ICO vs IPO: so alike and yet so different

Over the recent months, there has been more and more talks about the difference between ICO and IPO. It is largely due to the fact that these two procedures look quite similar for a layman. However, they differ in a variety of parameters, and this comparison is largely inaccurate. First you need to understand what are ICO and IPO.

ICO vs IPO: so alike and yet so different

ICO vs IPO: so alike and yet so different

20.11.2017 | in ICO | by Stanislav Sokolovskiy, senior lawyer at GMT Legal

IPO (Initial Public Offering) - is a type of public offering in which issuer's securities are first available to the general public. It should be noted that the placement of securities can be realized not only within the framework of an IPO. Companies that go public already have finished product, and their activities comply with all legal requirements (companies also get special licenses for this type of activity, the founders of the company and its management are given responsibility for non-compliance with the law). In this case, before IPO process begins investor has a chance to learn about the company's products, its activity, and also can determine its growth potential based on real economic and other indicators.

IPO (Initial Public Offering) - is a type of public offering in which issuer's securities are first available to the general public. It should be noted that the placement of securities can be realized not only within the framework of an IPO. Companies that go public already have finished product, and their activities comply with all legal requirements (companies also get special licenses for this type of activity, the founders of the company and its management are given responsibility for non-compliance with the law). In this case, before IPO process begins investor has a chance to learn about the company's products, its activity, and also can determine its growth potential based on real economic and other indicators.

ICO (Initial Coin Offering) - a way to raise funds for the project's development by selling software products of the company - tokens. In this context tokens are considered a software product sold to an unlimited number of persons. ICO shouldn't be considered as a form of crowdfunding, because, unlike crowdfunding, where individuals donate their funds for the development of a project, participants of ICO receive tokens that have a certain value. They can be sold on exchange or bring various kinds of advantages and even income to their holders.

Those ICO models, where token grants the right to pay dividends (passive income) shouldn't be considered as ICO in its classic form. In this case, it serves as a mechanism for the sale of securities, which, by its structure, doesn't differ much from IPO.

Most often the founders do not offer a finished product for ICO, but rather raise funds for its development and further promotion.

There are no uniform rules for regulating such investments, which potentially makes it possible for organizers not to fulfill their promises and avoid liability (in fact, there is liability for non-fulfillment of obligations, but it is not considered in this article).

Thus, ICO and IPO are very different in their purpose because they are created for different goals and implemented through different mechanisms.

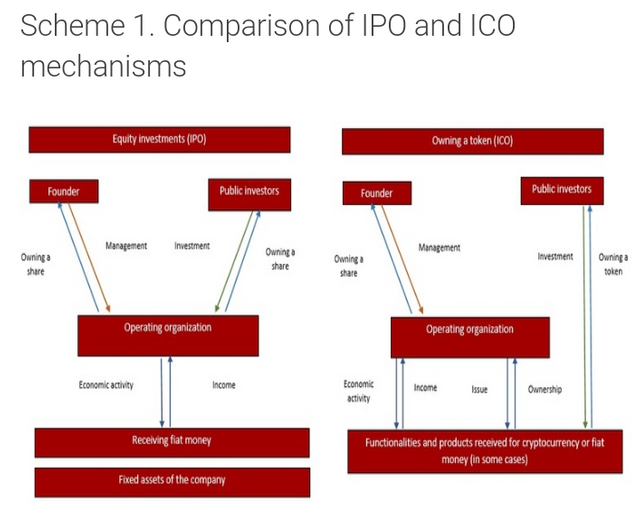

Model of functioning is another difference between ICO and IPO. IPO means that the founders create an organization whose shares are bought by investors who receive a certain amount of dividends from this, depending on how profitable is its economic activity. In ICO investors are in fact not connected in any way with founders of a project that issues tokens.

All the advantages and disadvantages of the project will be reflected in the value and functional component of the project's tokens, and this is particularly the case with regard to fundraising at the stage when project is developed from scratch.

Great post

Thnks#rose

Welcome

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitnewstoday.com/market/ico/ico-vs-ipo-so-alike-and-yet-so-different/

Up voted, thank you

Your wlcm i will vote u always

Thanks for for the great education

Your wlcm sir....follow me to get more important information.

thanks so much for having me-truly appreciate it-great work!!!!!!!