, personally I have 100% of my portfolio between grains and vegetables/fruits (lol), I managed to sell at the beginning of January all the short-term altcoins I had and when the market came down I took advantage of it to buy the safe ones, now the daily- trading is on hodl and I just wait for prices to go up.

Hey, no problem with that. Like I said, you want the grains and fruits & veg at least, the rest is each persons personal choice.

Thanks for the resteem!

Great information elaborated well. Good post. Thanks for sharing.

Where would you place Steem and EOS in that pyramid?

I believe they will be growth coins.

With BTC, ETH and perhaps LTC as base coins.

The speculative coins will be the harder to manage.

I think for the majority of the people, the best option would be to simply hold some growth coins, and avoid the others, even the base coins because they will probably be surpassed by growth coins.

At current prices, STEEM certainly has some room to increase in value. I am thinking that long-term STEEM could trade around a price of $10. It is a working coin, available to be earned from the masses. So there will always be plenty of people willing to sell all they get to buy something.

I would say the coins to be in the base are there for a reason, that they have shown themselves to be worthy. It would be smart to have them as you need stability. Not all growth coins will grow as you think.

Wauhhh....I actually read this post more than twice to really understand it in depth. You gave an insight of the actual and future coin and made me realize that I needed to take some times, studying on the coins and making great decision.

In Africa, cryptos are just penetrating and many people do not know yet more about cryptos. Some believe that it's a scam others don't believe in online stuff.

This made me think of the first guy who joined Bitcoin in Uganda. He could tell people about Bitcoin, but couldn't hear. He could move sensitizing people, but no one could hear. To day, he is not that normal man as he was few years back.

Ended, time will come when worldwide governments won't have control over cryptos and will have to welcome the upcoming newly ever global achievement regarding money exchange or transactions.

So you are at the cutting edge of the new technology there, jona - what a position to be in!

Great post and thanks for introducing the Cryptocurrency food pyramid and it's good to know that this food pyramid you learned at school and now amazingly interpreted in the form of Cryptocurrency investment percentages, and it's right, if we invest right then we can retire early, as you asked if this pyramid is useful or not, yes it's really useful and knowledgeable means this pyramid can let us know that, first of all we need an solid investments for the base and then we have to categorise more layers so that we can effectively face any type of crisis. Wishing you an great day. 🙂

Stay Blessed.

Hey, glad you found the crypto pyramid portfolio useful

Yes, it's really effective. 🙂

You can give example of which coins or tokens would fit into each category above mentioned?

Oh, I purposefully left specific coins out as I don't want to take away from the structure of the portfolio construction which is the purpose of this post.

I will let you in on one coin that I think should be in everyone's pyramid though -- STEEM! :D

You have no idea how much I needed this @getonthetrain. I've taken part in the cryptocurrency market for 3 months now, investing in 4 base coins so far. I feel I've not been active enough, still having fear of some coins not being able to make much, and some not surviving a bubble burst in the next few months.. This has been holding me back to go deeper and explore more with the various coins on the market cap. At one moment a speculative coin I haven't invested in shoots up beyond 1000%, yet the base coins I have invested in are going down by atleast 8%. The message in this post is what I've long needed for a long time. This alone is a lot of knowledge to use to create more awareness to people that have no idea about the cryptocurrency market. We can not get worried when the biggest investment is in the base coins that are guaranteed a rise in price however long it takes.. let it be months, years. This is surely worth waiting for. These coins will always continue existing. They have withstood the taste of time, and they are here to stay.

The growth coins at 30%, trading coins at 25%, speculative coins at 5%. This is absolutely a good percentage to share among these. The speculative coins involving the highest of risk taking, but who cares.. They will be carrying the least percentage of your investments. If they score big, that is a very big margin of profits made. If they lose out, you don't have to give a damn, the money invested in them is worth losing.

The first 2 months of this year have seen a number of dips.. lets choose the coins to invest in wisely whenever the market falls in a dip.

Thanks for this great post @getonthetrain. Let me start active trading right now.

Remember to have the solid base of your pyramid before you start chasing the rest