1000 "Pope" Mastered 40% Market Share of Bitcoin

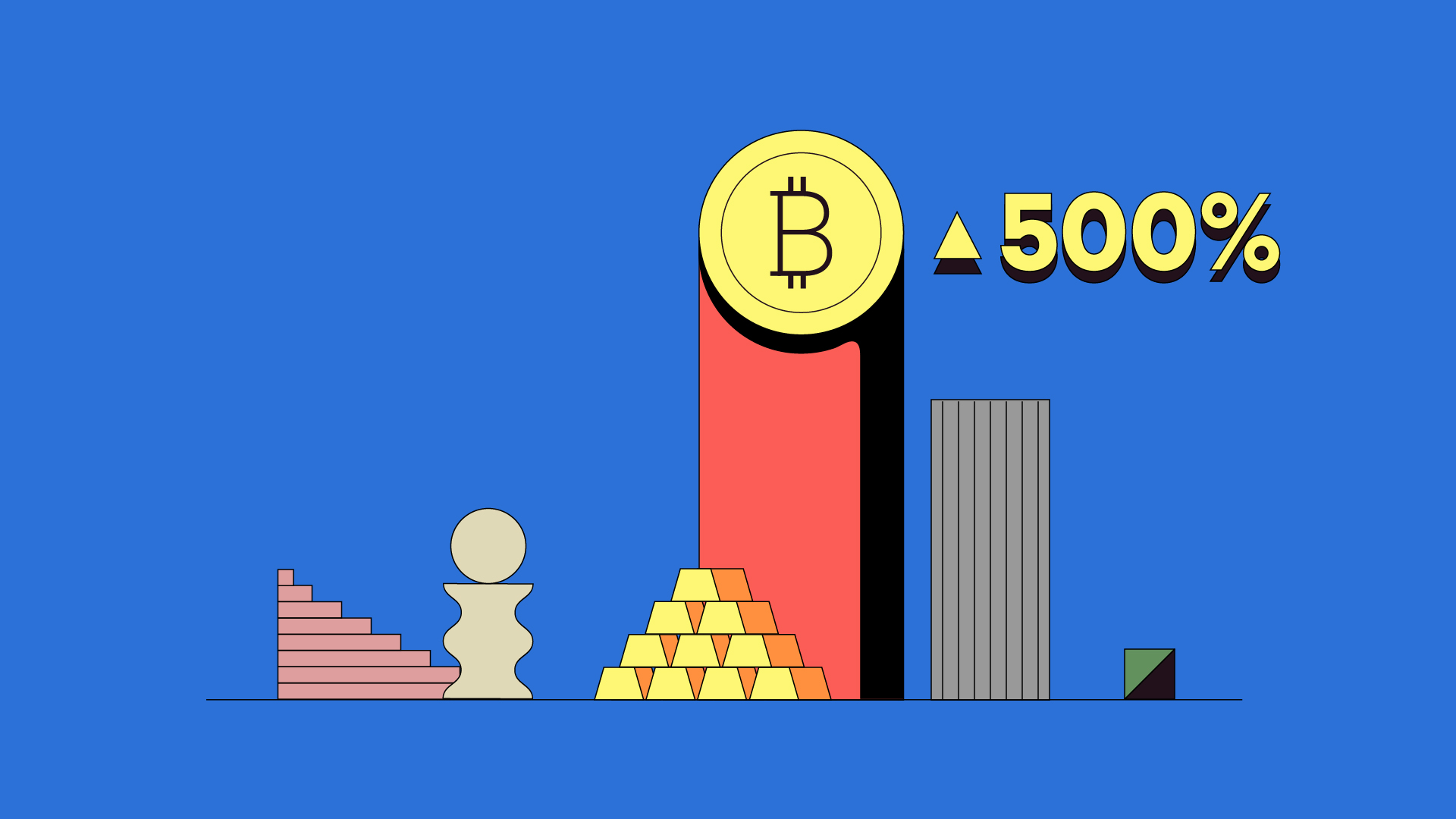

The bitcoin digital currencies are getting crowded, as the value continues to soar. At the end of November, the value of bitcoin "craze" in the figure of 9,671 US dollars per chip.

The increase is almost 12 times from the beginning of the year. This fluctuated value is influenced by several things, one of which is the buying power of bitcoin holders.

According to Head of Financial Markets Research of AQR Capital Management's global investment firm Aaron Brown, about 40 percent of the outstanding bitcoin is currently held by 1,000 users.

1,000 people are then dubbed "Pope" or whale. If one whale sells a portion or all of the portions it has, the bitcoin value will "shake". Moreover, whales can form a structured and coordinated collective to control bitcoin prices at will.

Early Players Collectivity

The reason, the whale generally know each other. The majority of them are early players in the world of bitcoin, when virtual money is still a mockery because it is considered less prospective. You could say they used to be a minority of like-mindedness, fate, and endurance.

"I think there are hundreds of people (who know each other). They could be interconnected with each other, "said Managing Partner in the digital currency market aka Cryptocurrency Multicoin Capital, Kyle Samani.

Simple scenario, the whale can agree to intensify their bitcoin investment to high market value. Then at one point, they simultaneously sell the assets they have and cause the bitcoin value to fall to its lowest point.

If it were so, the small-scale bitcoin investors would lose a lot. Especially the new bitcoin players who directly invest a lot, but not as much as the whale so it can not affect the market.

"As in all types of assets, large holders of both individuals and institutions can collude to manipulate prices," said founder of investment firm Cryptocurrency BlocTower Capital, Ari Paul.

"In cryptocurrency, manipulation can be extreme because the market is still very new and the characteristic of its assets is very speculative," Ari Paul added.

Rules are still loose

Global financial regulators are judged to slowly set rules about cryptocurrency problems that massive growth.

The rules are still cloudy so the value of bitcoin was unstable. In addition to the whale that can shake the price of transactions in a large value, bitcoin traders also often spread rumors for their benefit.

This type of fraud has not yet been regulated. "There is no transparency in this market (bitcoin)," said Martin Mushkin, an attorney focusing on bitcoin issues.