Pure Speculation: FIAT & Crypto in a Black Monday scenario.

Welcome to Pure Speculation, this is a series speculating about market scenarios in this brave new world of cryptocurrency.

Disclaimer: I’m not a professional economist (or historian), this is just pure speculation.

So let’s speculate: Being fairly new to the crypto scene, I have come across this notion of a coming FIAT financial crises being a good thing for crypto. I tend to believe this as well, seen as if one market crashes it’s a no-brainer to get funds into another healthier market, in this case crypto. The notion is here that the value of crypto would then skyrocket as banks, and investment firms, pour their funds into BTC, ETH, XRP and so on. This sounds fantastic right? We can all retire early, get that house by the beach, drive lambos and be surrounded by Brazilian bikini models with great “personalities” for the rest of our lives – STOP! – Not so fast. Maybe we should take a closer look at what might also happen. While the initial prognosis of fast wealth might be right, the aftermath could be equally to, or more catastrophic for crypto then FIAT – to examine this, let’s take a look at the day I was born, Black Monday.

Most people know about the financial crises like the one in 2008 and the Dot-Com bubble, a lesser known crash however is the crash of 87.

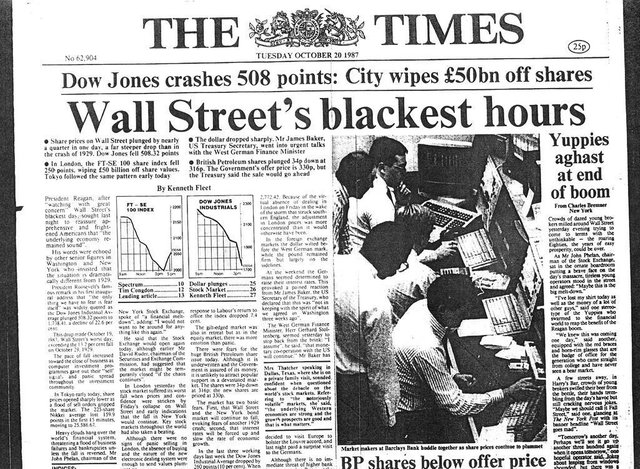

19th of October 1987 stock markets around the world crashed one after another, hitting Asia, Europe and the US Monday morning. Computer systems gets flooded by sell orders, trading breaks down. Greed turns to fear and becomes panic - the markets simply disappeared.

Black Monday was a reality; Dow Jones closes with an all-time record low of -22.6% total value. New Zealand’s market was hit especially hard with a 60% fall in total by the end of October – taking years to recover.

Long story short, most markets recovered in a number of days, the crash is averted in the US at the closing bell on 20th of October. The reasons for Black Monday are debated and likely multiple, one likely trigger could be that Dow Jones had closed on a new low at -100 points the previous Friday.

Returning to speculation. Why do I think that a FIAT crisis can be a potential catastrophe for crypto? First, let me stress that my goal here is not to spread fear, or counter hype with pessimism. However, an espresso shot of rationality might not hurt when fantasising about the gains from a failing Wall St.

When I have come across this FIAT-FAIL=Crypto-WIN proposition, there seems to be an implicit assumption that this would be just like 2008 where the markets crashed over a period, taking a long time to recover. I again agree, that would be the best case scenario (in an economic sense) for crypto. However, we can’t know how long a crash will go before the crash is over, every economist with two brain cells was shouting new depression back in 87 – and that lasted two days in the US and multiple years before New Zealand recovered.

So let’s imagine a future scenario where it's more a repeat of 87 then 08. We could call it “Black Monday, with a vengeance” – where the stock markets around the world crashes. Greed turns to panic, once again, and in a ditch effort to save capital banks, and investment firms, hurls unbelievable funds into crypto. That then skyrockets the value – XRP blows up as one of the first due to the easy access to XRP in large areas of the banking sector (at this imaginary point in time), one XRP now costs 1500-2000+ USD. BTC and ETH comes soon after and hits 7- and 6- figures respectively. Other coins moon with them while many (and some great technologies) are dumped and left in the mud by traders seeing the promised land in front of them. Multiple banks now see this opportunity to use its newfound wealth to jumpstart parts of the FIAT economy (again, I’m not an economist, this could be completely unrealistic), large part of the financial sector follows suit, along with a lot of all the new crypto millionaires and billionaires trying to cash out in time. – Imagine for a second what that dynamic would do to the crypto market?

...

Well, so that got dark… So is this it? Crypto being ultimately pumped and dumped by the very same institutions that it was suppose to oppose and rebel against? Ironically, as Black Monday serve as the inspiration for this doomsdays scenario, it also provides a solution to the problem. What happened the 20th of October back in 1987? How could a “new depression” be avoided in just two days?

In short and simplified; the traders insisted on trading, and recreated the marked by re-establishing value through those trades, intern nullifying the crash.

Applying this logic to the scenario above means that if this was to happen, a solution would be to trade out of it, letting go of fear and panic. The clock has to be reset and that could be done very quickly, as demonstrated by Black Monday, we simply have to sell and buy so we can get to the levels again – nullifying the dump. Imagine for a moment; sellers just readopting the pre-pump prices and buyers accepting these, all realising what had just happened. Possibly making the market even stronger as a result.

Again, this is just pure speculation and the worst-case scenario I could think of. The point being that a FIAT crisis is not necessarily the crypto-payday that some speculate it will be. Explosive growth upon a crisis can be very dangerous if we look a bit further then the dreamy price scenarios. So what do you think, could a FIAT Black Monday scenario turn into a crypto crisis? And how realistic would this be in a technical sense?

Thanks for reading,

Here is an adorable kitten I found.

Pure Speculation is a concept that I might do once in a while when getting inspired. I’m already thinking of doing another one relating the 80’s stock market to the current crypto market, as there seems to be some similarities, at lest in a psychological sense.

If you want to know more about Black Monday I will recommend this short introduction by Michael Lewis https://youtu.be/KFa4-SRIhIM this news compilation https://youtu.be/5PUwr8DsYeg along with this 43 min documentary https://youtu.be/jLfjEMDJubg as a great starting point. It makes for an interesting study of market dynamics.

Congratulations @gigabitguy! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP