Buying The Dip 023: Portfolio Update 002 Pt. 1

Hello Steemit.

As reported in an earlier post, I had lost access to my 2FA codes (article on that here) so being fully aware of all of my assets was quite difficult hence the delay in my updating you on my portfolio. Many trades have taken place in that time with access to new exchanges (partly due to a lack of access to others) and all of the dips that have taken place over the last few weeks. Overall the size of my portfolio in terms of assets and amounts of each asset has increases via me moving more dirty fiat into the crypto-sphere. Unlike my first update which took place over three parts this post will be done over two articles and will eventually be only one in the future. There were a lot of changes this time round with the dip that took place offering a lot of buying opportunities. As stated in my first update (available here) I will only be discussing the major changes and additions with a briefing on each of the notable assets. Again, these updates will only come when necessary. Today seemed like a good time for an update, especially as things look to be going green again.

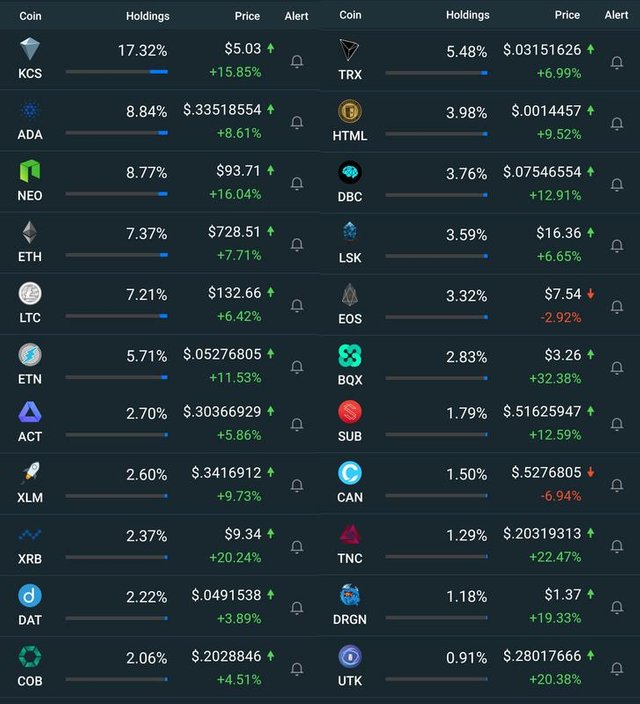

Percentage Holdings are true as of 06/02/18 @ 19:19

KuCoin Shares [KCS]

Most people hold the majority of their funds in Bitcoin or Ethereum, not this guy. Although those assets will eventually increase in size (no BTC on this list I hear you say) the reason they are not number one or two on this list is because I essentially use BTC as a store of value and my god do I love diversifying. That's why ETH is still on this list but there is no mention of Bitcoin; all my Bitcoin is in the rest of the assets you see. Previously sitting at 3% of my portfolio, KCS now takes up over 17% of my portfolio for exactly that reason, diversification. The reasons for why I hold so much can be found here or if you would like to hear me speaking about my top five holds for 2018, on which KCS sits, you can see my DTube video on that via this link too.

Neo [NEO]

Another coin that made it onto my top five holds video was Neo and my god I wish I owned more of it. Some of the other assets on this list will definitely be making way for some forking into Neo, such as Po.et (which should be on this list too sitting between Nano and Datum but isn't here for some reason), Lisk post rebranding spike (unless it rockets) and Tron if it ever decides to get to a figure I feel I can sell it at. This will of course increase the percentage of Gas I own (currently not even worth mentioning) so you can expect to see that on this list sometime considering the amount of NEO I want to eventually own.

Achain [ACT]

One of the newer additions to my portfolio, having purchased it just before my 2FA crisis (I may be exaggerating) and again on my top five holds video, Achain is my little underdog pick. My reasoning behind that can also be found in my video and I expect post-crash this will shoot up my list just on it's own due to the value of the project. If however the market doesn't fancy getting it's act (pun intended) together then it will shoot it's way right up the list by one simple factor, me buying more.

Stellar Lumens [XLM]

This one isn't entirely true and that's blockfolio's fault for not being as with it as me. Around 60% of this is actually invested in Mobius [MOBI] which is currently only available on StellarTerm, the decentralised exchange. The other 40% that is actually in XLM I am very happy to keep as I see Stellar being a great project this year. I also intend on picking up some more Stellar whilst it is a great price as if the DEX continues to grow so will the utility of the asset itself. As for Mobius, that is sitting pretty there at the moment and will continue to do so though I don't intend on picking much more up. Hopefully it will hit a bigger exchange and then Blockfolio will be able to tell you how much I own of that too, but I'm sure you can do the math.

Nano [XRB]

Another new addition, Nano (or RaiBlocks as it was called last time I did a portfolio update) has been on my radar for a long time. Nano is project a lot of people seem to believe in and the new name may well help it grow (shout-out AntShares) in price. I was finally able to pick some up in yesterdays dip which hopefully we have seen the last off and the profits I'm already making off it will continue to grow. Another sitter in my portfolio that may go up and down.

For the second part of this article please click this link here and for more updates on my portfolio as well as general news on cryptocurrency and analysis of assets within the market please follow my page as I update daily unless life gets in the way.

Remember, this is the accumulation period.

HJB. CryptoKnight.

Twitter:

@hjbcrypto

Dtube:

@hjbcrypto