Buying The Dip 024: Portfolio Update 002 Pt. 2

Hello Steemit.

As reported in an earlier post, I had lost access to my 2FA codes (article on that here) so being fully aware of all of my assets was quite difficult hence the delay in my updating you on my portfolio. Many trades have taken place in that time with access to new exchanges (partly due to a lack of access to others) and all of the dips that have taken place over the last few weeks. Overall the size of my portfolio in terms of assets and amounts of each asset has increases via me moving more dirty fiat into the crypto-sphere. Unlike my first update which took place over three parts this post will be done over two articles and will eventually be only one in the future. There were a lot of changes this time round with the dip that took place offering a lot of buying opportunities. As stated in my first update (available here) I will only be discussing the major changes and additions with a briefing on each of the notable assets. Again, these updates will only come when necessary. Today seemed like a good time for an update, especially as things look to be going green again.

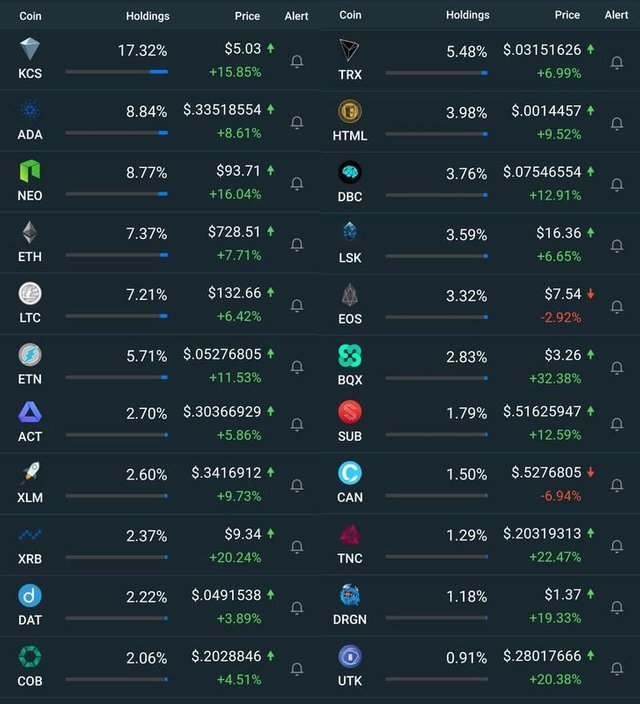

Percentage Holdings are true as of 06/02/18 @ 19:19

Cobinhood [COB]

I'm sitting pretty on my COB tokens. I still believe Cobinhood will grow as an exchange in general but it may have hit a bit of a stumbling block for the time being that may well end up working in it's favour and that is the news from Robinhood, the platform from which it took it's name, announcing plans to open up cryptocurrency trading. Robinhood saw an absolute influx of attention for this decision and essentially offer the same service in regards to the ability to trade with no fees. However where they differ is that your assets on Robinhood apparently are immovable and in that sense really own work as bonds and not assets whereas on Cobinhood the assets are actually yours and be transferred to your personal wallet. Oh and the amount of assets available differ significantly. Yes, Robinhood intend on adding more over time but that will take time and again you can't move them elsewhere. This probably explains why I haven't really commented on Robinhood for now. I have however commented on Cobinhood and my article on that can be found here.

HTML Coin [HTML]

Sometimes you have to be sharp in this game, buying assets before the rise. For those aware of the controversy surrounding eBTC's listing on KuCoin my holding of HTML will make perfect sense. For those who do not, eBTC has been accused of manipulation in the voting process taking it to the top of the voting with no real reason as to why. Well, other than the fact that they were manipulating the vote that is. I can confirm this to be true as 0.01 of my KuCoin Shares came via their telegram group where they were sending that amount (the amount needed to register a vote on KuCoin) to anyone willing to vote for the coin which led to an extreme rise overnight of eBTC's position. I can confirm this for one reason above all, I was a receiver of what was essentially a bribe. As I'm sure you can imagine, that 0.01 still remains in KCS as the more I have of that the better and also I do not rate eBTC at all (I think I won that one). I do however rate HTML, as do their large and active community. KuCoin recognised that their may be a lack of fairness at play so have decided that both assets will be listed which I think is a very diplomatic resolution to the problem. Not enough people are talking about this, which has helped keep the price down. And now it makes up 3.98% of my portfolio. Post KuCoin listing "some point in February" we can expect to see this number rise.

DeepBrain Chain [DBC]

Another coin that has made it's way up the rankings due to the dip in the market and one that I think was severely underpriced at the time of my initial investment. Sitting at 1.64% last time out, DBC now makes up 3.76% of my portfolio. A great project with a lot of room to grow, I would have got more if it were not for my other invesments that required a more hurried approach to by like HTML. I am currently quite happy with the amount that I own of this now and if it reaches the $0.19 range again this will shoot right up having been one of the larger affected coins in this dip.

Trinity [TNC]

For those of you who follow either Suppoman or Boxmining on YouTube you will know a lot about this coin already. For those who don't it is essentially a scaling solution for one of my top five holds Neo, working in the same way as the Lightning Network intends on working for Bitcoin via channels but to a much, much high level with a target of one million transactions per second which is just amazing. I highly recommend you watch this video here for information on exactly how Trinity intends to operate. Their project is ambitious, but so was Neo's. You should definitely be looking at Trinity.

For the first part of this article please click this link here and for more updates on my portfolio as well as general news on cryptocurrency and analysis of assets within the market please follow my page as I update daily unless life gets in the way.

Remember, this is the accumulation period.

HJB. CryptoKnight.

Twitter:

@hjbcrypto

Dtube:

@hjbcrypto